Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you please explain and give formula in detail? Duffy was just hired as CEO of Dog Food Inc. (DFI), which has no debt or

Can you please explain and give formula in detail?

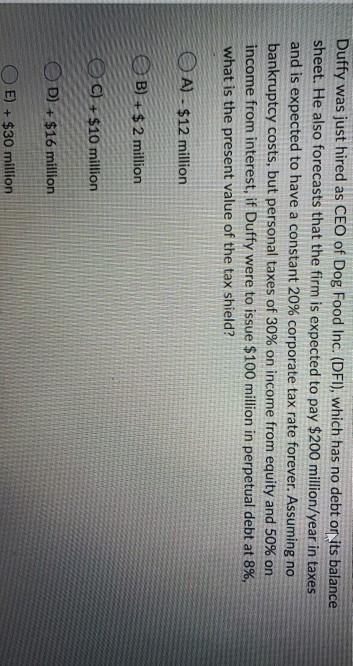

Duffy was just hired as CEO of Dog Food Inc. (DFI), which has no debt or its balance sheet. He also forecasts that the firm is expected to pay $200 million/year in taxes and is expected to have a constant 20% corporate tax rate forever. Assuming no bankruptcy costs, but personal taxes of 30% on income from equity and 50% on income from interest, if Duffy were to issue $100 million in perpetual debt at 8%, what is the present value of the tax shield? OA) - $12 million B) + $ 2 million OC) + $10 million OD) + $16 million E) + $30 millionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started