Can you please help me with blank questions asap PLEASE

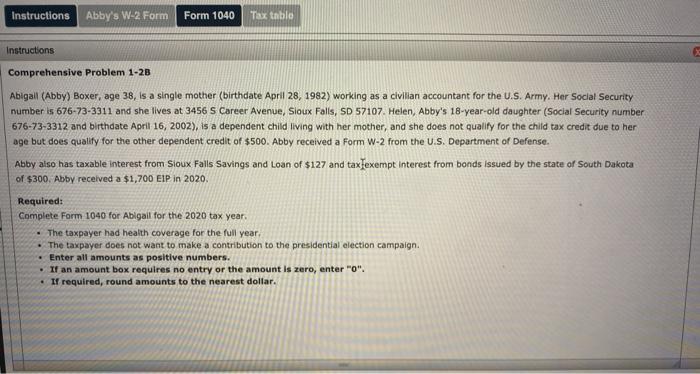

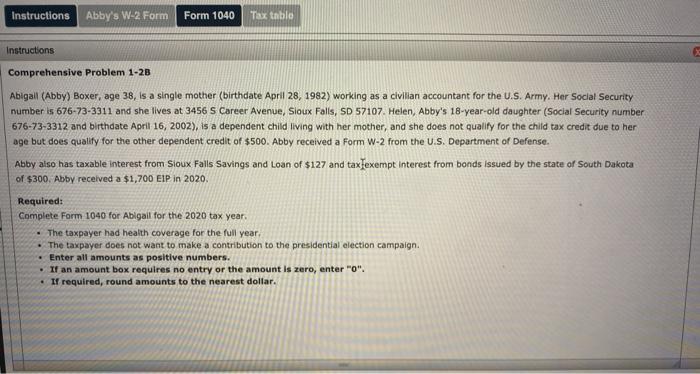

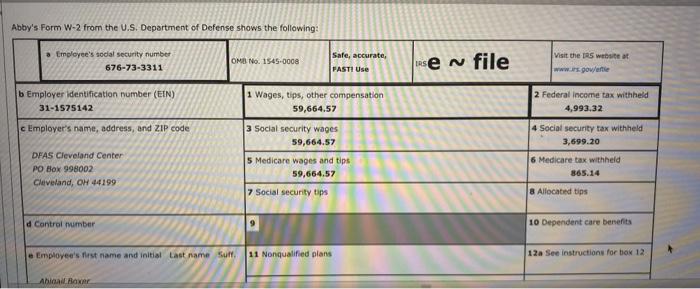

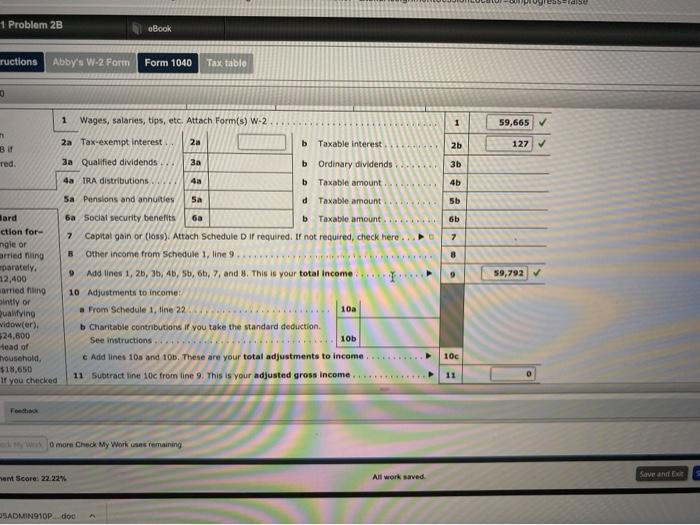

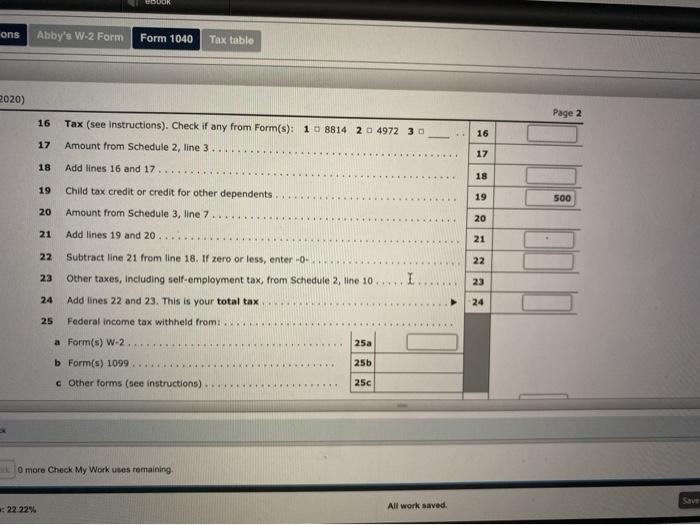

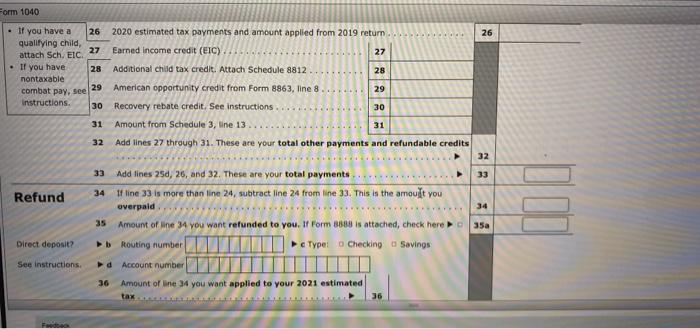

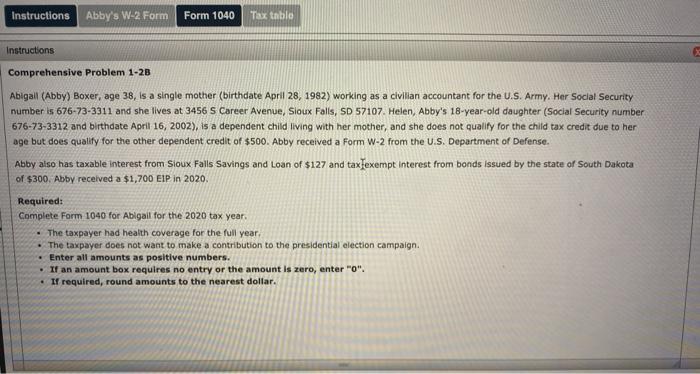

Instructions Abby's W-2 Form Form 1040 Tax tablo Instructions Comprehensive Problem 1-2B Abigail (Abby) Boxer, age 38, is a single mother (birthdate April 28, 1982) working as a civilian accountant for the U.S. Army. Her Social Security number is 676-73-3311 and she lives at 3456 S Career Avenue, Sioux Falls, SD 57107. Helen, Abby's 18-year-old daughter (Social Security number 676-73-3312 and birthdate April 16, 2002), is a dependent child living with her mother, and she does not qualify for the child tax credit due to her age but does qualify for the other dependent credit of $500. Abby received a Form W-2 from the U.S. Department of Defense. Abby also has taxable interest from Sioux Falls Savings and Loan of $127 and taxFexempt Interest from bonds issued by the state of South Dakota of $300. Abby received a $1,700 EIP in 2020. Required: Complete Form 1040 for Abigail for the 2020 tax year, The taxpayer had health coverage for the full year. The taxpayer does not want to make a contribution to the presidential election campaign. Enter all amounts as positive numbers. If an amount box requires no entry or the amount is zero, enter "0". If required, round amounts to the nearest dollar. Abby's Form W-2 from the U.S. Department of Defense shows the following: 3 Employee's social security number 676-73-3311 OMB No 1545-0008 Safe, accurate, FASTI Use en file Visit the website at www.is.gov/ente b Employer identification number (EIN) 31-1575142 2 Federal income tax withheld 4,993.32 c Employer's name, address, and ZIP code 1 Wages, tips, other compensation 59,664.57 3 Social security wages 59,664.57 5 Medicare wages and tips 59,664.57 Social security tips DFAS Cleveland Center PO Box 998002 Cleveland, OH 44199 4 Social security tax withheld 3,699.20 6 Medicare tax withheld 865.14 & Allocated tips d Control number 10 Dependent care benefits e Employee's first name and initial Last name Sull 11 Nonqualified plans 12a See instructions for box 12 Ablaaier fase 1 Problem 2B eBook ructions Abby's W-2 Form Form 1040 Tax tablo 0 Wages, salaries, tips, etc. Attach Form(s) W-2 1 59,665 2a Tax-exempt interest 2a b Taxable interest 2b 127 red 3b 4b 5b 6b 7 8 3a Qualified dividends... 