Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you please help me with these problems? can you please answer the first question? i posted the other 2 seperately just now Required Information

can you please help me with these problems?

can you please answer the first question? i posted the other 2 seperately just now

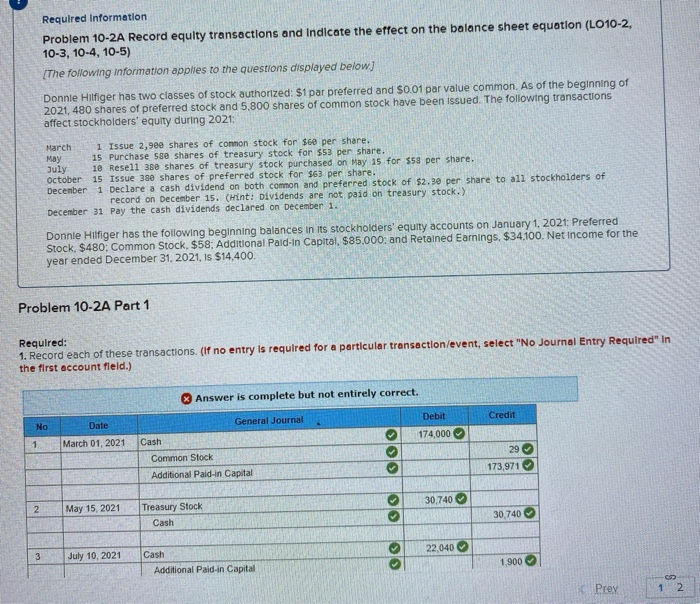

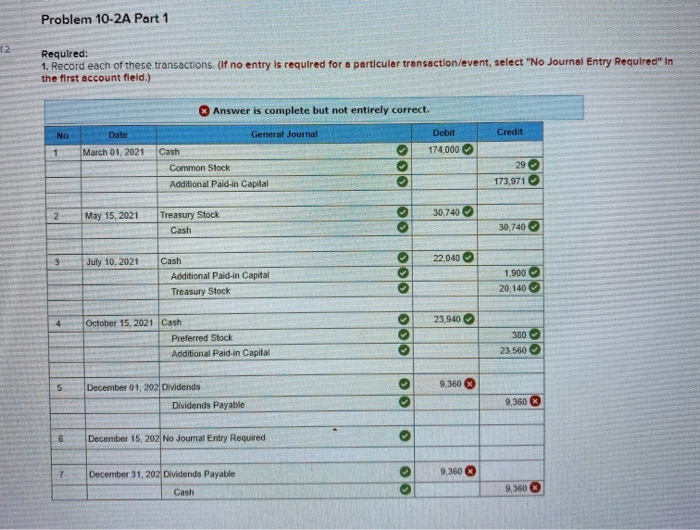

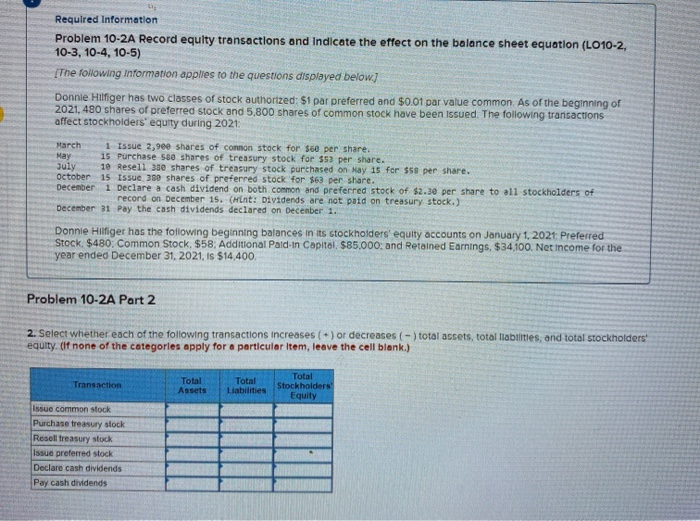

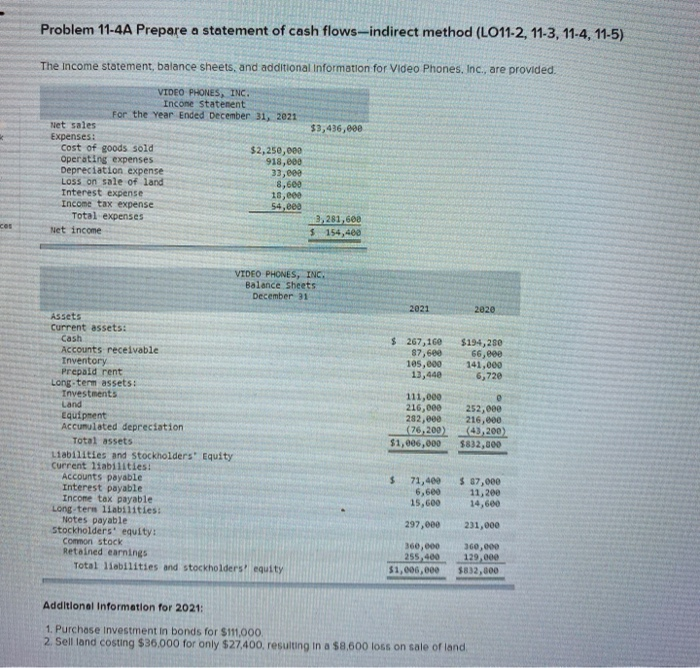

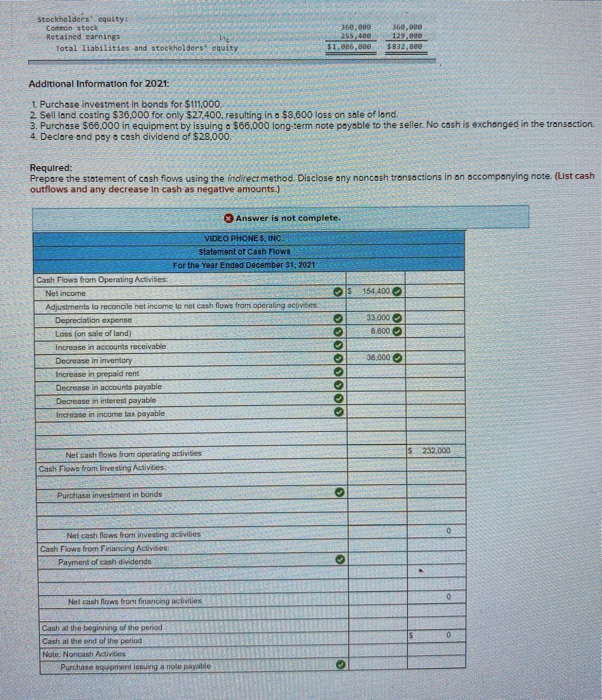

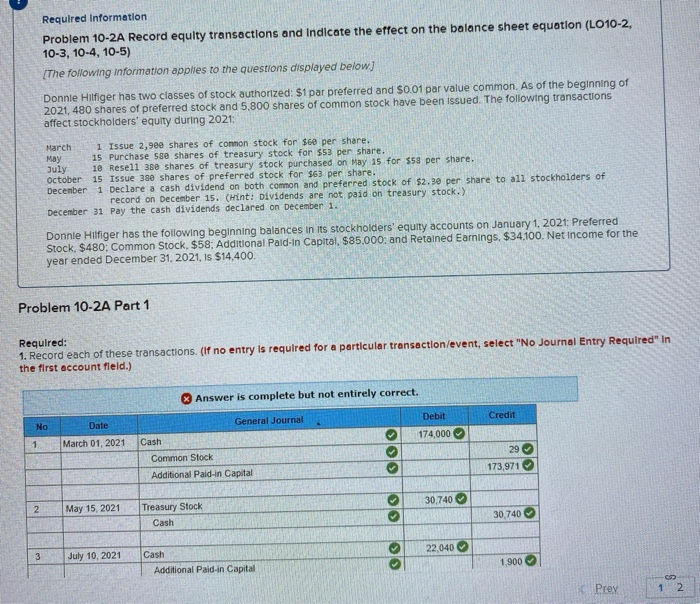

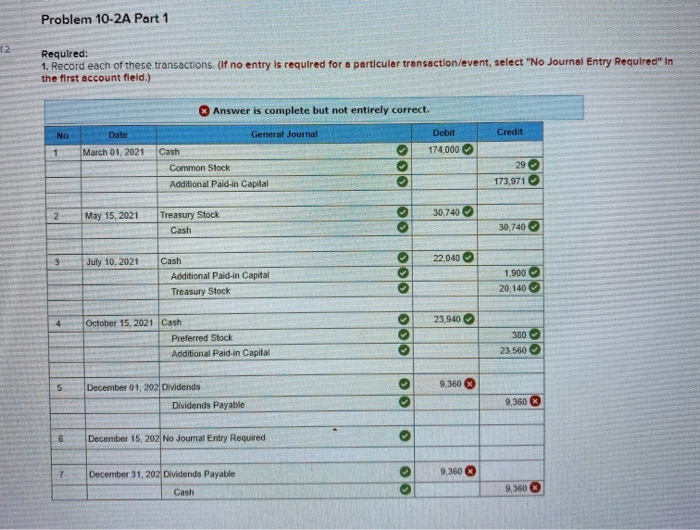

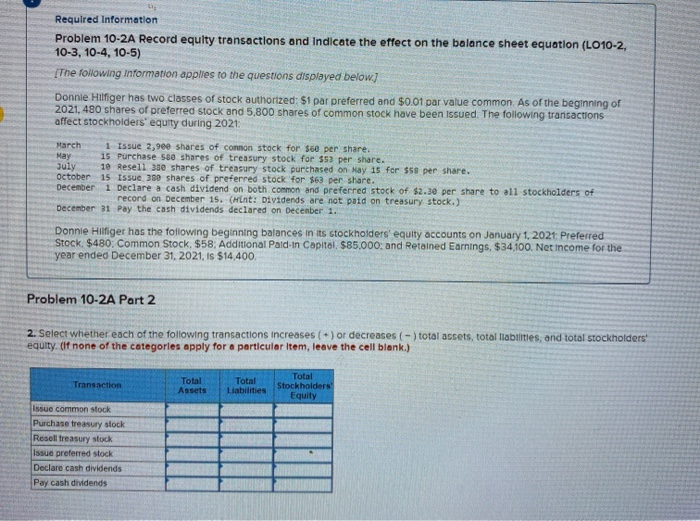

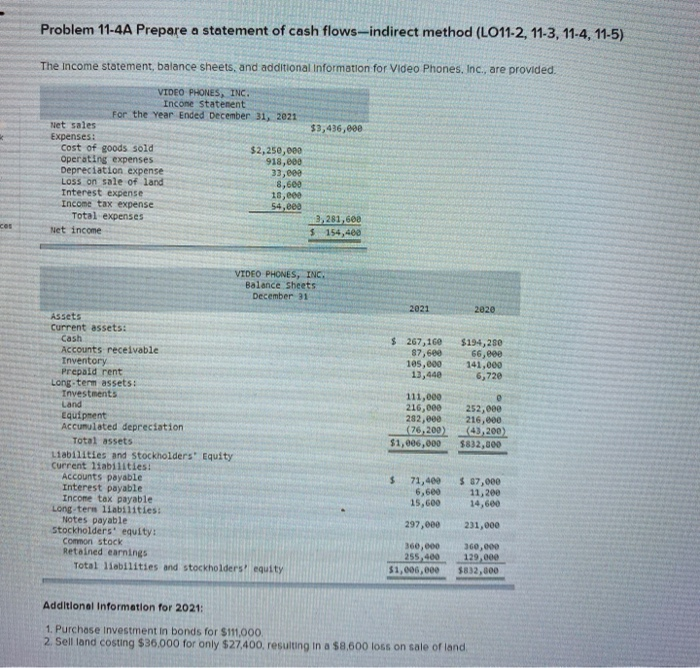

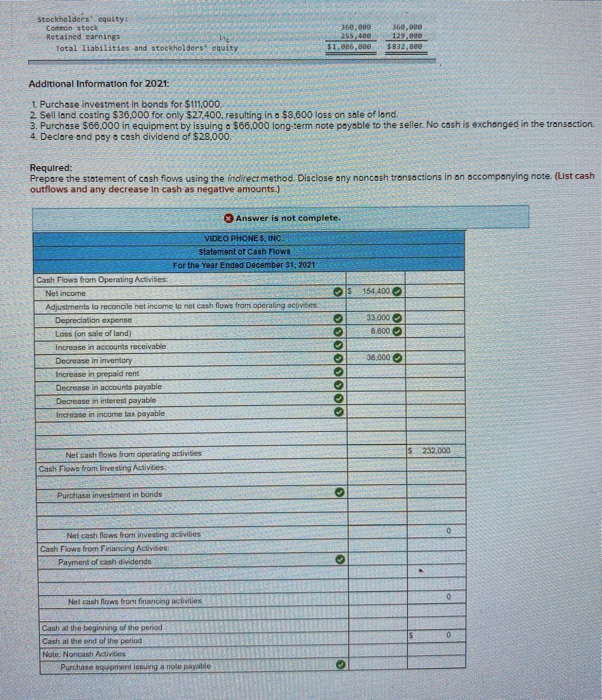

Required Information Problem 10-2A Record equity transactions and indicate the effect on the balance sheet equation (LO10-2, 10-3, 10-4, 10-5) [The following information applies to the questions displayed below) Donnie Hilfiger has two classes of stock authorized: $1 par preferred and $0.01 par value common. As of the beginning of 2021, 480 shares of preferred stock and 5,800 shares of common stock have been issued. The following transactions affect stockholders' equity during 2021: March 1 Issue 2,900 shares of common stock for $60 per share. May 15 Purchase 580 shares of treasury stock for $53 per share. July 1e Resell 380 shares of treasury stock purchased on May 15 for $58 per share. October 15 Issue 380 shares of preferred stock for $63 per share. December 1 Declare a cash dividend on both common and preferred