can you please make the statement of cash flows very quickly. I WILL RATE POSITIVLY

please stop. I pay money for these questions and i expect you to answer them. this is clear representation and proper formatting. i expect an answer. now please.

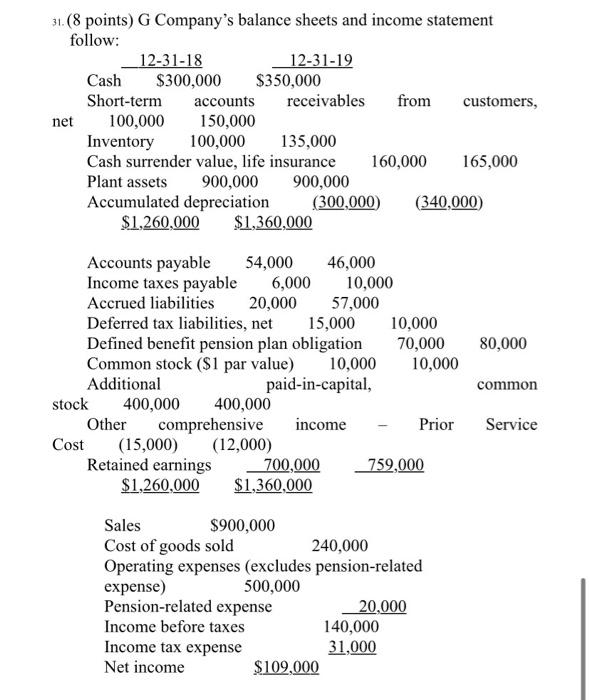

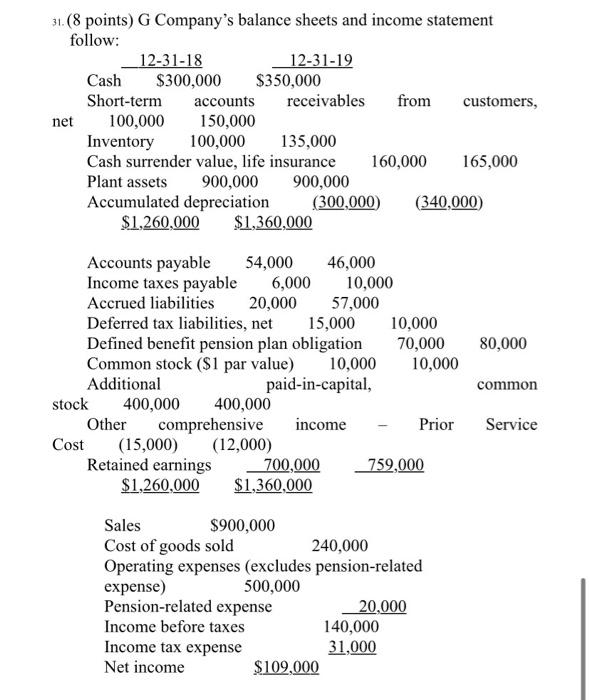

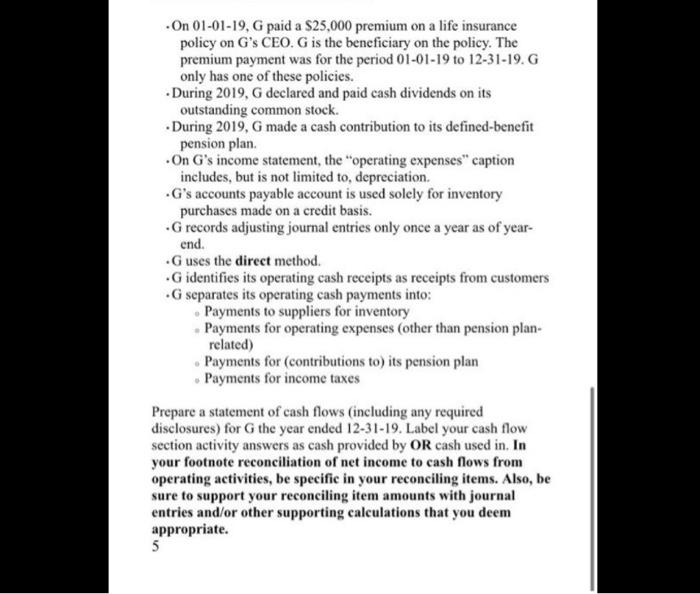

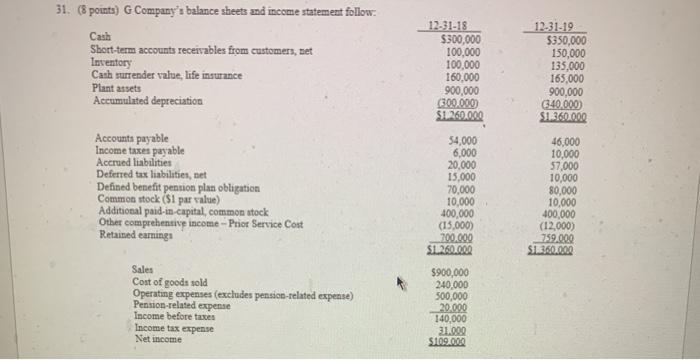

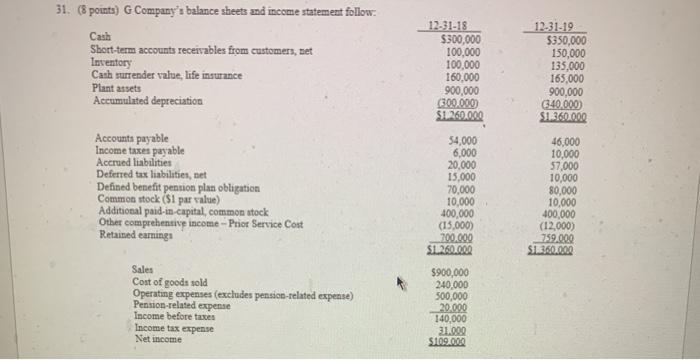

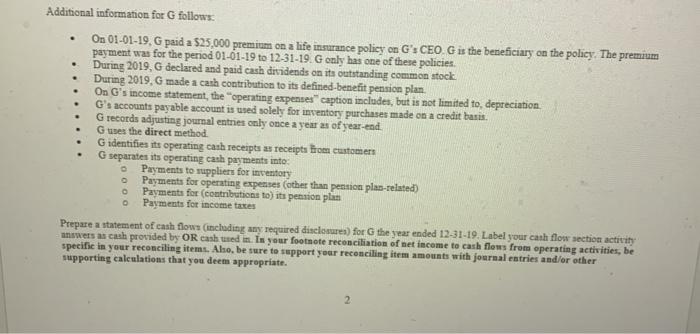

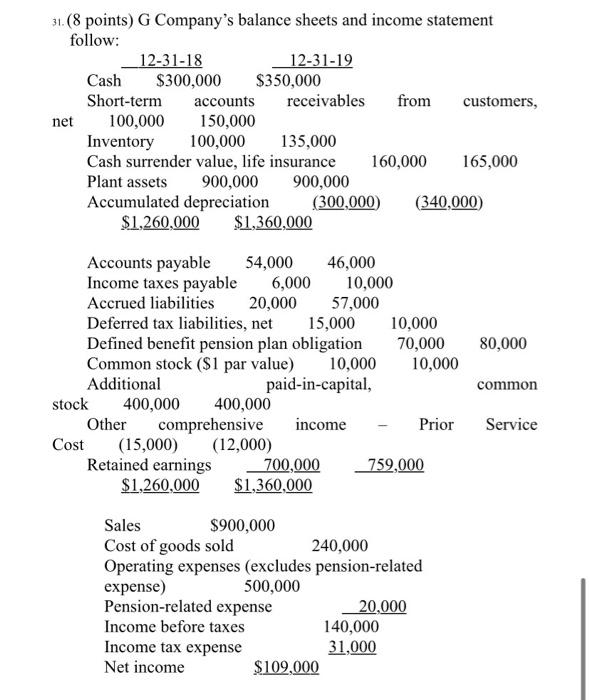

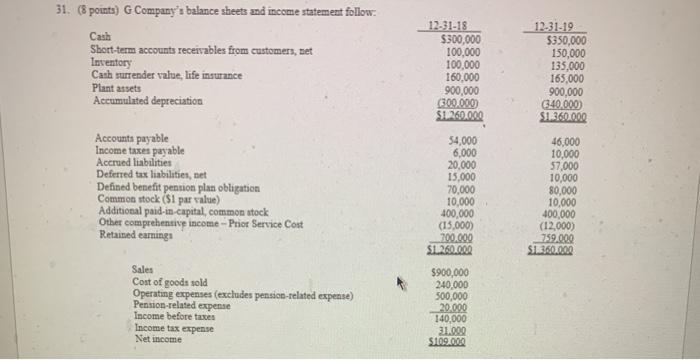

31(8 points) G Company's balance sheets and income statement follow: 12-31-18 12-31-19 Cash $300,000 $350,000 Short-term accounts receivables from customers, net 100,000 150,000 Inventory 100,000 135,000 Cash surrender value, life insurance 160,000 165,000 Plant assets 900,000 900,000 Accumulated depreciation (300,000) (340,000) $1,260,000 $1,360,000 80,000 Accounts payable 54,000 46,000 Income taxes payable 6,000 10,000 Accrued liabilities 20,000 57,000 Deferred tax liabilities, net 15,000 10,000 Defined benefit pension plan obligation 70,000 Common stock ($1 par value) 10,000 10,000 Additional paid-in-capital, stock 400,000 400,000 Other comprehensive income Prior Cost (15,000) (12,000) Retained earnings 700,000 759,000 $1,260,000 $1,360,000 common Service Sales $900,000 Cost of goods sold 240,000 Operating expenses (excludes pension-related expense) 500,000 Pension-related expense 20,000 Income before taxes 140,000 Income tax expense 31,000 Net income $109,000 On 01-01-19, G paid a $25,000 premium on a life insurance policy on G's CEO. G is the beneficiary on the policy. The premium payment was for the period 01-01-19 to 12-31-19. G only has one of these policies. During 2019, G declared and paid cash dividends on its outstanding common stock. During 2019, G made a cash contribution to its defined-benefit pension plan. .On G's income statement, the operating expenses" caption includes, but is not limited to, depreciation. G's accounts payable account is used solely for inventory purchases made on a credit basis. G records adjusting journal entries only once a year as of year- end. Guses the direct method. G identifies its operating cash receipts as receipts from customers G separates its operating cash payments into: Payments to suppliers for inventory Payments for operating expenses (other than pension plan- related) Payments for contributions to its pension plan Payments for income taxes Prepare a statement of cash