Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you please show me how to do this in excel by reference how each cell was completed thank you A B C D G

can you please show me how to do this in excel by reference how each cell was completed thank you

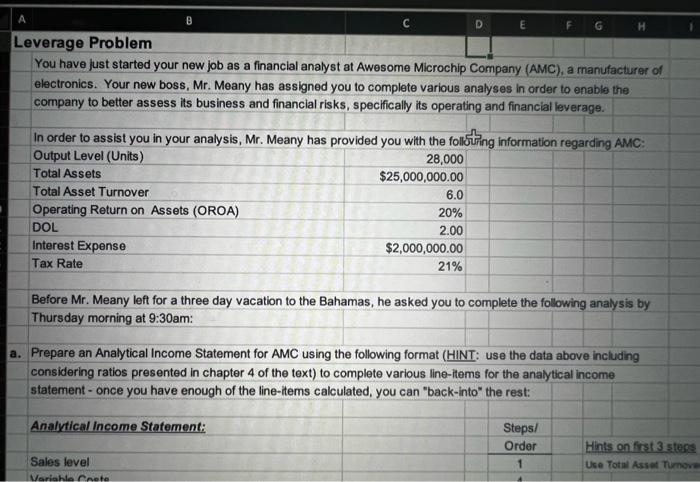

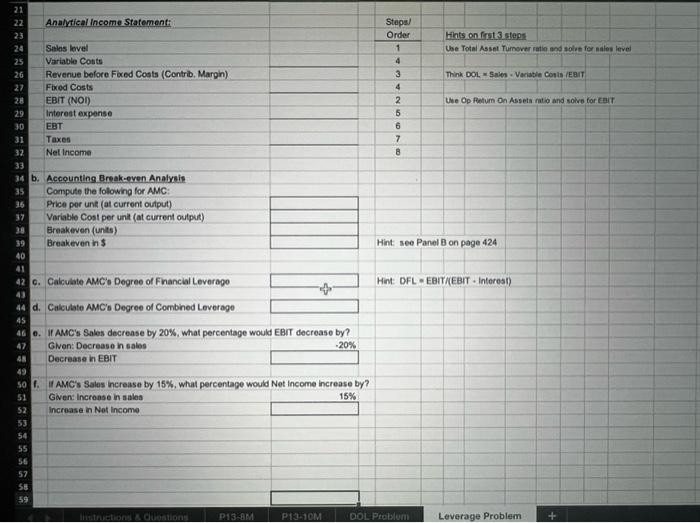

A B C D G H Leverage Problem You have just started your new job as a financial analyst at Awesome Microchip Company (AMC), a manufacturer of electronics. Your new boss, Mr. Meany has assigned you to complete various analyses in order to enable the company to better assess its business and financial risks, specifically its operating and financial leverage. In order to assist you in your analysis, Mr. Meany has provided you with the follisting information regarding AMC: Output Level (Units) 28,000 Total Assets $25,000,000.00 Total Asset Turnover 6.0 Operating Return on Assets (OROA) 20% DOL 2.00 Interest Expense $2,000,000.00 Tax Rate 21% Before Mr. Meany left for a three day vacation to the Bahamas, he asked you to complete the following analysis by Thursday morning at 9:30am: a. Prepare an Analytical Income Statement for AMC using the following format (HINT: use the data above including considering ratios presented in chapter 4 of the text) to complete various line-items for the analytical income statement - once you have enough of the line-items calculated, you can "back-into the rest: Analytical Income Statement: Steps/ Order 1 Hints on first 3 sters Use Total Assot Tumove Sales level Variable note O NA WA 21 22 Analytical Income Statement: Steps 23 Order Hints ont 3. stops 24 Sales level 1 Use Total Asset Tumover rate and solve for los level 25 Variable Conts 4 26 Revenue before Fibed Coats (Contrib. Margin) 3 Think DOL Sales - Variable Conta (EBIT 27 Fixed Costs 4 28 EBIT (NOI) 2 Uwe Op Return On Assets ratio and solve for EDIT 29 Interest expense 5 30 EBT 31 Taxes 7 32 Net Income 33 34 b. Accounting Break-even Analysis 35 Compute the following for AMC: Price por unt (at current output) 37 Variable Coat per unit (at current output) 38 Breakeven (units) 39 Breakeven in s Hint see Panel B on page 424 40 41 42 6. Calculate AMC's Degree of Financial Leverago Hint: OFLEBIT EBIT - Interest) 43 44 d. Calculate AMC' Degree of Combined Loverage 45 46. AMC's Sales decrease by 20%, what percentage would EBIT decrease by? 47 Glen: Decrease in sales -20% 48 Decrease in EBIT 49 SO . AMC's Salos Increase by 15%, what percentage would Not Income increase by? 51 Given: Increase in sales 15% 52 Increase in Not Income 53 54 55 56 57 58 59 Instruction & Contion P13-8M P13-10M DOL Problem Leverage

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started