Can you please help in explaining the solution to the below queries. (Prompt provided via photo below)Thanks!

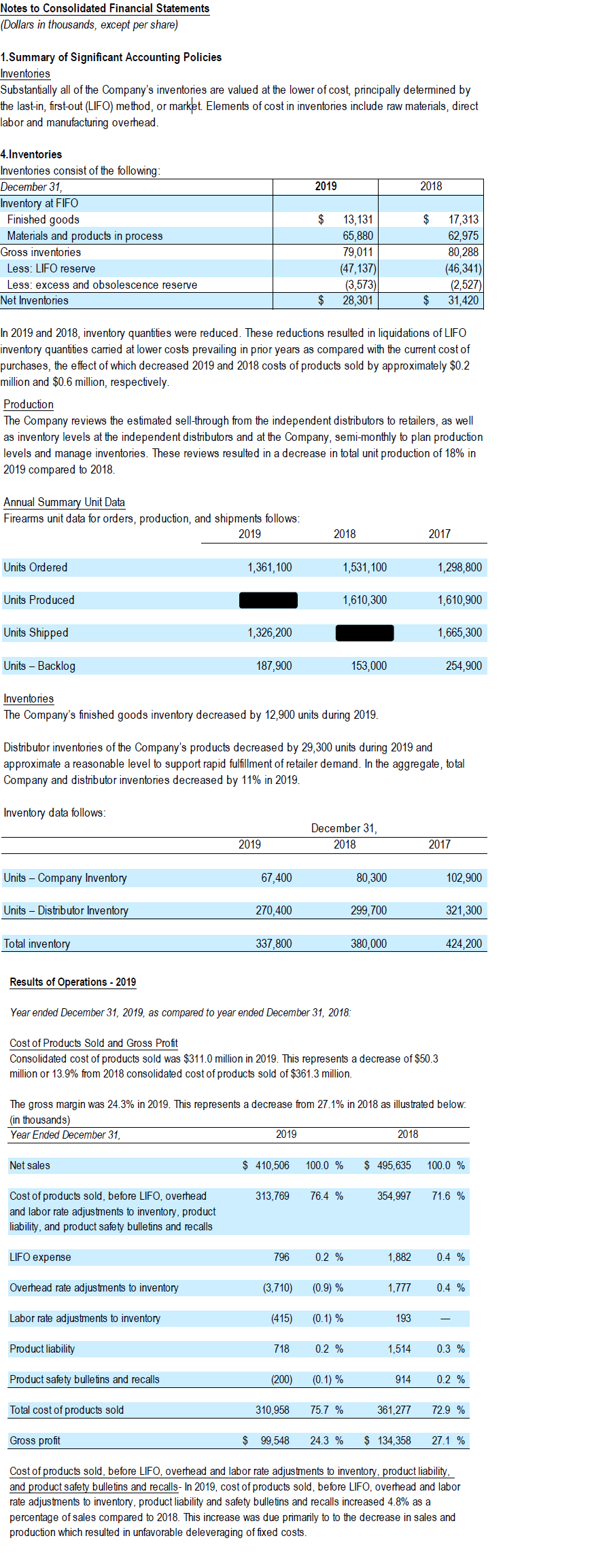

Notes to Consolidated Financial Statements Dollars in thousands, except per share) 1.Summary of Significant Accounting Policies Inventories Substantially all of the Company's inventories are valued at the lower of cost, principally determined by he last-in, first-out (LIFO) method, or market. Elements of cost in inventories include raw materials, direct labor and manufacturing overhead. 4.Inventories Inventories consist of the following: December 31, 2019 2018 Inventory at FIFO Finished goods $ 13, 131 $ 17,313 Materials and products in process 65.880 62,975 Gross inventories 79,011 80,288 Less: LIFO reserve (47, 137) (46,341) Less: excess and obsolescence reserve (3,573 2,527) Net Inventories $ 28,301 $ 31,420 In 2019 and 2018, inventory quantities were reduced. These reductions resulted in liquidations of LIFO nventory quantities carried at lower costs prevailing in prior years as compared with the current cost of purchases, the effect of which decreased 2019 and 2018 costs of products sold by approximately $0.2 million and $0.6 million, respectively. Production The Company reviews the estimated sell-through from the independent distributors to retailers, as well as inventory levels at the independent distributors and at the Company, semi-monthly to plan production levels and manage inventories. These reviews resulted in a decrease in total unit production of 18% in 2019 compared to 2018. Annual Summary Unit Data Firearms unit data for orders, production, and shipments follows: 2019 2018 2017 Units Ordered 1,361, 100 1,531, 100 1,298,800 Units Produced 1,610,300 1,610,900 Units Shipped 1,326,200 1,665,300 Units - Backlog 187,900 153,000 254,900 Inventories The Company's finished goods inventory decreased by 12,900 units during 2019. Distributor inventories of the Company's products decreased by 29,300 units during 2019 and approximate a reasonable level to support rapid fulfillment of retailer demand. In the aggregate, total Company and distributor inventories decreased by 11% in 2019. Inventory data follows: December 31, 2019 2018 2017 Units - Company Inventory 67,400 80,300 102,900 Units - Distributor Inventory 270,400 299,700 321,300 Total inventory 337,800 380,000 424,200 Results of Operations - 2019 Year ended December 31, 2019, as compared to year ended December 31, 2018: Cost of Products Sold and Gross Profit Consolidated cost of products sold was $311.0 million in 2019. This represents a decrease of $50.3 million or 13.9% from 2018 consolidated cost of products sold of $361.3 million. The gross margin was 24.3% in 2019. This represents a decrease from 27.1% in 2018 as illustrated below. (in thousands) Year Ended December 31, 2019 2018 Net sales $ 410,506 100.0 % $ 495,635 100.0 % Cost of products sold, before LIFO, overhead 313,769 76.4 % 354,997 71.6 % and labor rate adjustments to inventory, product liability, and product safety bulletins and recalls LIFO expense 796 0.2 % 1,882 0.4 % Overhead rate adjustments to inventory (3,710) (0.9) % 1,777 0.4 % Labor rate adjustments to inventory (415) (0.1) % 193 Product liability 718 0.2 % 1,514 0.3 % Product safety bulletins and recalls (200) (0.1) % 914 0.2 % Total cost of products sold 310,958 75.7 % 361.277 72.9 % Gross profit $ 99,548 24.3 % $ 134,358 27.1 % Cost of products sold, before LIFO, overhead and labor rate adjustments to inventory, product liability, and product safety bulletins and recalls- In 2019, cost of products sold, before LIFO, overhead and labor rate adjustments to inventory, product liability and safety bulletins and recalls increased 4.8% as a percentage of sales compared to 2018. This increase was due primarily to to the decrease in sales and production which resulted in unfavorable deleveraging of fixed costs