Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you please help me with does question + X C QUESTION + Suppose Corporal X ny.edu/webapps/assessment/take/launch jsp?course assessment id=1892817 18 course id2007385 1&content id=5757315

can you please help me with does question

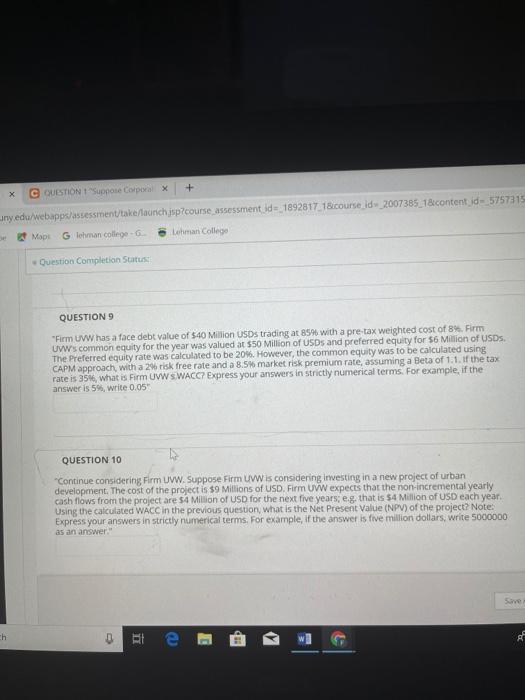

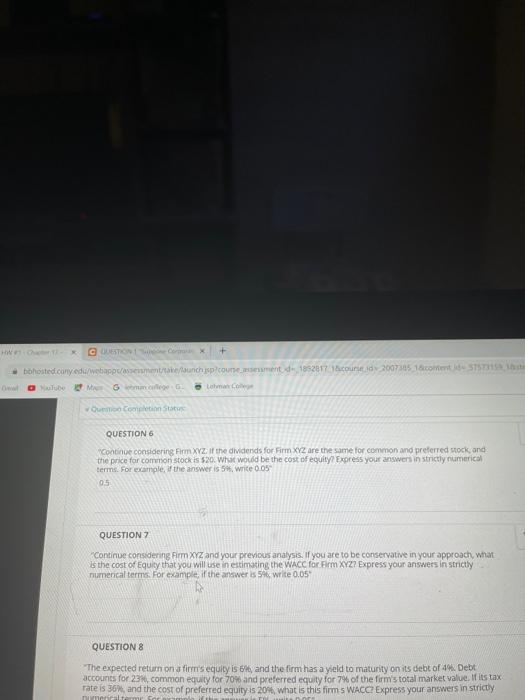

+ X C QUESTION + Suppose Corporal X ny.edu/webapps/assessment/take/launch jsp?course assessment id=1892817 18 course id2007385 1&content id=5757315 Glohman college-6 Leman College Mapl Question Completion Status QUESTION 9 "Firm UWW has a face debt value of $40 Million USDs trading at 85% with a pre-tax weighted cost of 89. Firm UWs common equity for the year was valued at $50 Million of USDs and preferred equity for $6 Million of USDs. The Preferred equity rate was calculated to be 20%. However, the common equity was to be calculated using CAPM approach with a 2% risk free rate and a 8.5% market risk premium rate, assuming a Beta of 1.1. If the tax rate is 3546, what is Firm UVWS WACC? Express your answers in strictly numerical terms. For example, if the answer is 5%, write 0.05 h QUESTION 10 "Continue considering Firm UVW. Suppose Firm UWW is considering Investing in a new project of urban development. The cost of the project is $9 Millions of USD. Firm UWW expects that the non-incremental yearly cash flows from the project are $4 Million of USD for the next five years eg. that is $4 Million of USD each year. Using the calculated WACC in the previous question, what is the Net Present Value (NPV) of the project? Note: Express your answers in strictly numerical terms. For example, if the answer is five million dollars, write 5000000 as an answer Save ch DRE e E CETOX + boosted.cuny.edu/webapp/mnt/te/launchip counement de 1052017 .count 20070518cm Shit Olubo MN Loco Contat QUESTION 6 "Continge considering Firm XYZ. If the dividends for Firm XYZ are the same for common and preferred stock and the price for common stock is $20. What would be the cost of equity Express your answers in strictly numerical terms. For example, the answer is 59. write 0.05 05 QUESTION "Continue considering Firm XYZ and your previous analysis. If you are to be conservative in your approach what is the cost of Equity that you will use in estimating the WACC for Firm XYZ? Express your answers in strictly numerical terms. For example, if the answer is 5% write 0.054 QUESTIONS "The expected return on a firm's equity is it and the firm has a yield to maturity on its debt of Debt accounts for 23 common equity for 70% and preferred equity for 7% of the firm's total market value. its tax rate is 36 and the cost of preferred equitys 20%, what is this firms WACC Express your answers in strictly Talte Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started