3a b Ordinary dividends........ 4a TRA distributions 4a b Taxable amount Sa Pensions and annuities Sa d Taxable amount. 6a Social security benefits b Taxable amount 7 Capital gain or loss). Attach Schedule D if required. If not required, check here ... B Other income from Schedule 1, line 9 Add lines 1, 2, 3, 4, 5, 6, 7 and 8. This is your total income: 10 Adjustments to income - From Schedule 1, line 22 10a b Charitable contributions if you take the standard deduction See instructions 10b c Add lines 10s and 10b. These are your total adjustments to income.............. 9 Hard ction for ngle or arried ning eparately 12,400 med hang sintly or Qualifying widower). 24,800 Head of household $18,650 If you checked 59,792 106 11 Subtract line 10c from line 9. This is your adjusted gross income... 11 O more Check My Works remaining am Score: 22.22% All work saved Save and 5ADMIN910P.doc ODOR ons Abby's W-2 Form Form 1040 Tax table 2020) Page 2 16 Tax (see Instructions). Check if any from Form(s): 1 08814 2 4972 30 16 17 Amount from Schedule 2, line 3 17 18 Add lines 16 and 17..... 18 19 Child tax credit or credit for other dependents 19 500 20 Amount from Schedule 3, line 7.... 20 21 Add lines 19 and 20. 21 22 22 Subtract line 21 from line 18. If zero or less, enter -0 Other taxes, including self-employment tax, from Schedule 2, line 10 23 I 23 24 Add lines 22 and 23. This is your total tax 24 25 Federal income tax withheld from a Form(s) W-2 25a 25b b Form(s) 1099. c Other forms (see instructions) 25c O more Check My Work uses remaining. 22.22% All work saved 26 2020 estimated tax payments and amount applied from 2019 return.. Earned Income credit (EIC) 27 Form 1040 If you have a 26 qualifying child 27 attach Sch. EIC If you have 28 montaxable combat pay, see 29 Instructions 30 31 Additional child tax credit. Attach Schedule 8812 28 29 American opportunity credit from Form 8863, line 8 Recovery rebate credit. See instructions 30 Amount from Schedule 3, line 13 31 32 Add lines 27 through 31. These are your total other payments and refundable credits 32 33 Add lines 25d, 26, and 32. These are your total payments 33 Refund tt line 33 is more than line 24, subtract line 24 from line 33. This is the amoult you overpaid 34 35 Amount of line 34 you want refunded to you. If Form 3888 is attached, check