flows (including any required disclosures) for the year ended 12-31-19. Label your cash flow section activity answers as cash provided by OR cash used in. In your footnote reconciliation of net income to cash flows from operating activities, be specific in your reconciling items. Also, be sure to support your reconciling item amounts with journal entries and/or other supporting calculations that you deem appropriate. 5 31. (8 points) G Company's balance sheets and income statement follow: Cash Short-term accounts receivables from customers, net Inventory Cash surrender value, life insurance Plant assets Accumulated depreciation 12-31-19 $350,000 150,000 135,000 165,000 900,000 (340.000 $1.360.000 Accounts payable Income taxes payable Accrued liabilities Deferred tax liabilities, net Defined benefit pension plan obligation Common stock (si par value) Additional paid-in capital common stock Other comprehensive income --Prior Service Cost Retained earnings 12-31-18 $300,000 100,000 100,000 160,000 900,000 (300.000 $1260.000 34,000 6,000 20.000 15,000 70.000 10,000 400,000 (15.000) 700.000 S1.260.000 46,000 10,000 57,000 10,000 80,000 10,000 400,000 (12,000) 759.000 SL360.000 Sales Cost of goods sold Operating expenses (excludes pension-related expense) Pension-related expense Income before tastes Income tax expense Net income $900,000 240.000 500,000 20.000 140,000 31.000 $109.000 . Additional information for G follows: On 01-01-19. G paid a 525,000 premium on a life insurance policy on G': CEO G is the beneficiary on the policy. The premium payment was for the period 01-01-19 to 12-31-19. G only has one of these policies. During 2019. G declared and paid cash dividends on its outstanding common stock During 2019. G made a cash contribution to its defined benefit pension plan On G's income statement, the operating expenses" caption includes, but is not limited to, depreciation G's accounts payable account is used solely for inventory purchases made on a credit basis G records adjusting journal entries only once a year as of year-end Guses the direct method G identifies its operating cash receipts as receipts from customers G separates its operating cash payments into: Payments to suppliers for inventory Payments for operating expenses (other than pension plas-related) o Payments for contributions to its pension plan Payments for income taxes Prepare a statement of cash flows (including any required disclosures) for the year ended 12-31-19. Label your cash flow section activity answers as cash provided by OR cash tused in. In your footnote reconciliation of net income to cash flows from operating activities, be specific in your reconciling items. Also, be sure to support your reconciling item amounts with journal entries and/or other supporting calculations that you deem appropriate. 