stock of $2.30 per share to all stockholders of record on December 15. (Hint: Dividends are not paid on treasury stock.) December 31 Pay the cash dividends declared on December 1. Donnie Hilfiger has the following beginning balances in its stockholders' equity accounts on January 1, 2021: Preferred Stock. $480: Common Stock, $58; Additional Pald-in Capital, $85.000: and Retained Earnings. $34.100. Net Income for the year ended December 31, 2021, Is $14,400. Problem 10-2A Part 1 Required: 1. Record each of these transactions. (If no entry is required for a particular transaction/event, select "No Journal Entry Required in the first account field.) Answer is complete but not entirely correct. Debit Credit Date General Journal No 174,000 1 March 01, 2021 29 Cash Common Stock Additional Paid-in Capital 173,971 30,740 2 May 15, 2021 Treasury Stock Cash 30,740 3 22,040 July 10, 2021 Cash Additional Paid-in Capital 00 1,900 Prey 1 2 Problem 10-2A Part 1 12 Required: 1. Record each of these transactions (if no entry is required for a particular transaction/event, select "No Journal Entry Required" In the first account field.) Answer is complete but not entirely correct. NO Date Debit Credit March 01, 2021 174,000 General Journal Cash Common Stock Additional Paid-in Capital OO 29 173,971 2 May 15, 2021 30.740 Treasury Stock Cash OO 30,740 o 3 July 10, 2021 22,040 Cash Additional Paid-in Capital Treasury Stock D OS 1.900 20.140 23,940 October 15, 2021 Cash Preferred Stock Additional Paid in Capital oloo 380 23,560 OO 5 9,360 December 01, 202 Dividends Dividends