Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you please show the answer written in profile application? Assignment Problem Four - 7 (Comprehensive Tax Payable) Lydia Hines is a translator who works

Can you please show the answer written in profile application?

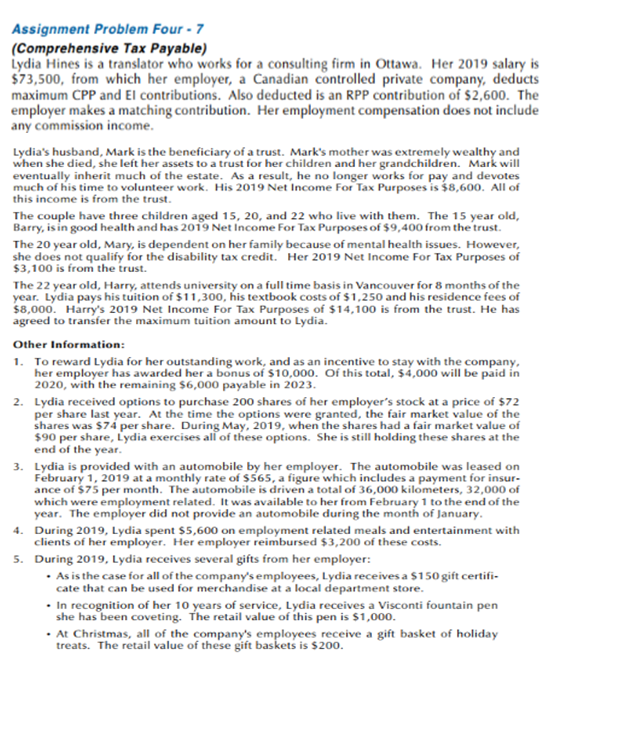

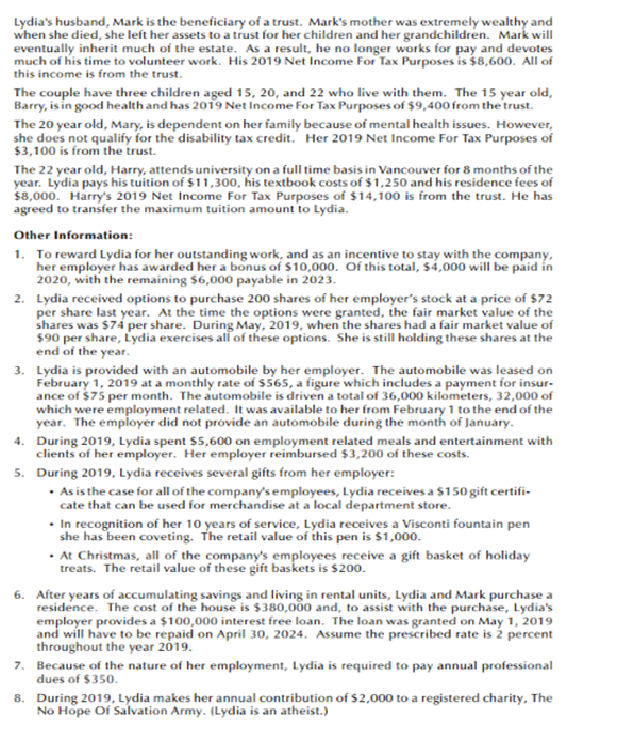

Assignment Problem Four - 7 (Comprehensive Tax Payable) Lydia Hines is a translator who works for a consulting firm in Ottawa. Her 2019 salary is $73,500, from which her employer, a Canadian controlled private company, deducts maximum CPP and El contributions. Also deducted is an RPP contribution of $2,600. The employer makes a matching contribution. Her employment compensation does not include any commission income Lydia's husband, Mark is the beneficiary of a trust. Mark's mother was extremely wealthy and when she died, she left her assets to a trust for her children and her grandchildren. Mark will eventually inherit much of the estate. As a result, he no longer works for pay and devotes much of his time to volunteer work. His 2019 Net Income For Tax Purposes is 58,600. AIl of this income is from the trust. The couple have three children aged 15, 20, and 22 who live with them. The 15 year old, Barry, is in good health and has 2019 Net Income For Tax Purposes of $9,400 from the trust. The 20 year old, Mary, is dependent on her family because of mental health issues. However she does not qualify for the disability tax credit.' Her 2019 Net Income For Tax Purposes of $3,100 is from the trust The 22 year old, Harry, attends university on a full time basis in Vancouver for 8 months of the year. Lydia pays his tuition of $11,300, his textbook costs of $ 1,250 and his residence fees of $8,000. Harry's 2019 Net Income For Tax Purposes of $14,100 is from the trust. He has agreed to transfer the maximum tuition amount to Lydia Other Information: To reward Lydia for her outstanding work, and as an incentive to stay with the company, her employer has awarded her a bonus of $10,000. Of this total, $4,000 will be paid in 2020, with the remaining $6,000 payable in 2023. 1. 2. Lydia received options to purchase 200 shares of her employer's stock at a price of $72 per share last year. At the time the options were granted, the fair market value of the shares was $74 per share. During May, 2019, when the shares hada fair market value of $90 per share, Lydia exercises all of these options. She is still holding these shares at the end of the year Lydia is provided with an automobile by her employer. The automobile was leased on February 1, 2019 at a monthly rate of $565, a figure which includes a payment for insur ance of $75 per month. The automobile is driven a total of 36,000 kilometers, 32,000 of which were employment related. It was available to her from February 1 to the end of the year. The employer did not provide an automobile during the month of January 3. 4. During 2019, Lydia spent $5,600 on employment related meals and entertainment with clients of her employer. Her employer reimbursed $3,200 of these costs. 