0 2 31(8 points) G Company's balance sheets and income statement follow: 12-31-18 12-31-19 Cash $300,000 $350,000 Short-term accounts receivables from customers, net 100,000 150,000 Inventory 100,000 135,000 Cash surrender value, life insurance 160,000 165,000 Plant assets 900,000 900,000 Accumulated depreciation (300,000) (340,000) $1,260,000 $1,360,000 80,000 Accounts payable 54,000 46,000 Income taxes payable 6,000 10,000 Accrued liabilities 20,000 57,000 Deferred tax liabilities, net 15,000 10,000 Defined benefit pension plan obligation 70,000 Common stock ($1 par value) 10,000 10,000 Additional paid-in-capital, stock 400,000 400,000 Other comprehensive income Prior Cost (15,000) (12,000) Retained earnings 700,000 759,000 $1,260,000 $1,360,000 common Service Sales $900,000 Cost of goods sold 240,000 Operating expenses (excludes pension-related expense) 500,000 Pension-related expense 20,000 Income before taxes 140,000 Income tax expense 31,000 Net income $109,000 On 01-01-19, G paid a $25,000 premium on a life insurance policy on G's CEO. G is the beneficiary on the policy. The premium payment was for the period 01-01-19 to 12-31-19. G only has one of these policies. During 2019, G declared and paid cash dividends on its outstanding common stock. During 2019, G made a cash contribution to its defined-benefit pension plan. .On G's income statement, the operating expenses" caption includes, but is not limited to, depreciation. G's accounts payable account is used solely for inventory purchases made on a credit basis. G records adjusting journal entries only once a year as of year- end. Guses the direct method. G identifies its operating cash receipts as receipts from customers G separates its operating cash payments into: Payments to suppliers for inventory Payments for operating expenses (other than pension plan- related) Payments for contributions to its pension plan Payments for income taxes Prepare a statement of cash flows (including any required disclosures) for the year ended 12-31-19. Label your cash flow section activity answers as cash provided by OR cash used in. In your footnote reconciliation of net income to cash flows from operating activities, be specific in your reconciling items. Also, be sure to support your reconciling item amounts with journal entries and/or other supporting calculations that you deem appropriate. 