Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you please show de thanks QUESTION 4 (25 MARKS) The financial statements of Armstong Ltd, a wholesaler of electronic products, are given below: Income

can you please show de thanks

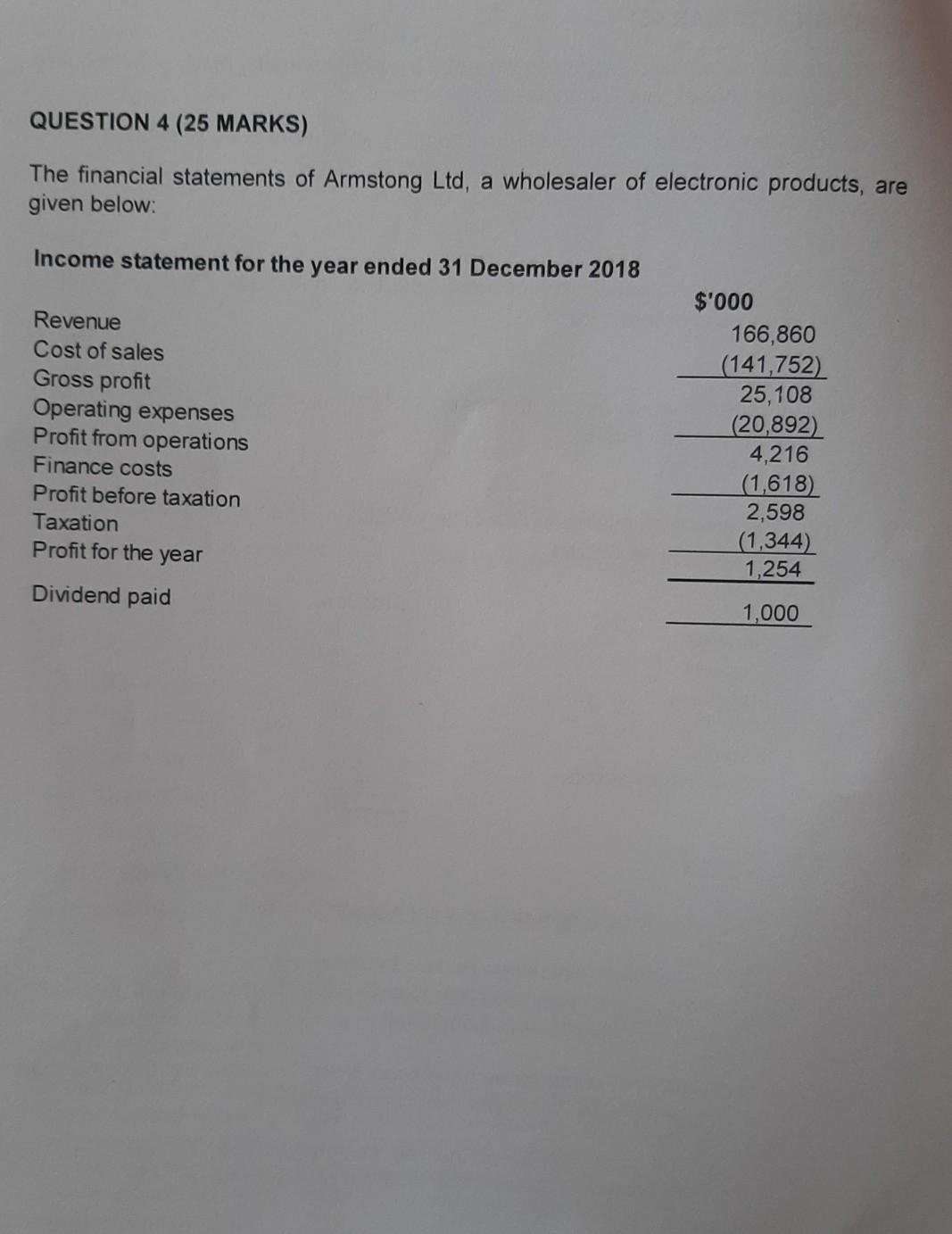

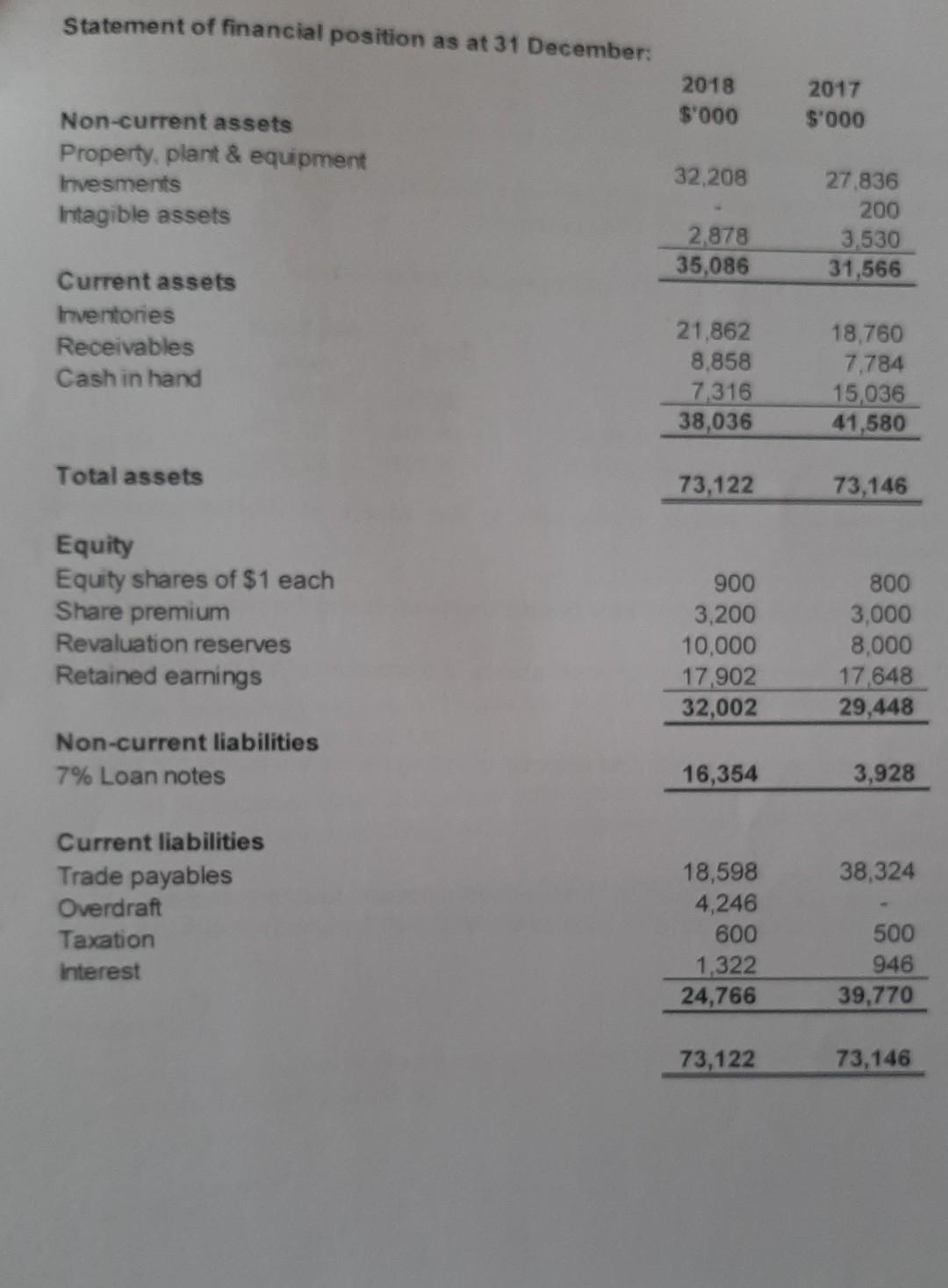

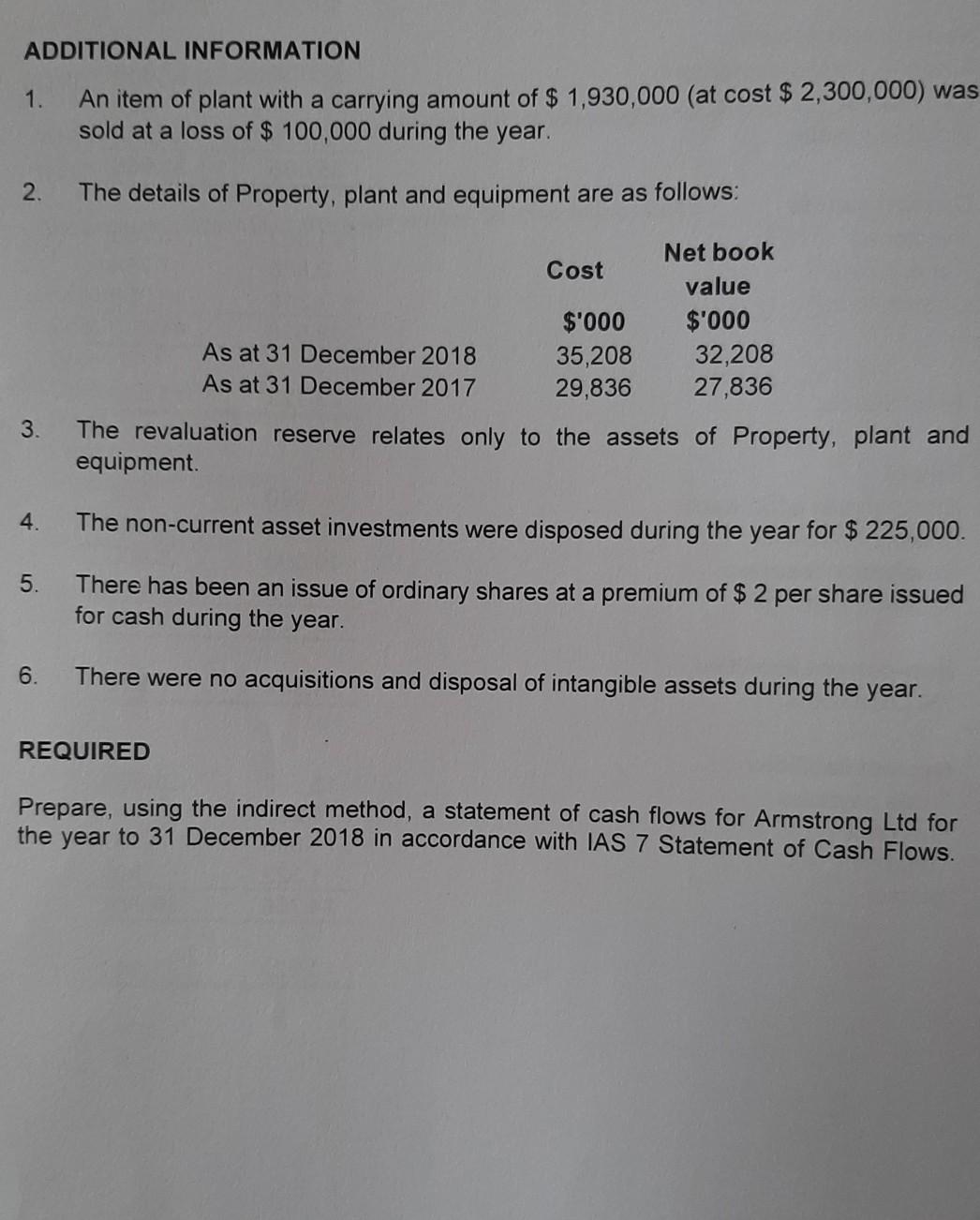

QUESTION 4 (25 MARKS) The financial statements of Armstong Ltd, a wholesaler of electronic products, are given below: Income statement for the year ended 31 December 2018 Revenue Cost of sales Gross profit Operating expenses Profit from operations Finance costs Profit before taxation Taxation Profit for the year $'000 166,860 (141,752) 25,108 (20,892) 4,216 (1,618) 2,598 (1,344) 1,254 Dividend paid 1,000 Statement