can you please help me with this problem thanks

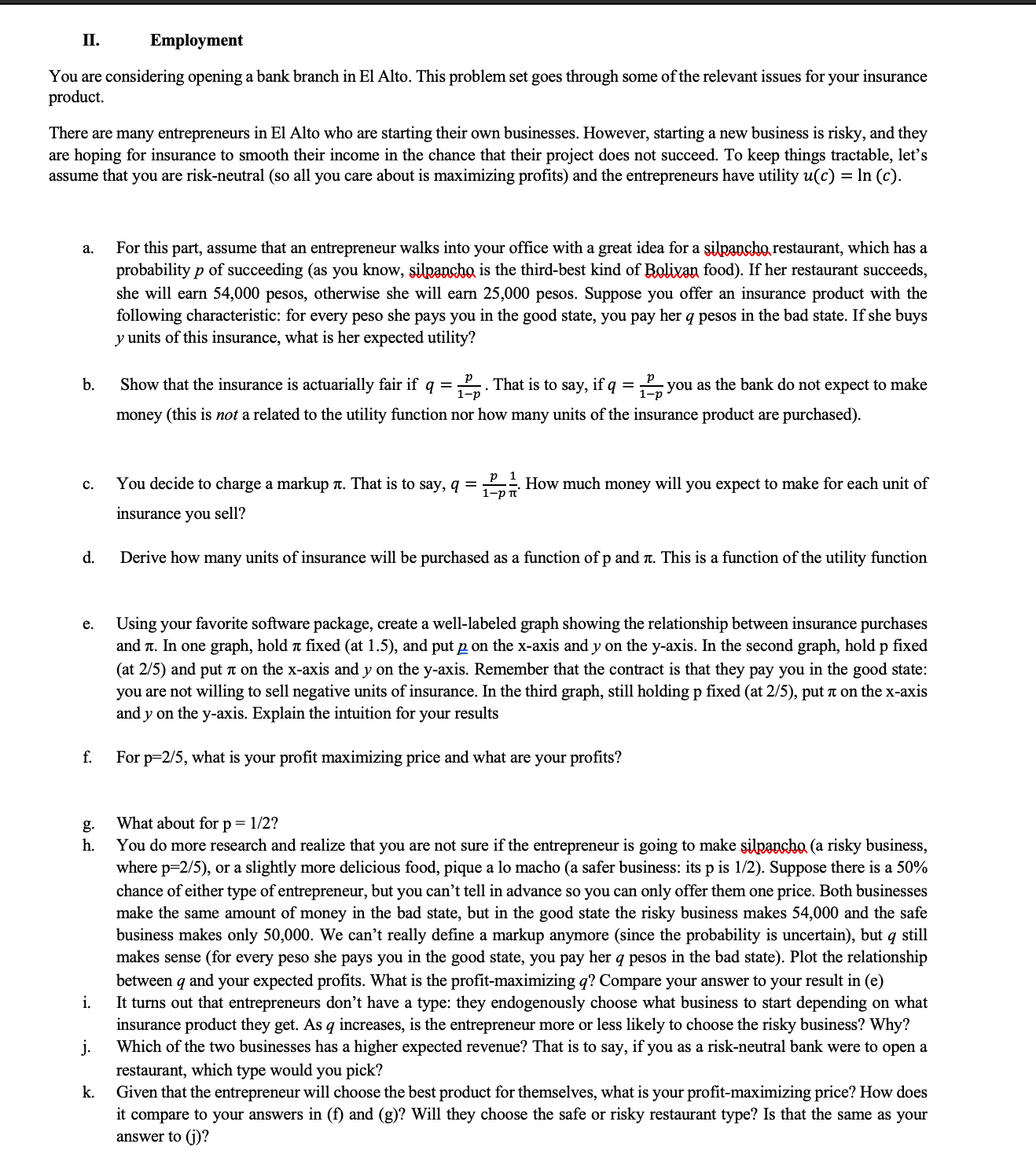

11. Employment You are considering opening abank branch in El Alto. This problem set goes through some of the relevant issues for your insurance product. There are many entrepreneurs in El Alto who are starting their own businesses. However, starting a new business is risky, and they are hoping for insurance to smooth their income in the chance that their project does not succeed. To keep things tractable, let's assume that you are risk-neutral (so all you care about is maximizing prots) and the entrepreneurs have utility 110:) = In (at). a. For this part, assume that an entrepreneur walks into your ofce with a great idea for a Wrestaurant, which has a probability p of succeeding (as you know, 5m is the third-best kind of Baum food). If her restaurant succeeds, she will earn 54,000 pesos, otherwise she will earn 25,000 pesos. Suppose you offer an insurance product with the following characteristic: for every peso she pays y0u in the good state, you pay her q pesos in the bad state. If she buys 3: units of this insurance, what is her expected utility? b. Showthatthe insurance is actuariallyfairif q = 1%, . That is to say, ifq = 1youasthe bankdonotexpecttomake money (this is not a related to the utility inction nor how many units of the insurance product are purchased). c. You decide to charge a markup 7E. That is to say, = 1312:? How much money will you expect to make for each unit of insurance you sell? d. Derive how many units of insurance will be purchased as a function of p and 2:. This is a function of the utility function e. Using your favorite software package, create a well-labeled graph showing the relationship between insurance purchases and It. In one graph, hold 1: xed (at 1.5), and put E on the xaxis and y on the yaxis. In the second graph, hold p xed (at 2/5) and put a: on the xaxis and J: on the y-axis. Remember that the contract is that they pay you in the good state: you are not willing to sell negative units of insurance. In the third graph, still holding p xed (at 25), put 1: on the x-axis and y on the yaxis. Explain the intuition for your results f. For p=2/5, what is your prot maximizing price and what are your prots? g. What about for p = 1/2? h. You do more research and realize that you are not sure ifthe entrepreneur is going to make gamma risky business, where p=2/5), or a slightly more delicious food, pique a lo macho (a safer business: its p is 1f2). Suppose there is a 50% chance of either type of entrepreneur, but you can't tell in advance so you can only offer them one price. Both businesses make the same amount of money in the bad state, but in the good state the risky business makes 54,000 and the safe business makes only 50,000. We can't really dene a markup anymore (since the probability is uncertain), but q still makes sense (for every peso she pays you in the good state, you pay her (1 pesos in the bad state). Plot the relationship between q and your expected prots. What is the prot-maximizing q? Compare your answer to your result in (e) i. It turns out that entrepreneurs don't have a type: they endogenously choose what business to start depending on what insurance product they get. As q increases, is the entrepreneur more or less likely to choose the risky business? Why? j. Which of the two businesses has a higher expected revenue? That is to say, if you as a risk-neutral bank were to open a restaurant, which type would you pick? k. Given that the entrepreneur will choose the best product for themselves, what is your prot-maximizing price? How does it compare to your answers in (f) and (g)? Will they choose the safe or risky restaurant type? Is that the same as your answer to (i)