Can you please help me and upload the completed Financial Statement Analysis of the below answer?

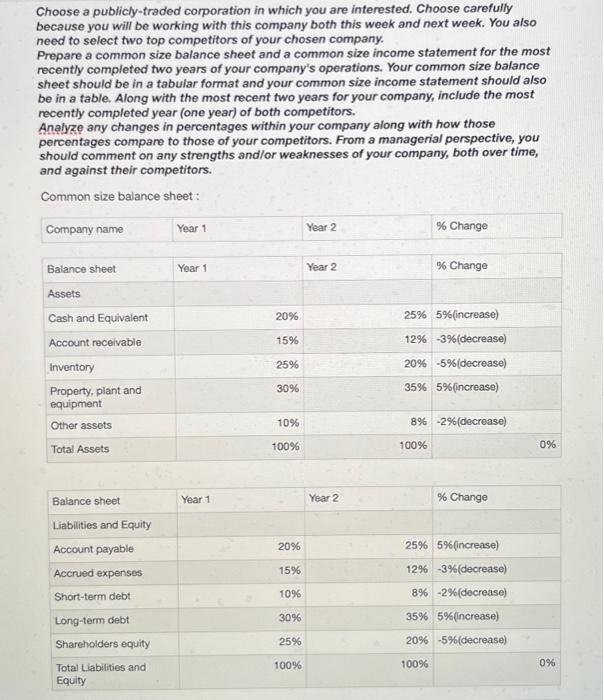

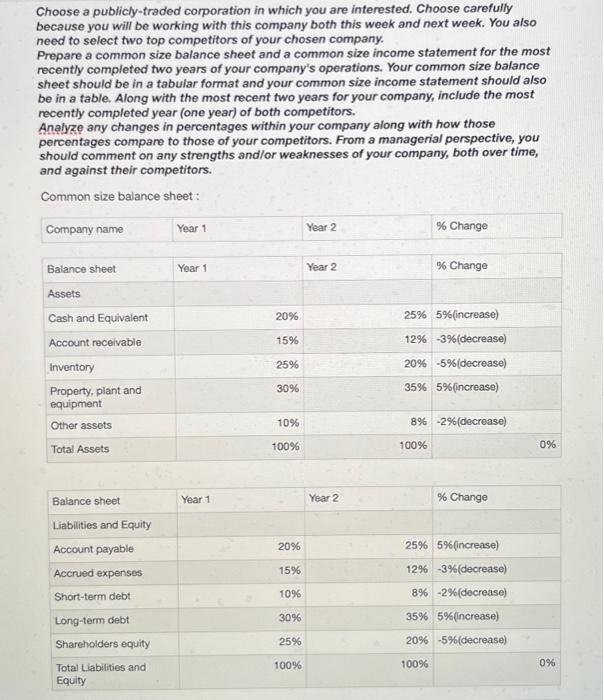

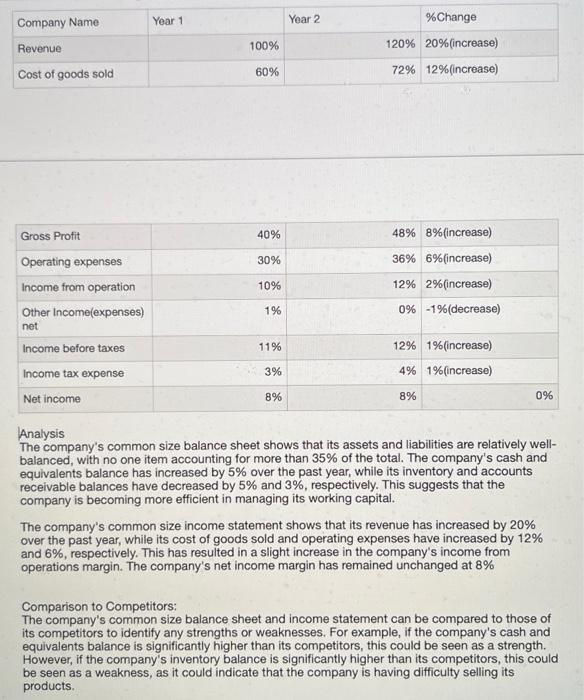

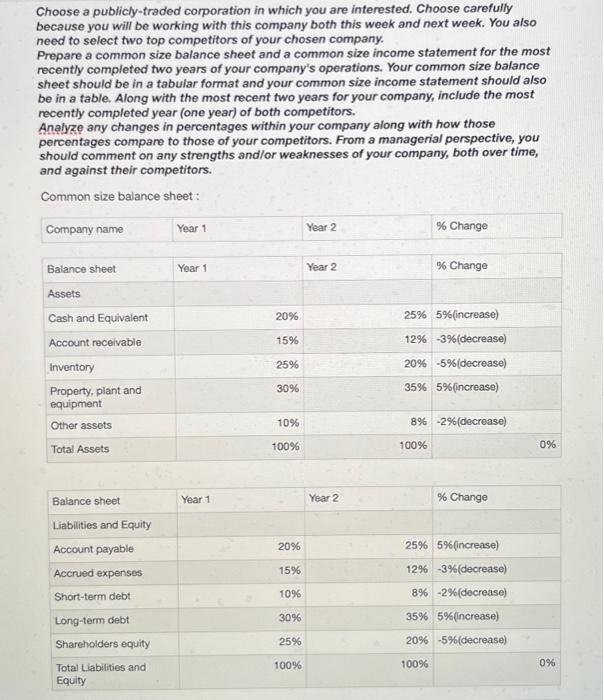

Choose a publicly-traded corporation in which you are interested. Choose carefully because you will be working with this company both this week and next week. You also need to select two top competitors of your chosen company. Prepare a common size balance sheet and a common size income statement for the most recently completed two years of your company's operations. Your common size balance sheet should be in a tabular format and your common size income statement should also be in a table. Along with the most recent two years for your company, include the most recently completed year (one year) of both competitors. Analyze any changes in percentages within your company along with how those percentages compare to those of your competitors. From a managerial perspective, you should comment on any strengths and/or weaknesses of your company, both over time, and against their competitors. Analysis The company's common size balance sheet shows that its assets and liabilities are relatively wellbalanced, with no one item accounting for more than 35% of the total. The company's cash and equivalents balance has increased by 5% over the past year, while its inventory and accounts receivable balances have decreased by 5% and 3%, respectively. This suggests that the company is becoming more efficient in managing its working capital. The company's common size income statement shows that its revenue has increased by 20% over the past year, while its cost of goods sold and operating expenses have increased by 12% and 6%, respectively. This has resulted in a slight increase in the company's income from operations margin. The company's net income margin has remained unchanged at 8% Comparison to Competitors: The company's common size balance sheet and income statement can be compared to those of its competitors to identify any strengths or weaknesses. For example, if the company's cash and equivalents balance is significantly higher than its competitors, this could be seen as a strength. However, if the company's inventory balance is significantly higher than its competitors, this could be seen as a weakness, as it could indicate that the company is having difficulty selling its products. Managerial Perspective: From a managerial perspective, it is important to monitor the company's common size balance sheet and income statement over time to identify any trends. For example, if the company's inventory balance has been increasing steadily over the past several years, this could be a sign that the company needs to improve its inventory management practices. The company's common size balance sheet and income statement appear to be healthy. The company is generating positive cash flow and has a relatively well-balanced balance sheet. However, it is important for the company to continue to monitor its financial performance and identify any areas where it can improve. The company's financial performance appears to be healthy overall, with increasing revenue and a relatively well-balanced balance sheet. However, it is important to continue monitoring trends in inventory management and operational efficiency