Can you please help me with this Question ?

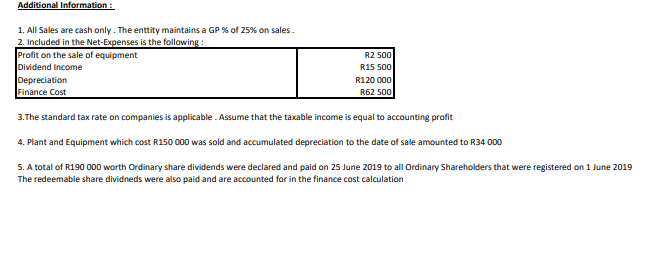

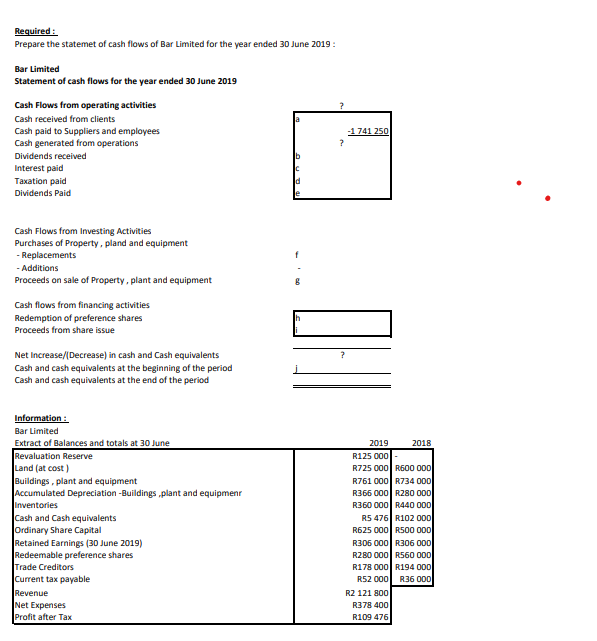

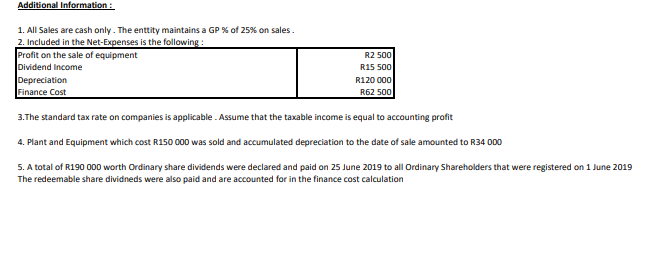

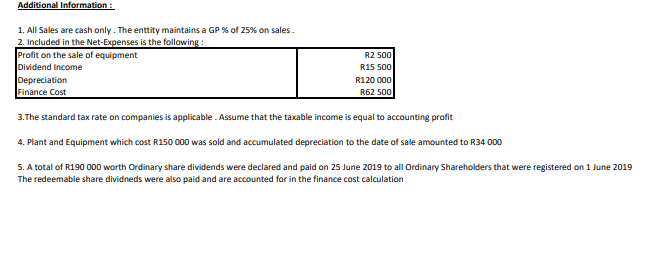

Required : Prepare the statemet of cash flows of Bar Limited for the year ended 30 June 2019 : Bar Limited Statement of cash flows for the year ended 30 June 2019 Cash Flows from operating activities Cash received from clients Cash paid to Suppliers and employees 1 741 250 Cash generated from operations Dividends received Interest paid Taxation paid Dividends Paid Cash Flows from Investing Activities Purchases of Property , pland and equipment -Replacements -Additions Proceeds on sale of Property , plant and equipment Cash flows from financing activities Redemption of preference shares Proceeds from share issue Net Increase/[ Decrease) in cash and Cash equivalents Cash and cash equivalents at the beginning of the period Cash and cash equivalents at the end of the period Information : Bar Limited Extract of Balances and totals at 30 June 2019 2018 Revaluation Reserve R125 000 Land (at cost ] R725 000 | R600 ODD Buildings , plant and equipment R761 000|R734 00D Accumulated Depreciation -Buildings ,plant and equipment R366 000 | R280 0DO Inventories R360 000 | R440 ODD Cash and Cash equivalents R5 476 R102 0DD Ordinary Share Capital R625 000 | R500 ODD Retained Earnings (30 June 2019) R306 000 | R306 0DD Redeemable preference shares R280 000|R560 ODD Trade Creditors R178 000|R194 0DO Current tax payable R52 000 R36 000 Revenue R2 121 800 Net Expenses R378 400 Profit after Tax R109 476Additional Information : 1. All Sales are cash only . The enttity maintains a GP % of 25%% on sales . 2. Included in the Net-Expenses is the following : Profit on the sale of equipment R2 500 Dividend Income R15 500 Depreciation R120 000 Finance Cost R62 500 3. The standard tax rate on companies is applicable . Assume that the taxable income is equal to accounting profit 4. Plant and Equipment which cost R150 000 was sold and accumulated depreciation to the date of sale amounted to R34 000 5. A total of R190 000 worth Ordinary share dividends were declared and paid on 25 June 2019 to all Ordinary Shareholders that were registered on 1 June 2019 The redeemable share dividneds were also paid and are accounted for in the finance cost calculation