Payable C 9,360 6 December 15, 202 No Journal Entry Required 7 9,360 December 31, 202 Dividends Payable Cash 9,360 3 Required Information Problem 10-2A Record equity transactions and indicate the effect on the balance sheet equation (LO10-2, 10-3, 10-4, 10-5) [The following information applies to the questions displayed below] Donnie Hilfiger has two classes of stock authorized: $1 par preferred and $0.01 par value common. As of the beginning of 2021, 480 shares of preferred stock and 5,800 shares of common stock have been issued. The following transactions affect stockholders' equity during 2021 May March 1 Issue 2,9ee shares of common stock for $60 per share. 15 Purchase 580 shares of treasury stock for $5 per share. July 10 Resell 330 shares of treasury stock purchased on May 15 for $58 per share. October 15 Issue 350 shares of preferred stock for $63 per share. December 1 Declare a cash dividend on both common and preferred stock of $2.30 per Share to all stockholders of record on December 15. (Hint: Dividends are not paid on treasury stock.) December 31 Pay the cash dividends declared on December 1. Donnie Hilfiger has the following beginning balances in its stockholders' equilty accounts on January 1, 2021: Preferred Stock $480. Common Stock $58, Additional Paldin Capitol. $85.000: and Retained Earnings, $34.100. Net Income for the year ended December 31, 2021, is $14.400, Problem 10-2A Part 2 2. Select whether each of the following transactions increases ( + ) or decreases ( - ) total assets, total liabilities, and total stockholders! equity. (If