Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you please explain to me how the correct answers are calculated ! Use the information below to help answer questions 1-7 The risk free

Can you please explain to me how the correct answers are calculated !

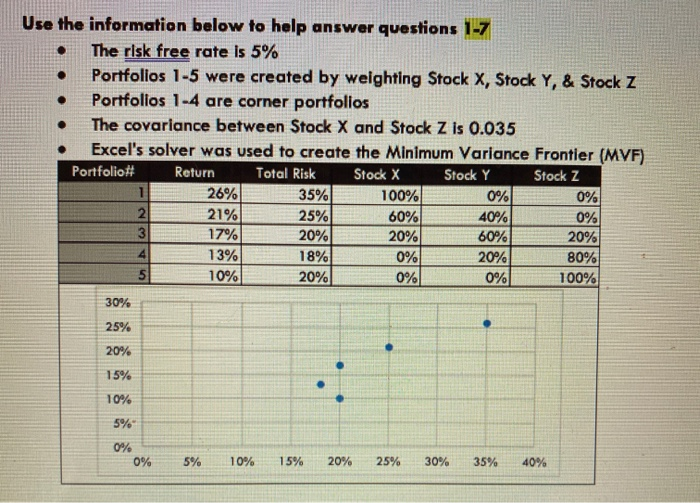

Use the information below to help answer questions 1-7

- The risk free rate is 5%

- Portfolios 1-5 were created by weighting Stock X, Stock Y, & Stock Z

- Portfolios 1-4 are corner portfolios

- The covariance between Stock X and Stock Z is 0.035

- Excels solver was used to create the Minimum Variance Frontier (MVF)

- A two risk asset portfolio with 50% Stock X and 50% Stock Z has a total risk closest to _________. Round your answer to the nearest 0.1%.

- 4.2%

- 20.5%

- 24.1%

- 27.5%

- None of the above

- Your clients portfolio is currently 100% Stock X. Stock W (not listed above) has Sharpe Ratio of 0.50. The correlation of the two stocks is 0.80. Based on this information, you should add Stock W to your existing portfolio. Evaluate the underlined words in italics. True or False?

- True

- False

- Which portfolio is most likely the optimal portfolio?

- Portfolio 1

- Portfolio 2

- Portfolio 3

- Portfolio 4

- Portfolio 5

- Which portfolio is most likely not on the efficient frontier?

- Portfolio 1

- Portfolio 2

- Portfolio 3

- Portfolio 4

- Portfolio 5

- Which of the following statements about MVO using Excels solver is most likely TRUE?

- To find the optimal portfolio, maximize the portfolios return

- To find the minimum variance portfolio, minimize the portfolios return

- To find the minimum variance portfolio, minimize the portfolios total risk

- To find the minimum variance portfolio, minimize the Sharpe Ratio

- Since shorting is not allowed, dont check the box that says make unconstrained variables non-negative

- If shorting were allowed when conducting MVO, the Sharpe Ratio of the optimal portfolio would most likely be lower. Evaluate the underlined words in italics. True or False?

- True

- False

- Your client requires 20% return and gives you $1000 cash to invest in stocks X,Y, or Z. Given the security weights in the corner portfolios, which of the following actions would be required:

- Buy $400 Stock X

- Buy $400 Stock Y

- Buy $500 Stock X

- Buy $500 Stock Y

- None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started