Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you please pay attention to the numbers while solving this question, as there are many other similar questions to it but with different numbers

Can you please pay attention to the numbers while solving this question, as there are many other similar questions to it but with different numbers or requirements.

Thank you.

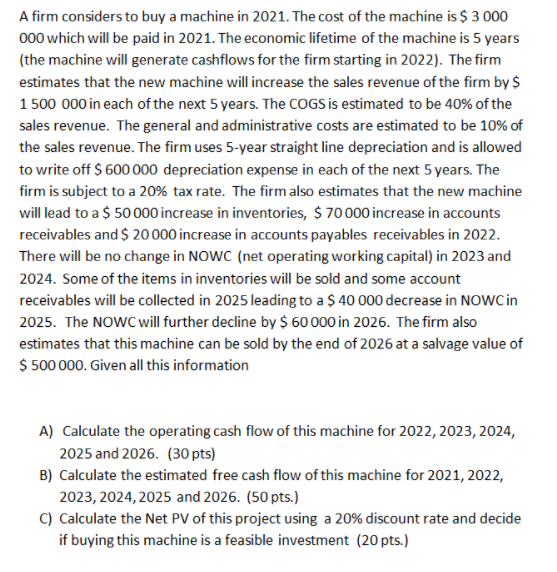

A firm considers to buy a machine in 2021. The cost of the machine is $ 3 000 000 which will be paid in 2021. The economic lifetime of the machine is 5 years (the machine will generate cashflows for the firm starting in 2022). The firm estimates that the new machine will increase the sales revenue of the firm by $ 1 500 000 in each of the next 5 years. The COGS is estimated to be 40% of the sales revenue. The general and administrative costs are estimated to be 10% of the sales revenue. The firm uses 5-year straight line depreciation and is allowed to write off $ 600 000 depreciation expense in each of the next 5 years. The firm is subject to a 20% tax rate. The firm also estimates that the new machine will lead to a $ 50 000 increase in inventories, $ 70000 increase in accounts receivables and $ 20000 increase in accounts payables receivables in 2022. There will be no change in NOWC (net operating working capital) in 2023 and 2024. Some of the items in inventories will be sold and some account receivables will be collected in 2025 leading to a $ 40 000 decrease in NOWC in 2025. The NOWC will further decline by $ 60 000 in 2026. The firm also estimates that this machine can be sold by the end of 2026 at a salvage value of $ 500 000. Given all this information A) Calculate the operating cash flow of this machine for 2022, 2023, 2024, 2025 and 2026. (30 pts) B) Calculate the estimated free cash flow of this machine for 2021, 2022, 2023, 2024, 2025 and 2026. (50 pts.) C) Calculate the Net PV of this project using a 20% discount rate and decide if buying this machine is a feasible investment (20 pts.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started