Answered step by step

Verified Expert Solution

Question

1 Approved Answer

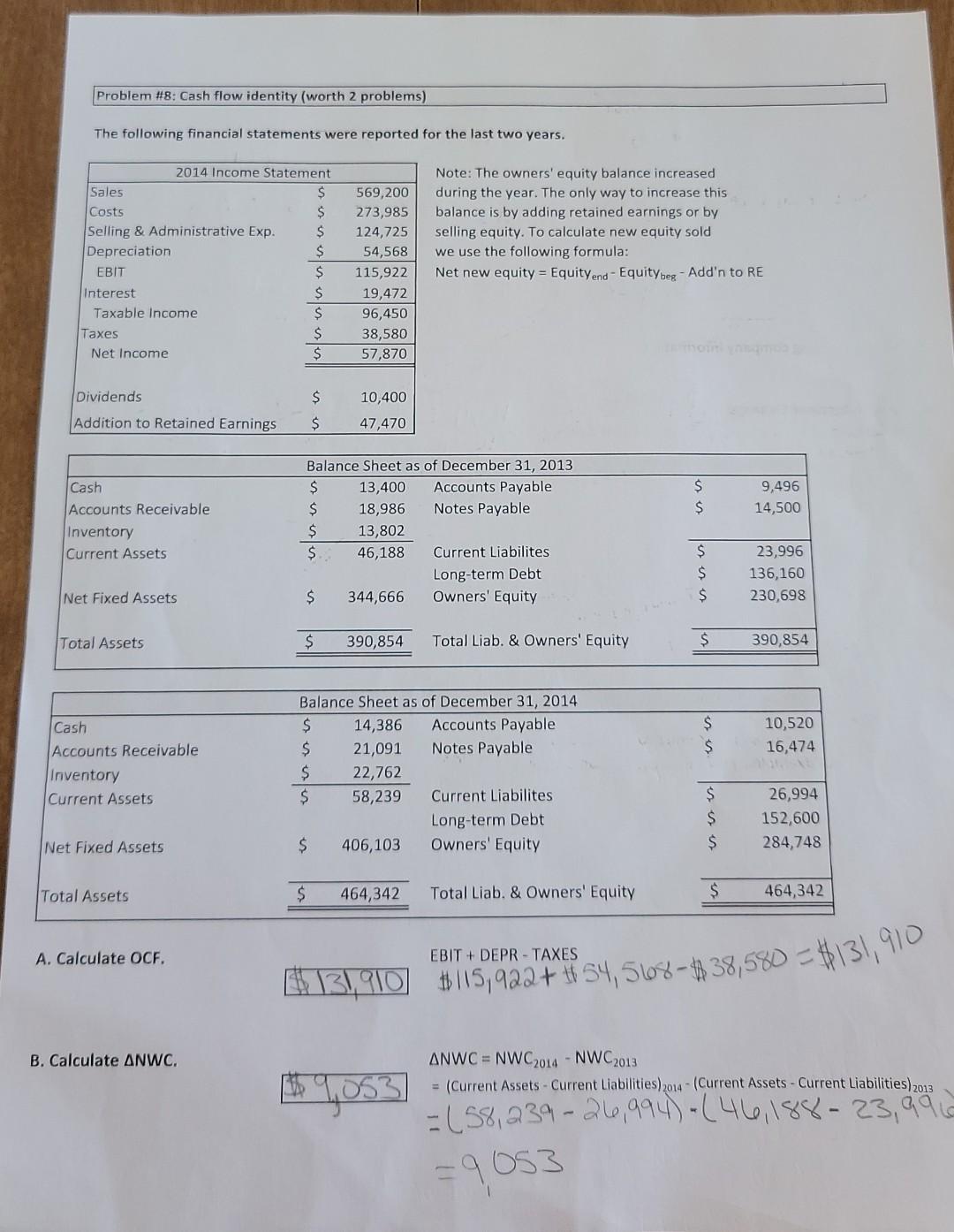

can you please explain part G? Problem #8: Cash flow identity (worth 2 problems) The following financial statements were reported for the last two years.

can you please explain part G?

