Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you please help me answer these questions with these numbers step by step showinh me the specifc steps with the way the questions is

Can you please help me answer these questions with these numbers step by step showinh me the specifc steps with the way the questions is being asked. Showing yhe final answer and how yiu got to it

Problem A farmer is thinking about investing in a center pivot irrigation system to irrigate acres of land in Dawson County. This land is used to produce cotton and is currently a dryland operation. Current production is approximately bale of cotton per acre. The current operating expenses are $ per acre. With an irrigation system, operating expenses would increase by $ per acre due to electricity, maintenance and additional labor Total operating expense $ The irrigation system will be used during periods of low precipitation for the growing of cotton and for preparing the ground for breaking. It is estimated that the irrigation will increase yields and thus operating receipts by $ per acre. The cost for drilling a well would be $ and the cost for the center pivot irrigation system would be $ The irrigation system would be mile long and would irrigate acres. This system would run off electricity and would be able to apply any amount of water over any givn period. Suppose that the farmer wants to evaluate this investment over a fiveyear period of time. The farmer believes that if he sold the farm in five years, the irrigation system would add $ to the sale price. The farmer anticipates that his marginal tax rate over the next six years. will be The IRS will allow the farmer to depreciate the investment $$ using straightline over years. Assume that the terminal value of this investment is $ at the end of five years. The farmer requires a return to capital pretax

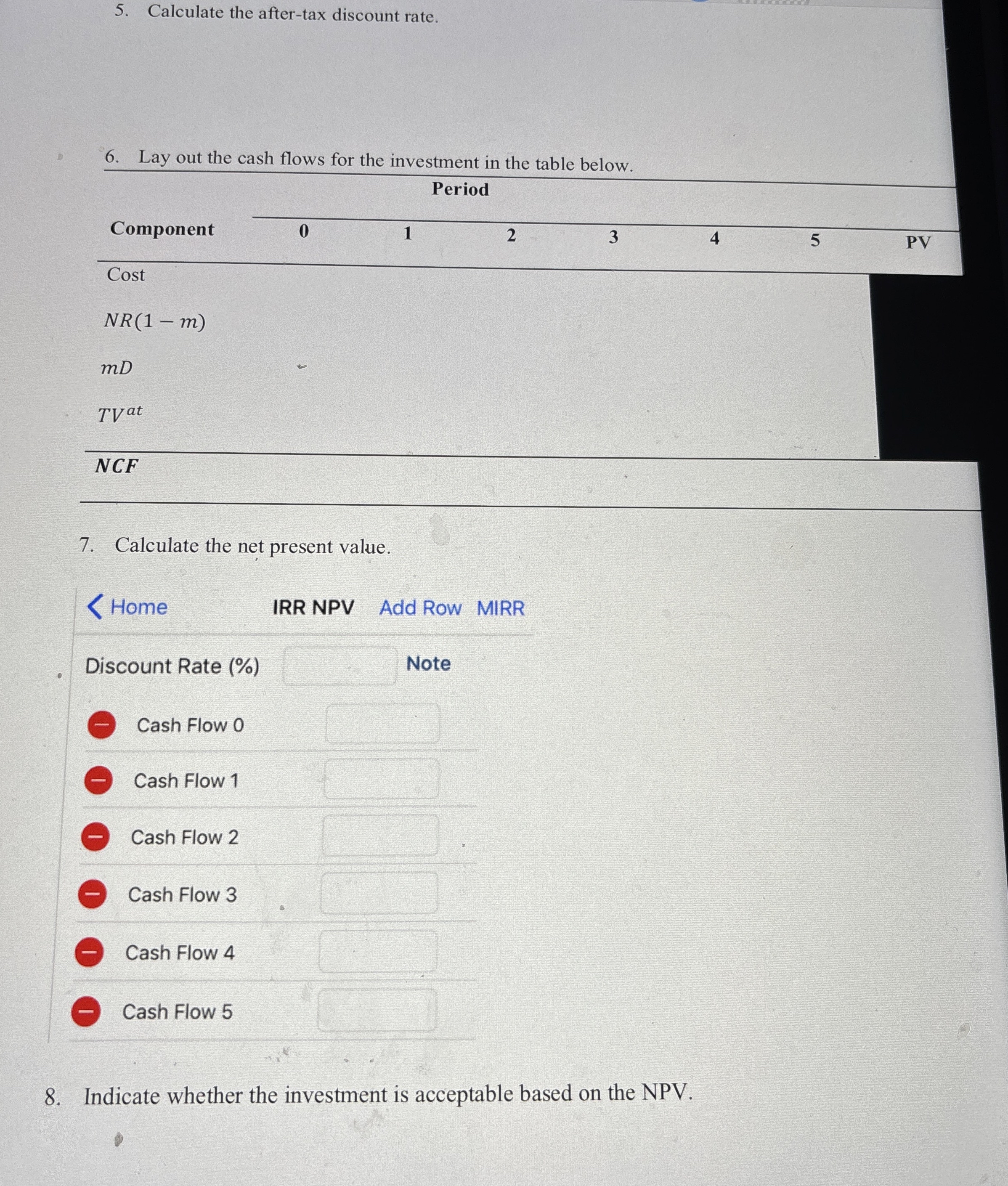

What is the initial cost of the equipment?

Calculate the aftertax net returns per year for the next years.

Calculate the tax savings from depreciation

Calculate the aftertax terminal value.

Calculate the aftertax discount rate.

Lay out the cash flows for the investment in the table below.

Calculate the net present value.

Home

IRR NPV Add Row MIRR

Discount Rate

Note

Cash Flow

Cash Flow

Cash Flow

Cash Flow

Cash Flow

Cash Flow

Indicate whether the investment is acceptable based on the NPV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started