none of the categories apply for a particular Item, leave the cell blank.) Transaction Total Assets Total Liabilities Total Stockholders Equity Issue common stock Purchase treasury stock Resell treasury stock Issue preferred stock Declare cash dividends Pay cash dividends Problem 11-4A Prepare a statement of cash flows--indirect method (LO11-2, 11-3, 11-4, 11-5) The Income statement, balance sheets, and additional Information for Video Phones, Inc., are provided. $3,436,000 VIDEO PHONES, INC. Income Statement For the Year Ended December 31, 2021 Net sales Expenses: Cost of goods sold $2,250,000 Operating expenses 918,000 Depreciation expense 33,000 Loss on sale of land 8,600 Interest expense 18,000 Income tax expense 54,00 Total expenses Net income 3,281,600 $ 154,400 VIDEO PHONES, INC Balance sheets December 31 2021 2020 $ 267,160 87,600 105,000 13,440 $194,250 66,000 141,000 6,720 Assets Current assets: Cash Accounts receivable Inventory Prepaid rent Long-term assets: Investments Land Equipment Accumulated depreciation Total assets Liabilities and stockholders' Equity Current liabilities! Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity 111,000 216,000 282,000 (26,200) $1,006,000 252,000 216,000 (43,200) $832,000 $ 71,400 6,600 15,600 $ 87,000 11,200 14,600 297,000 231,000 360,000 255,400 $1,000,000 360,000 129,000 $832,000 Additional Information for 2021; 1. Purchase investment in bonds for $111.000. 