here 35a Direct deposit? Routing number E e Type: Checking Savings See instructions: a Account number 36 Amount of line 34 you want applied to your 2021 estimated tax 36 Instructions Abby's W-2 Form Form 1040 Tax tablo Instructions Comprehensive Problem 1-2B Abigail (Abby) Boxer, age 38, is a single mother (birthdate April 28, 1982) working as a civilian accountant for the U.S. Army. Her Social Security number is 676-73-3311 and she lives at 3456 S Career Avenue, Sioux Falls, SD 57107. Helen, Abby's 18-year-old daughter (Social Security number 676-73-3312 and birthdate April 16, 2002), is a dependent child living with her mother, and she does not qualify for the child tax credit due to her age but does qualify for the other dependent credit of $500. Abby received a Form W-2 from the U.S. Department of Defense. Abby also has taxable interest from Sioux Falls Savings and Loan of $127 and taxFexempt Interest from bonds issued by the state of South Dakota of $300. Abby received a $1,700 EIP in 2020. Required: Complete Form 1040 for Abigail for the 2020 tax year, The taxpayer had health coverage for the full year. The taxpayer does not want to make a contribution to the presidential election campaign. Enter all amounts as positive numbers. If an amount box requires no entry or the amount is zero, enter "0". If required, round amounts to the nearest dollar. Abby's Form W-2 from the U.S. Department of Defense shows the following: 3 Employee's social security number 676-73-3311 OMB No 1545-0008 Safe, accurate, FASTI Use en file Visit the website at www.is.gov/ente b Employer identification number (EIN) 31-1575142 2 Federal income tax withheld 4,993.32 c Employer's name, address, and ZIP code 1 Wages, tips, other compensation 59,664.57 3 Social security wages 59,664.57 5 Medicare wages and tips 59,664.57 Social security tips DFAS Cleveland Center PO Box 998002 Cleveland, OH 44199 4 Social security tax withheld 3,699.20 6 Medicare tax withheld 865.14 & Allocated tips d Control number 10 Dependent care benefits e Employee's first name and initial Last name Sull 11 Nonqualified plans 12a See instructions for box 12 Ablaaier fase 1 Problem 2B eBook ructions Abby's W-2 Form Form 1040 Tax tablo 0 Wages, salaries, tips, etc. Attach Form(s) W-2 1 59,665 2a Tax-exempt interest 2a b Taxable interest 2b 127 red 3b 4b 5b 6b 7 8 3a Qualified dividends... 3a b Ordinary dividends........ 