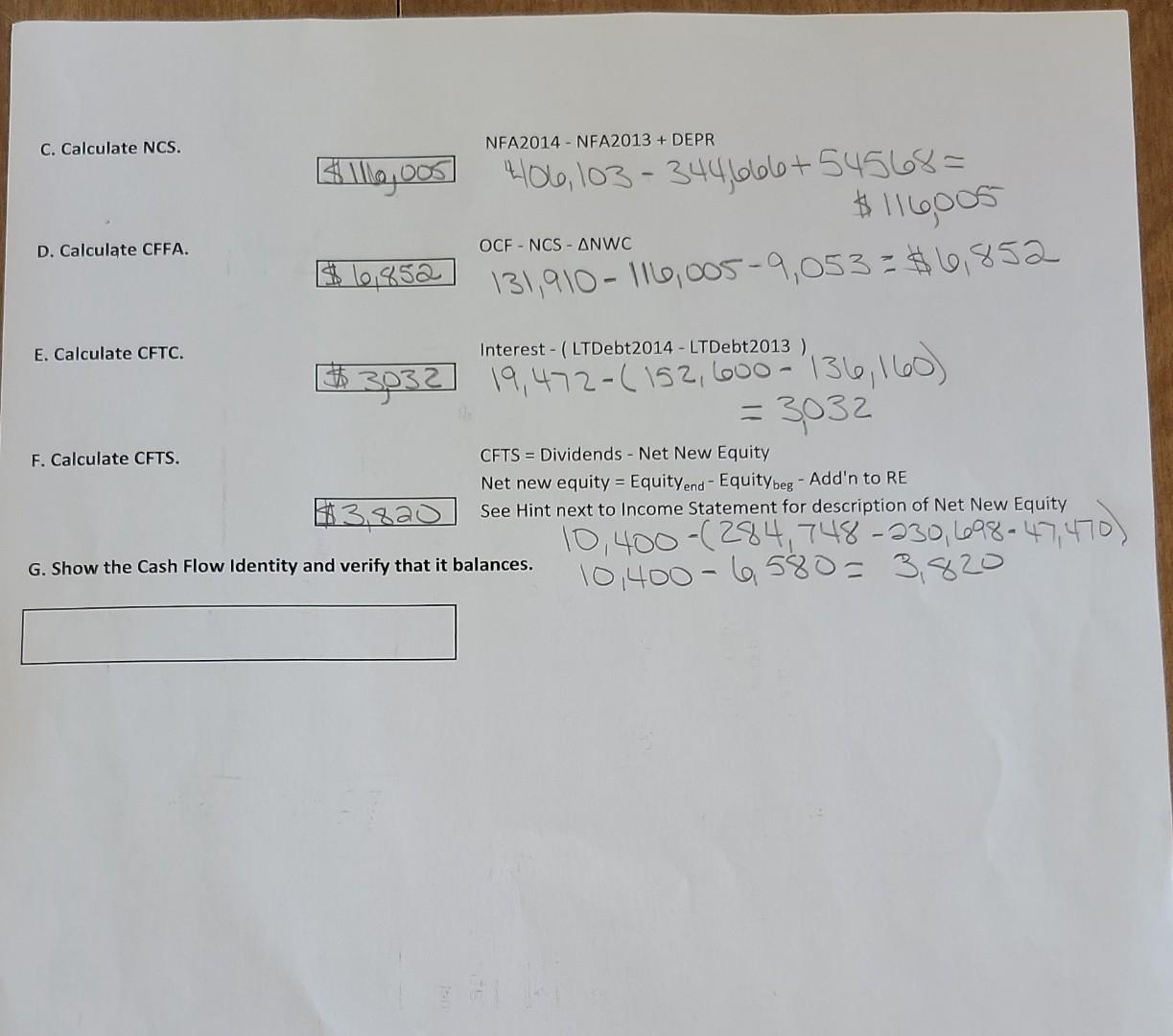

Problem #8: Cash flow identity (worth 2 problems) The following financial statements were reported for the last two years. Sales 2014 Income Statement $ Costs $ Selling & Administrative Exp. $ Depreciation $ EBIT $ Interest $ Taxable income $ Taxes $ Net Income $ 569,200 273,985 124,725 54,568 115,922 19,472 96,450 38,580 57,870 Note: The owners' equity balance increased during the year. The only way to increase this balance is by adding retained earnings or by selling equity. To calculate new equity sold we use the following formula: Net new equity = Equityend - Equity beg - Add'n to RE Dividends $ 10,400 47,470 Addition to Retained Earnings $ $ $ 9,496 14,500 Cash Accounts Receivable Inventory Current Assets Balance Sheet as of December 31, 2013 $ 13,400 Accounts Payable $ 18,986 Notes Payable $ 13,802 $ 46,188 Current Liabilites Long-term Debt $ 344,666 Owners' Equity $ $ $ 23,996 136,160 230,698 Net Fixed Assets Total Assets $ 390,854 Total Liab. & Owners' Equity $ 390,854 $ $ 10,520 16,474 Cash Accounts Receivable Inventory Current Assets Balance Sheet as of December 31, 2014 $ 14,386 Accounts Payable $ 21,091 Notes Payable $ 22,76 $ 58,239 Current Liabilites Long-term Debt $ 406,103 Owners' Equity $ $ $ 26,994 152,600 284,748 Net Fixed Assets Total Assets $ 464,342 Total Liab. & Owners' Equity $ 464,342 A. Calculate OCF. EBIT + DEPR - TAXES 131,910 #115,922+ #54,568-838,580 = $131,910 B. Calculate ANWC. ANWC = NWC2014-NWC2013 = (Current Assets - Current Liabilities) 2014 - (Current Assets - Current Liabilities) 2013 $9,053 = (58,239-266,994) -(46,188 - 23,996 =9053 C. Calculate NCS. NFA2014 - NFA2013 + DEPR $10,00 406, 103 - 344666+54568= 1 |1000 1$ 10,852 131,910-116,005-9,053 $6,852 D. Calculate CFFA. OCF - NCS - ANWC E. Calculate CFTC. Interest - (LTDebt2014 - LTDebt2013 ) $ 3832 19,472-(152,600 ) = 3032 136,160) = F. Calculate CFTS. CFTS = Dividends - Net New Equity Net new equity = Equityend - Equity beg - Add'n to RE See Hint next to Income Statement for description of Net New Equity $3,800 G. Show the Cash Flow Identity and verify that it balances. 10,400-(284,748-230, 698-47,470) 10,400 - 6580=3,820Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started