Answered step by step

Verified Expert Solution

Question

1 Approved Answer

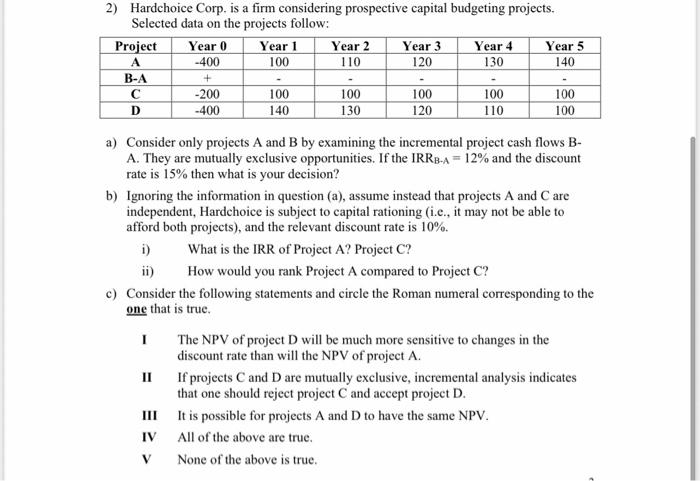

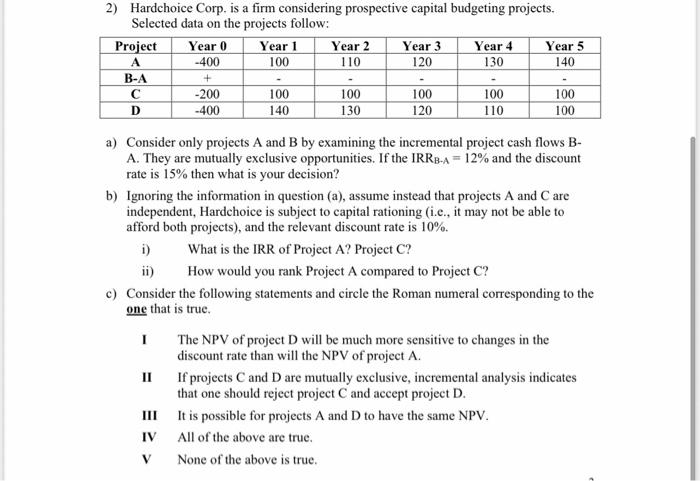

can you please show all formulas. Thank You 2) Hardchoice Corp. is a firm considering prospective capital budgeting projects. Selected data on the projects follow:

can you please show all formulas. Thank You

2) Hardchoice Corp. is a firm considering prospective capital budgeting projects. Selected data on the projects follow: Project Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 A -400 100 110 120 130 140 B-A -200 100 100 100 100 100 D -400 140 130 120 110 100 + a) Consider only projects A and B by examining the incremental project cash flows B- A. They are mutually exclusive opportunities. If the IRRB-A = 12% and the discount rate is 15% then what is your decision? b) Ignoring the information in question (a), assume instead that projects A and Care independent, Hardchoice is subject to capital rationing (i.e., it may not be able to afford both projects), and the relevant discount rate is 10%. i) What is the IRR of Project A? Project C? ii) How would you rank Project A compared to Project C? c) Consider the following statements and circle the Roman numeral corresponding to the one that is true. 1 The NPV of project will be much more sensitive to changes in the discount rate than will the NPV of project A. IIIf projects C and Dare mutually exclusive, incremental analysis indicates that one should reject project C and accept project D. III It is possible for projects A and D to have the same NPV. IV All of the above are true. None of the above is true. V

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started