5 31. (8 points) G Company's balance sheets and income statement follow: Cash Short-term accounts receivables from customers, net Inventory Cash surrender value, life insurance Plant assets Accumulated depreciation 12-31-19 $350,000 150,000 135,000 165,000 900,000 (340.000 $1.360.000 Accounts payable Income taxes payable Accrued liabilities Deferred tax liabilities, net Defined benefit pension plan obligation Common stock (si par value) Additional paid-in capital common stock Other comprehensive income --Prior Service Cost Retained earnings 12-31-18 $300,000 100,000 100,000 160,000 900,000 (300.000 $1260.000 34,000 6,000 20.000 15,000 70.000 10,000 400,000 (15.000) 700.000 S1.260.000 46,000 10,000 57,000 10,000 80,000 10,000 400,000 (12,000) 759.000 SL360.000 Sales Cost of goods sold Operating expenses (excludes pension-related expense) Pension-related expense Income before tastes Income tax expense Net income $900,000 240.000 500,000 20.000 140,000 31.000 $109.000 . Additional information for G follows: On 01-01-19. G paid a 525,000 premium on a life insurance policy on G': CEO G is the beneficiary on the policy. The premium payment was for the period 01-01-19 to 12-31-19. G only has one of these policies. During 2019. G declared and paid cash dividends on its outstanding common stock During 2019. G made a cash contribution to its defined benefit pension plan On G's income statement, the operating expenses" caption includes, but is not limited to, depreciation G's accounts payable account is used solely for inventory purchases made on a credit basis G records adjusting journal entries only once a year as of year-end Guses the direct method G identifies its operating cash receipts as receipts from customers G separates its operating cash payments into: Payments to suppliers for inventory Payments for operating expenses (other than pension plas-related) o Payments for contributions to its pension plan Payments for income taxes Prepare a statement of cash flows (including any required disclosures) for the year ended 12-31-19. Label your cash flow section activity answers as cash provided by OR cash tused in. In your footnote reconciliation of net income to cash flows from operating activities, be specific in your reconciling items. Also, be sure to support your reconciling item amounts with journal entries and/or other supporting calculations that you deem appropriate. 0 2