4a TRA distributions 4a b Taxable amount Sa Pensions and annuities Sa d Taxable amount. 6a Social security benefits b Taxable amount 7 Capital gain or loss). Attach Schedule D if required. If not required, check here ... B Other income from Schedule 1, line 9 Add lines 1, 2, 3, 4, 5, 6, 7 and 8. This is your total income: 10 Adjustments to income - From Schedule 1, line 22 10a b Charitable contributions if you take the standard deduction See instructions 10b c Add lines 10s and 10b. These are your total adjustments to income.............. 9 Hard ction for ngle or arried ning eparately 12,400 med hang sintly or Qualifying widower). 24,800 Head of household $18,650 If you checked 59,792 106 11 Subtract line 10c from line 9. This is your adjusted gross income... 11 O more Check My Works remaining am Score: 22.22% All work saved Save and 5ADMIN910P.doc ODOR ons Abby's W-2 Form Form 1040 Tax table 2020) Page 2 16 Tax (see Instructions). Check if any from Form(s): 1 08814 2 4972 30 16 17 Amount from Schedule 2, line 3 17 18 Add lines 16 and 17..... 18 19 Child tax credit or credit for other dependents 19 500 20 Amount from Schedule 3, line 7.... 20 21 Add lines 19 and 20. 21 22 22 Subtract line 21 from line 18. If zero or less, enter -0 Other taxes, including self-employment tax, from Schedule 2, line 10 23 I 23 24 Add lines 22 and 23. This is your total tax 24 25 Federal income tax withheld from a Form(s) W-2 25a 25b b Form(s) 1099. c Other forms (see instructions) 25c O more Check My Work uses remaining. 22.22% All work saved 26 2020 estimated tax payments and amount applied from 2019 return.. Earned Income credit (EIC) 27 Form 1040 If you have a 26 qualifying child 27 attach Sch. EIC If you have 28 montaxable combat pay, see 29 Instructions 30 31 Additional child tax credit. Attach Schedule 8812 28 29 American opportunity credit from Form 8863, line 8 Recovery rebate credit. See instructions 30 Amount from Schedule 3, line 13 31 32 Add lines 27 through 31. These are your total other payments and refundable credits 32 33 Add lines 25d, 26, and 32. These are your total payments 33 Refund tt line 33 is more than line 24, subtract line 24 from line 33. This is the amoult you overpaid 34 35 Amount of line 34 you want refunded to you. If Form 3888 is attached, check here 35a Direct deposit? Routing number E e Type: Checking Savings See instructions: a Account number 36 Amount of line 34 you want applied to your 2021 estimated tax 36