Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you please explain and show me how to do it? Thank you Macintosh Inc. changed from LIFO to the FIFO Inventory costing method on

Can you please explain and show me how to do it? Thank you

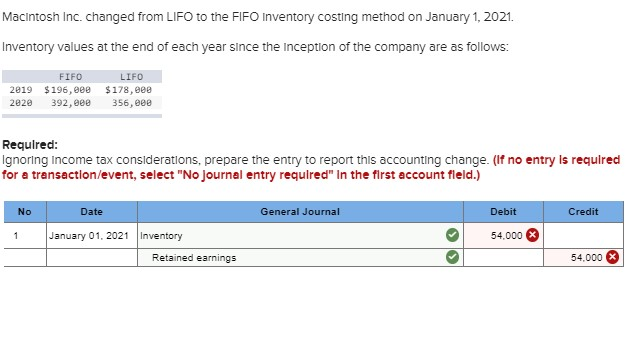

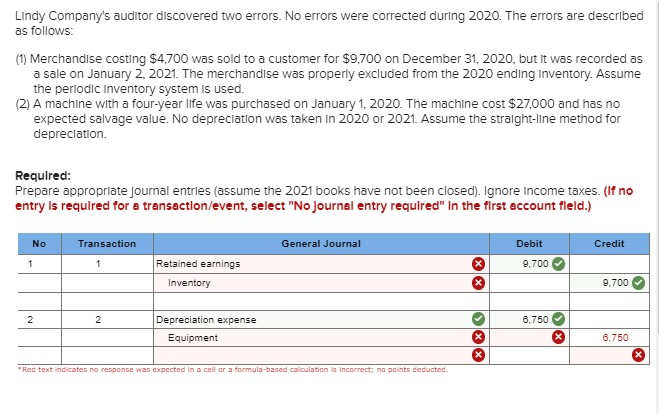

Macintosh Inc. changed from LIFO to the FIFO Inventory costing method on January 1, 2021. Inventory values at the end of each year since the Inception of the company are as follows: 2019 2020 FIFO $196, 392, eee LIFO $178, 356,00 Required: Ignoring Income tax considerations, prepare the entry to report this accounting change. (If no entry is required for a transaction/event, select "No Journal entry required in the first account field.) No Date General Journal Credit Debit 54.000 1 January 01, 2021 Inventory Retained earnings 54.000 X Lindy Company's auditor discovered two errors. No errors were corrected during 2020. The errors are described as follows: (1) Merchandise costing $4,700 was sold to a customer for $9,700 on December 31, 2020, but it was recorded as a sale on January 2, 2021. The merchandise was properly excluded from the 2020 ending Inventory. Assume the periodic Inventory system is used. (2) A machine with a four-year life was purchased on January 1, 2020. The machine cost $27,000 and has no expected salvage value. No depreciation was taken in 2020 or 2021. Assume the straight-line method for depreciation. Required: Prepare appropriate Journal entries (assume the 2021 books have not been closed). Ignore Income taxes. (If no entry is required for a transaction/event, select "No Journal entry required in the first account field.) No Transaction General Journal Credit Debit 9.700 Retained earnings Inventory 9,700 6.750 Depreciation expense Equipment 6.750 Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deductedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started