Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you please explain what values are needed to fill out the PV CCA Tax Shield formula in the solution below? Also, how is the

Can you please explain what values are needed to fill out the PV CCA Tax Shield formula in the solution below? Also, how is the PV (SV) 19, 090.91?

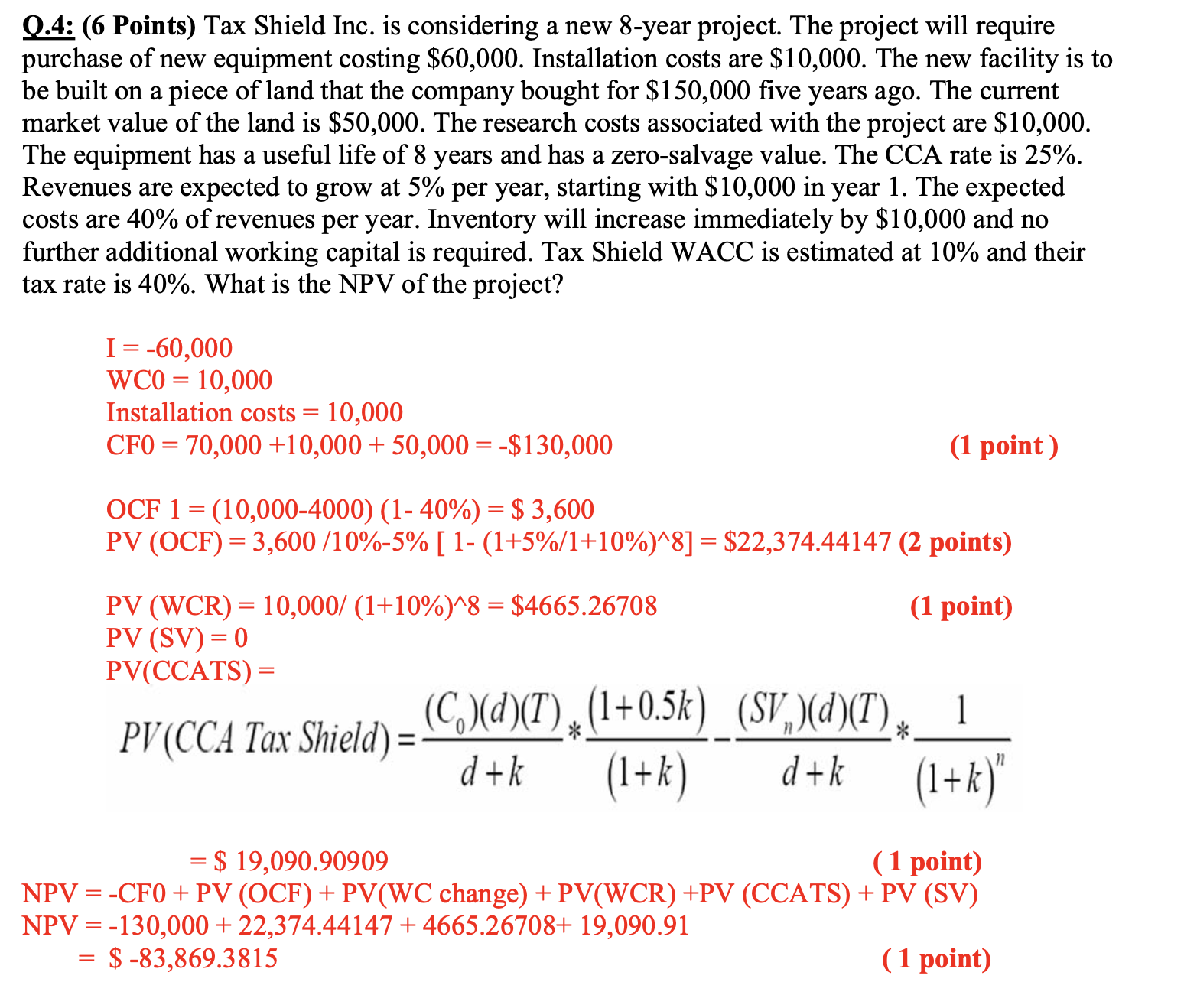

Q.4: (6 Points) Tax Shield Inc. is considering a new 8-year project. The project will require purchase of new equipment costing $60,000. Installation costs are $10,000. The new facility is to be built on a piece of land that the company bought for $150,000 five years ago. The current market value of the land is $50,000. The research costs associated with the project are $10,000. The equipment has a useful life of 8 years and has a zero-salvage value. The CCA rate is 25%. Revenues are expected to grow at 5% per year, starting with $10,000 in year 1 . The expected costs are 40% of revenues per year. Inventory will increase immediately by $10,000 and no further additional working capital is required. Tax Shield WACC is estimated at 10% and their tax rate is 40%. What is the NPV of the project? I=60,000WC0=10,000Installationcosts=10,000CF0=70,000+10,000+50,000=$130,000(1point)OCF1=(10,0004000)(140%)=$3,600PV(OCF)=3,600/10%5%[1(1+5%/1+10%)8]=$22,374.44147(2points)PV(WCR)=10,000/(1+10%)8=$4665.26708(1point)PV(SV)=0PV(CCATS)=PV(CCATaxShield)=d+k(C0)(d)(T)(1+k)(1+0.5k)d+k(SVn)(d)(T)(1+k)n1=$19,090.90909(1point)NPV=CF0+PV(OCF)+PV(WCchange)+PV(WCR)+PV(CCATS)+PV(SV)NPV=130,000+22,374.44147+4665.26708+19,090.91=$83,869.3815(1point)

Q.4: (6 Points) Tax Shield Inc. is considering a new 8-year project. The project will require purchase of new equipment costing $60,000. Installation costs are $10,000. The new facility is to be built on a piece of land that the company bought for $150,000 five years ago. The current market value of the land is $50,000. The research costs associated with the project are $10,000. The equipment has a useful life of 8 years and has a zero-salvage value. The CCA rate is 25%. Revenues are expected to grow at 5% per year, starting with $10,000 in year 1 . The expected costs are 40% of revenues per year. Inventory will increase immediately by $10,000 and no further additional working capital is required. Tax Shield WACC is estimated at 10% and their tax rate is 40%. What is the NPV of the project? I=60,000WC0=10,000Installationcosts=10,000CF0=70,000+10,000+50,000=$130,000(1point)OCF1=(10,0004000)(140%)=$3,600PV(OCF)=3,600/10%5%[1(1+5%/1+10%)8]=$22,374.44147(2points)PV(WCR)=10,000/(1+10%)8=$4665.26708(1point)PV(SV)=0PV(CCATS)=PV(CCATaxShield)=d+k(C0)(d)(T)(1+k)(1+0.5k)d+k(SVn)(d)(T)(1+k)n1=$19,090.90909(1point)NPV=CF0+PV(OCF)+PV(WCchange)+PV(WCR)+PV(CCATS)+PV(SV)NPV=130,000+22,374.44147+4665.26708+19,090.91=$83,869.3815(1point) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started