Can you please help me with the answers I got wrong in the red boxes? Thank you for your time.

unfortunately this is the whole question, this is why I am having a hard time coming up with the answers.

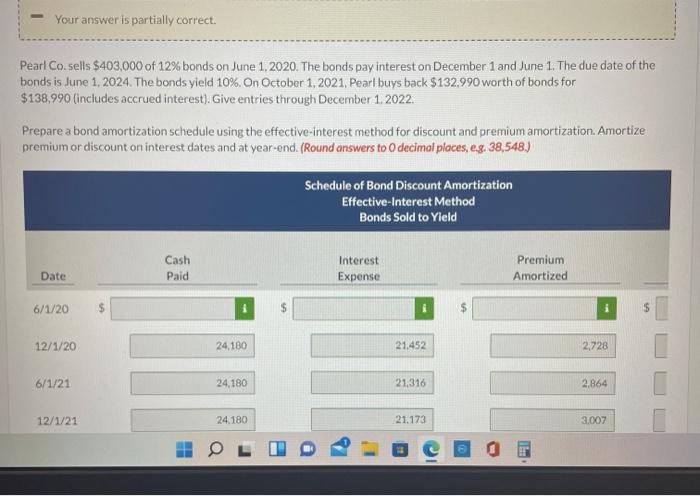

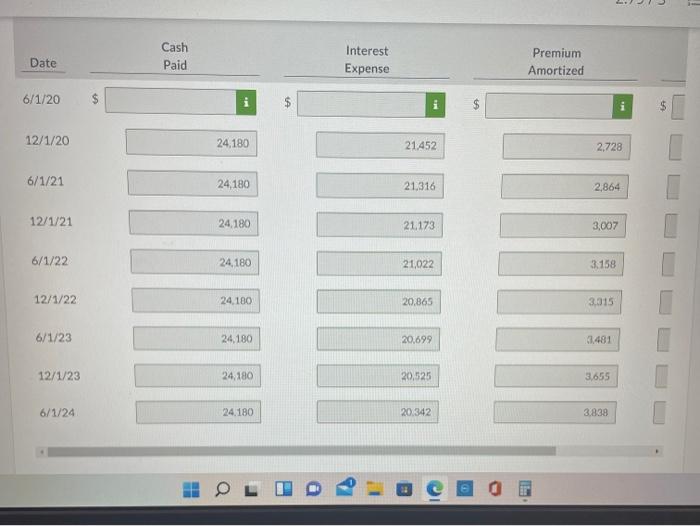

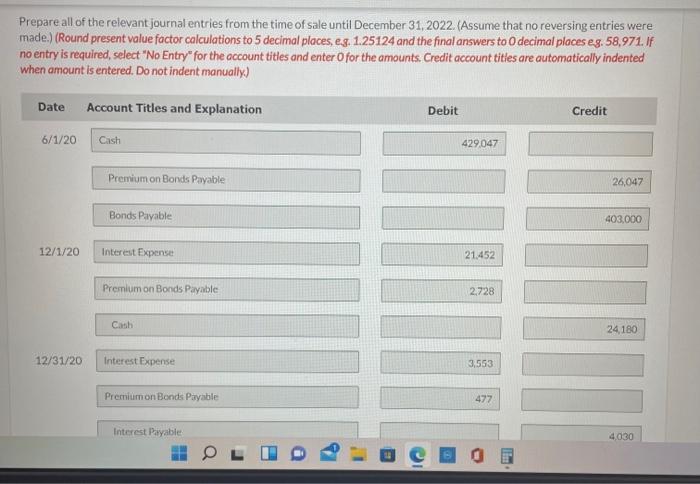

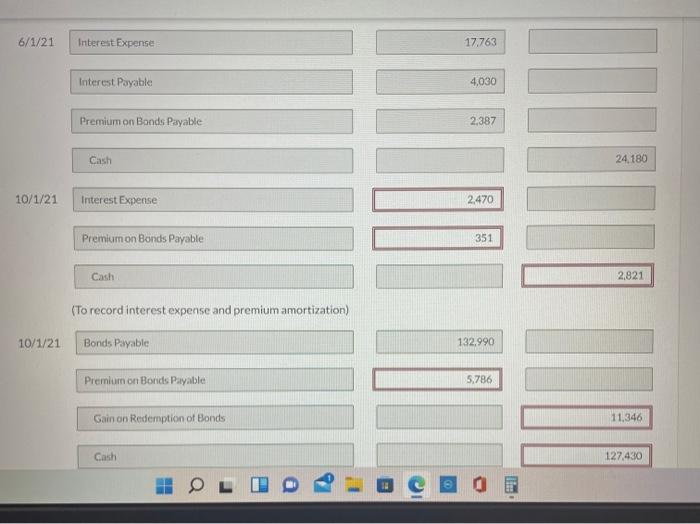

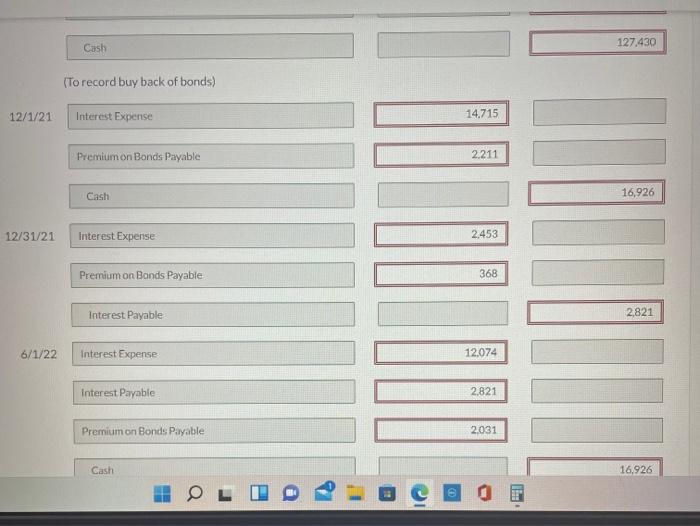

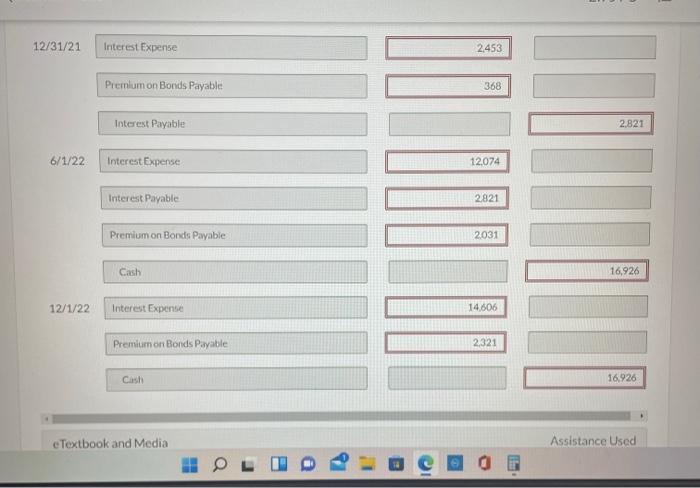

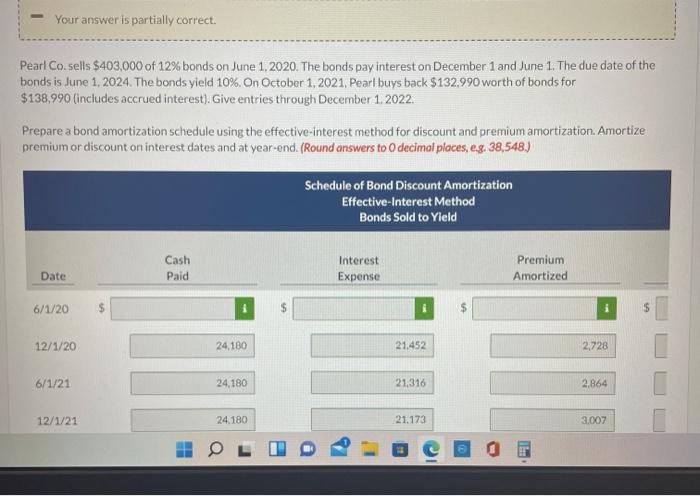

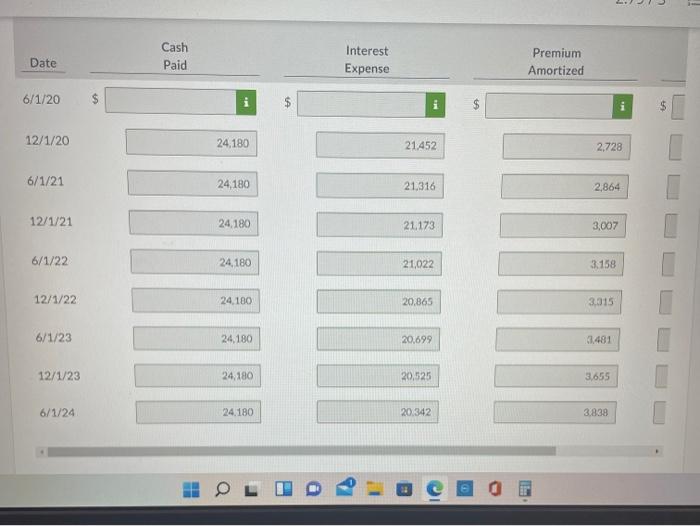

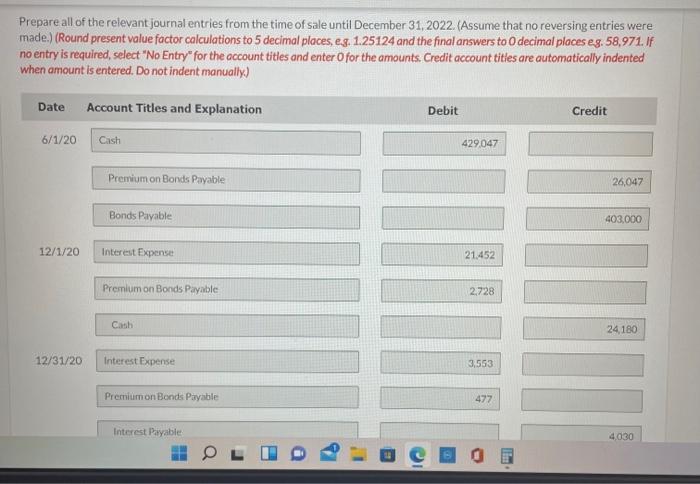

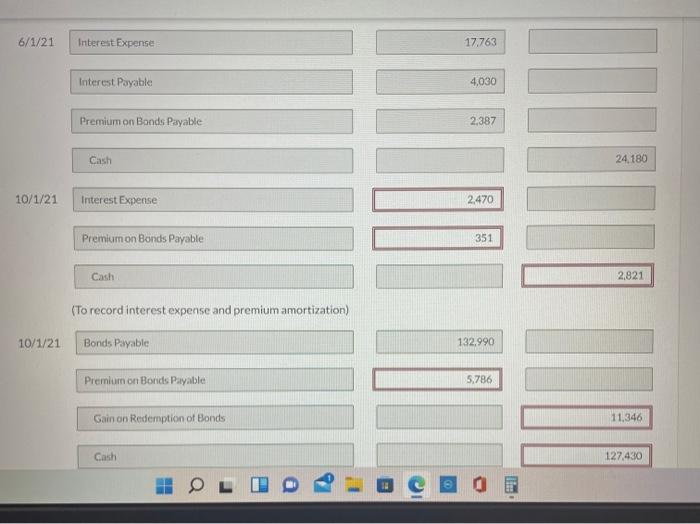

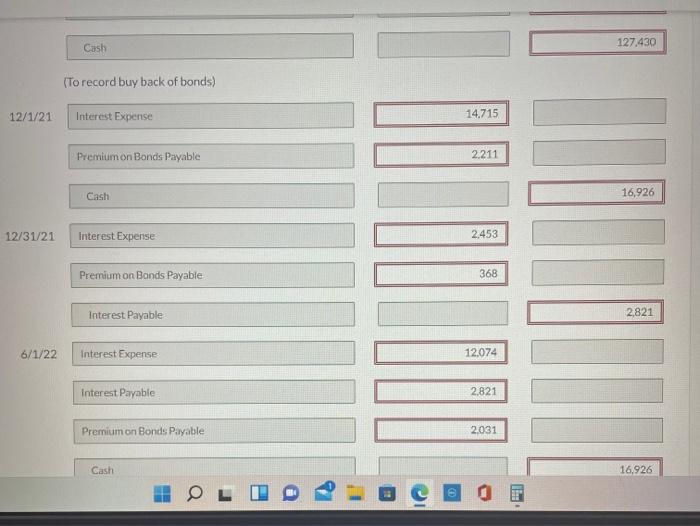

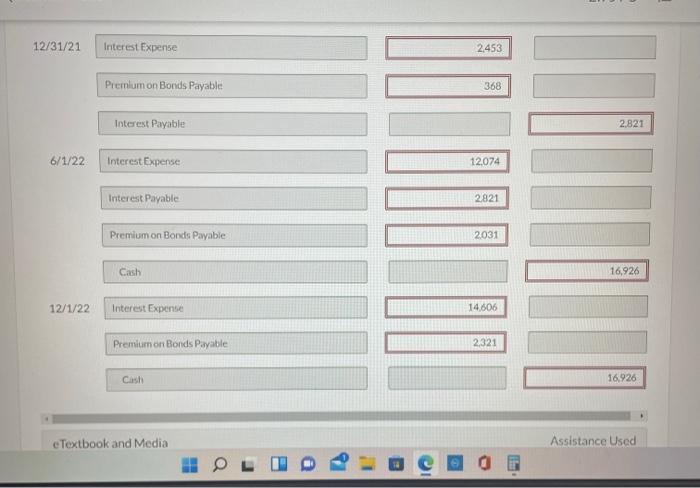

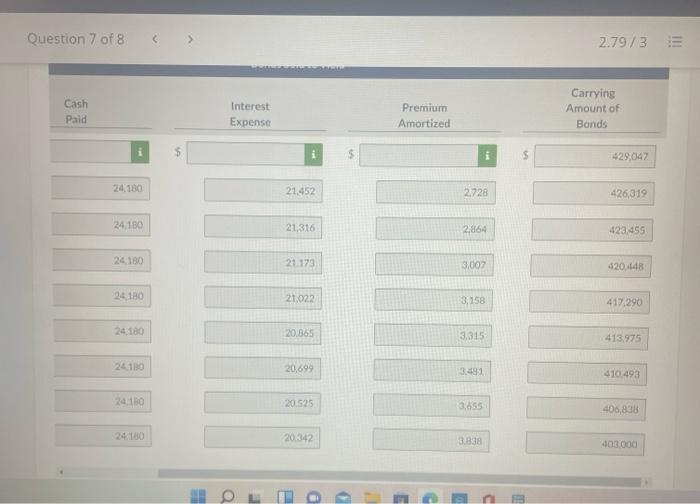

Your answer is partially correct. Pearl Co.sells $403,000 of 12% bonds on June 1. 