Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you please explain Just Dew It Corporation reports the following balance sheet information for 2020 and 2021 2020 2021 Assets Current assets Cash Accounts

can you please explain

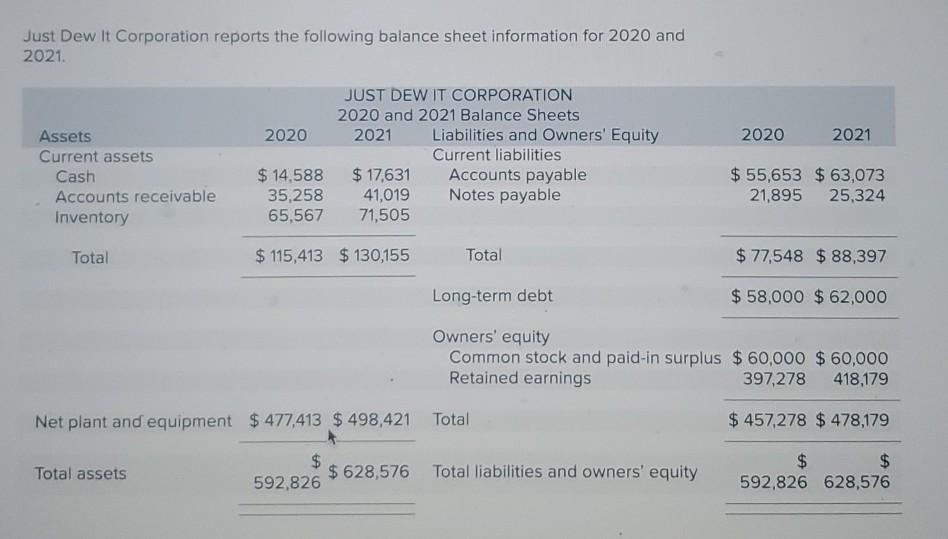

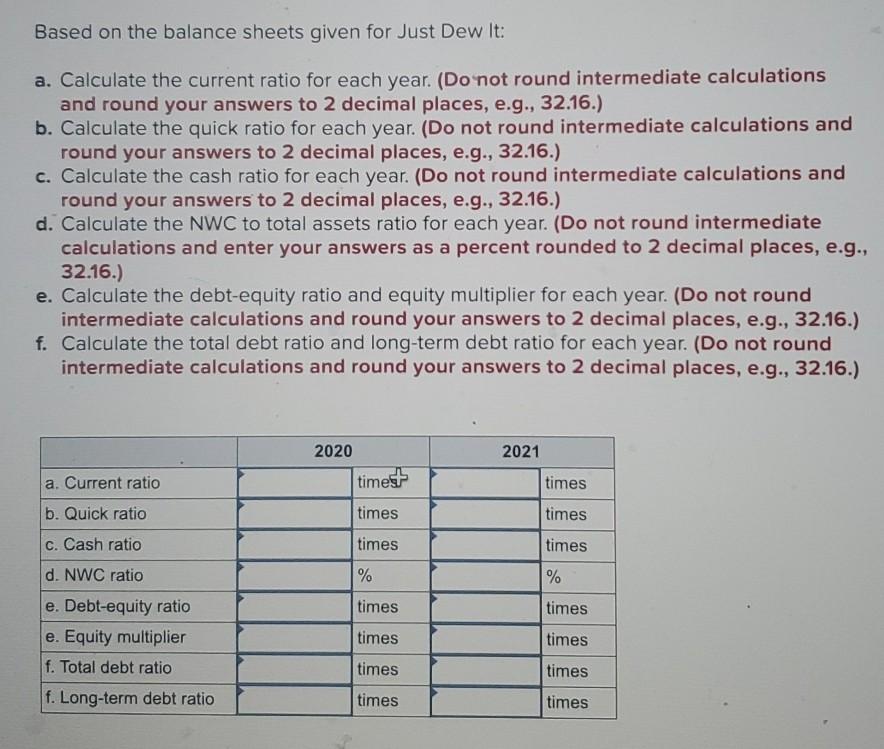

Just Dew It Corporation reports the following balance sheet information for 2020 and 2021 2020 2021 Assets Current assets Cash Accounts receivable Inventory JUST DEW IT CORPORATION 2020 and 2021 Balance Sheets 2020 2021 Liabilities and Owners' Equity Current liabilities $ 14,588 $ 17,631 Accounts payable 35,258 41,019 Notes payable 65,567 71,505 $ 55,653 $ 63,073 21,895 25,324 Total $ 115,413 $ 130,155 Total $ 77,548 $ 88,397 Long-term debt $ 58,000 $ 62,000 Owners' equity Common stock and paid-in surplus $ 60,000 $ 60,000 Retained earnings 397,278 418,179 Net plant and equipment $ 477,413 $ 498,421 Total $ 457,278 $ 478,179 Total assets $ $ 628,576 592,826 Total liabilities and owners' equity $ 592.826 628,576 Based on the balance sheets given for Just Dew It: a. Calculate the current ratio for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. Calculate the quick ratio for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) C. Calculate the cash ratio for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) d. Calculate the NWC to total assets ratio for each year. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) e. Calculate the debt-equity ratio and equity multiplier for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) f. Calculate the total debt ratio and long-term debt ratio for each year. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) 2020 2021 a. Current ratio timest times b. Quick ratio times times c. Cash ratio times times d. NWC ratio % % times times e. Debt-equity ratio e. Equity multiplier times times f. Total debt ratio times times f. Long-term debt ratio times timesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started