of financial position as at 31 December: 2018 $'000 2017 $'000 Non-current assets Property, plant & equipment Invesments Intagible assets 32,208 2,878 35,086 27.836 200 3.530 31,566 Current assets Inventories Receivables Cash in hand 21.862 8,858 7 316 38,036 18,760 7,784 15,036 41,580 Total assets 73,122 73,146 Equity Equity shares of $1 each Share premium Revaluation reserves Retained earnings 900 3,200 10,000 17,902 32,002 800 3,000 8,000 17,648 29,448 Non-current liabilities 7% Loan notes 16,354 3,928 38,324 Current liabilities Trade payables Overdraft Taxation Interest 18,598 4,246 600 1,322 24,766 500 946 39,770 73,122 73,146 ADDITIONAL INFORMATION 1. An item of plant with a carrying amount of $ 1,930,000 (at cost $ 2,300,000) was sold at a loss of $ 100,000 during the year. 2. The details of Property, plant and equipment are as follows: Cost Net book value $'000 32,208 27,836 $'000 35,208 29,836 As at 31 December 2018 As at 31 December 2017 3. The revaluation reserve relates only to the assets of Property, plant and equipment 4. The non-current asset investments were disposed during the year for $ 225,000. 5. There has been an issue of ordinary shares at a premium of $ 2 per share issued for cash during the year. 6. There were no acquisitions and disposal of intangible assets during the year. REQUIRED Prepare, using the indirect method, a statement of cash flows for Armstrong Ltd for the year to 31 December 2018 in accordance with IAS 7 Statement of Cash FlowsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started