Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you please show me how you would calculate the answers using excel, Thank you! Risk-adjusted discount rates. After a careful evaluation of investment alternatives

Can you please show me how you would calculate the answers using excel, Thank you!

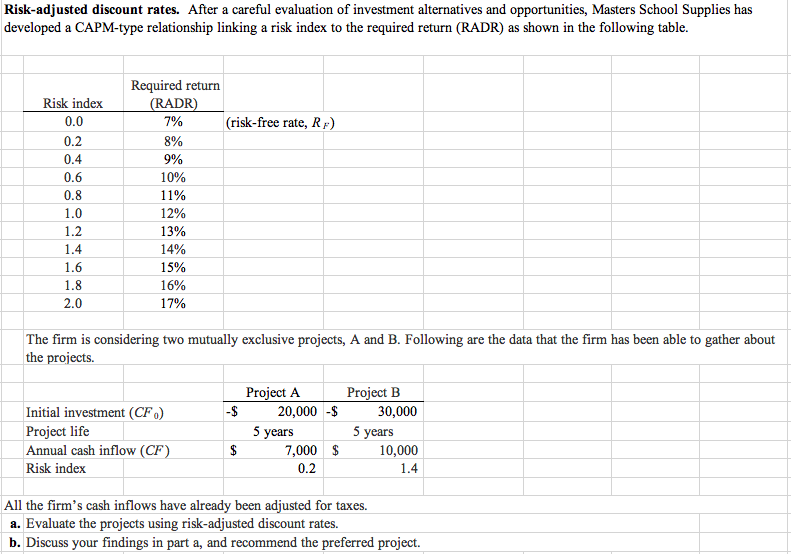

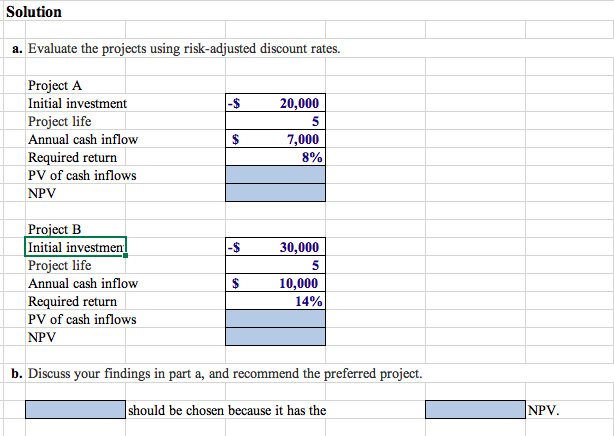

Risk-adjusted discount rates. After a careful evaluation of investment alternatives and opportunities, Masters School Supplies has developed a CAPM-type relationship linking a risk index to the required return (RADR) as shown in the following table. Required return (RADR) 7% (risk-free rate, R:) Risk index 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8 2.0 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% The firm is considering two mutually exclusive projects, A and B. Following are the data that the firm has been able to gather about the projects. $ Initial investment (CF) Project life Annual cash inflow (CF) Risk index Project A 20,000-$ 5 years 7,000 $ 0.2 Project B 30,000 5 years 10,000 1.4 $ All the firm's cash inflows have already been adjusted for taxes. a. Evaluate the projects using risk-adjusted discount rates b. Discuss your findings in part a, and recommend the preferred project. Solution a. Evaluate the projects using risk-adjusted discount rates. |-$ 20,000 Project A Initial investment Project life Annual cash inflow Required return PV of cash inflows NPV $ 7,000 18% 30,000 Project B Initial investmen! Project life Annual cash inflow Required return PV of cash inflows NPV $ 10,000 14% b. Discuss your findings in part a, and recommend the preferred project. NPV. should be chosen because it has theStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started