2. Sell and costing $36,000 for only $27,400, resulting in a $8,600 loss on sale of land 360.000 Stockholders' equity! Connon stock Retained earnings Total liabilities and stockholders' equity 60,000 129.00 $832,see $1,006,000 Additional Information for 2021 1. Purchase investment in bonds for $111.000. 2 Sell land costing $36.000 for only $27.400, resulting in a $8,600 loss on sale of land. 3. Purchase $66,000 in equipment by issuing a $66.000 long-term.note payable to the seller. No cash is exchanged in the transaction 4. Declare and pay a cash dividend of $28,000. Required: Prepare the statement of cash flows using the indirect method. Disclose any noncash transactions in an accompanying note. (List cash outflows and any decrease in cash as negative amounts.) Answer is not complete. s164.400 VIDEO PHONES, INC statement of Cash Flows For the Year Ended December 31, 2021 Cash Flows from Operating Activities Net income Adjustments to reconcile net income to not cash flows from operating activities Depreciation expense Loss on sale of land) Increase in accounts receivable Decrease in inventory Increase in prepaid rent Decrease in accounts payable Decrease in interest payable Increase in income tax payable 33.000 18.600 38,000 OOOOOOOO 2:32.000 Ner cash flows from operating activities Cash Flows from investing Activities Purchase investment in bands ol Net cash flows from investing activities Cash Flows from Financing Activities Payment of cash dividends lol 0 Net cash flows from financing activities Cash at the beginning of the period Cash at the end of the period Note: Noncash Activities Purchase equipment issuing a non payable Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started