2020. The bonds pay interest on December 1 and June 1. The due date of the bonds is June 1, 2024. The bonds yield 10%. On October 1, 2021. Pearl buys back $132,990 worth of bonds for $138,990 (includes accrued interest). Give entries through December 1, 2022. Prepare a bond amortization schedule using the effective-interest method for discount and premium amortization. Amortize premium or discount on interest dates and at year-end. (Round answers to decimal places, eg. 38,548.) Schedule of Bond Discount Amortization Effective-Interest Method Bonds Sold to Yleld Cash Paid Interest Expense Premium Amortized Date 6/1/20 $ 12/1/20 24,180 21.452 2,728 6/1/21 24,180 21,316 2,864 12/1/21 24 180 21.173 3.007 . i Date Cash Paid Interest Expense Premium Amortized 6/1/20 $ 12/1/20 24,180 21.452 2,728 6/1/21 24,180 21.316 2,864 12/1/21 24.180 21.173 3,007 6/1/22 24, 180 21.022 3.158 12/1/22 24.180 20.865 3.315 6/1/23 24,180 20,699 1481 12/1/23 24,180 20,525 3,655 6/1/24 24.180 20.342 3.838 O Prepare all of the relevant journal entries from the time of sale until December 31, 2022. (Assume that no reversing entries were made.) (Round present value factor calculations to 5 decimal places, eg. 1.25124 and the final answers to decimal places eg. 58,971. If no entry is required, select "No Entry for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit 6/1/20 Cash 429.047 Premium on Bonds Payable 26,047 Bonds Payable 403,000 12/1/20 Interest Expense 21.452 Premium on Bonds Payable 2,728 Cash 24180 12/31/20 Interest Expense 3,553 Premium on Bonds Payable 477 Interest Payable 4030 6/1/21 Interest Expense 17.763 Interest Payable 4,030 Premium on Bonds Payable 2,387 Cash 24,180 10/1/21 Interest Expense 2.470 Premium on Bonds Payable 351 Cash 2.821 (To record interest expense and premium amortization) 10/1/21 Bonds Payable 132.990 Premium on Bonds Payable 5.786 Gain on Redemption of Bonds 11,346 Cash 127,430 lis 127.430 Cash (To record buy back of bonds) 12/1/21 Interest Expense 14.715 Premium on Bonds Payable 2.211 Cash 16,926 12/31/21 Interest Expense 2,453 Premium on Bonds Payable 368 Interest Payable 2.821 6/1/22 Interest Expense 12.074 Interest Payable 2.821 Premium on Bonds Payable 2,031 Cash 16,926 OL . 12/31/21 Interest Expense 2453 Premium on Bonds Payable 368 Interest Payable 2.821 6/1/22 Interest Expense 12074 Interest Payable 2821 Premium on Bonds Payable 2031 Cash 16.926 12/1/22 Interest Expense 14,606 Premium on Bonds Payable 2321 Cash 16.926 e Textbook and Media Assistance Used 0 Question 7 of 8 2.79/3 Cash Paid Interest Expense Premium Amortized Carrying Amount of Bonds 429,042 24.180 21.452 2.728 426,319 24 180 21.316 2.864 423,455 24 180 21.173 3,002 420.448 24 180 21.022 3.158 417.290 24180 20.865 3.315 413.975 24.100 20,699 3,481 410 493 24,130 20.525 365 406,838 24.100 20342 3838 403.000 OLO