5 During 2019, Lydia receives several gifts from her employer: As is the case for all of the company's employees, Lydia receives a $150 gift certifi- cate that can be used for merchandise at a local department store. In recognition of her 10 years of service, Lydia receives a Visconti fountain pen she has been coveting. The retail value of this pen is $1,000. At Christmas, all of the company's employees receive a gift basket of holiday treats. The retail value of these gift baskets is $200. Lydia's husband, Mark is the beneficiary of a trust. Mark's mother was extremely wealthy and when she died, she left her assets to a trust for her children and her grandchildren. Markwill eventually inherit much of the estate. As a result, he no longer works for pay and devotes this income is from the trust The couple have three children aged 15, 20, and 22 who live with them. The 15 year old, Barry, is in good health and has 2019 Net Income For Tax Purposes of $9,400 from the trust. The 20 year old, Mary, is dependent on her family because of mental health issues. However she does not qualify for the disability tax credit.' Her 2019 Net Income For Tax Purposes of $3,100 is from the trust. The 22 year old, Harry, attends university on a full time basis in Vancouver for 8 months of the year. Lydia pays his tuition of $11,300, his textbook costs of $1,250 and his residence fees of $8,000 Harry's 2019 Net Income For Tax Purposes of $14,100 is from the trust. He has agreed to transfer the maximum tuition amount to Lydia. Other Information: To reward Lydia for her outstanding work, and as an incentive to stay with the company her employer has awarded her a bonus of $10,000. Of this total, $4,000 will be paid in 2020, with the remaining $6,000 payable in 2023. 1. Lydia received options to purchase 200 shares of her employer's stock at a price of $72 per share last year. At the time the options were granted, the fair market value of the 2. $90 per share, Lydia exercises all of these options. She is still hlding these shares at the end of the year. 3. Lydia is provided with an automobile by her employer. The automobile was leased on February 1, 2019 at a monthly rate of $565, a figure which includes a payment for insur- ance of $75 per month. The automobile is driven a total of 36,000 kilometers, 32,000 of which were emplayment related. It was available to her from February 1 to the end of the year. The employer did not provide an automobile during the month of January 4. During 2019, Lydia spent $5,600 on employment related meals and entertain ment with clients of her employer. Her employer reimbursed $3,200 of these costs. 5. During 2019, Lydia receives several gifts from her employer: As is the case for all of the companysemployees, Lydia receives a $150 gift certifi cate that can be used for merchandise at a local department store. In recognition of her 10 years of service, Lydia receives a Visconti founta in pen she has been coveting. The retail value of this pen is $1,000. treats. The retail value of these gift bas kets is $200. 6. After years of accumulating savings and living in rental units, Lydia and Mark purchase a residence. The cost of the house is $380,000 and, to assist with the purchase, Lydia's employer provides a $100,000 interest free loan. The loan was granted on May 1, 2019 and will have to be repaid on April 30, 2024. Assume the prescribed rate is percent throughout the year 2019. 7. Because of the nature of her employment, Lydia is required to pay annual professional dues of $350 During 2019, Lydia makes her annual contribution of $2,000 to a registered charity, The No Hope Of Salvation Army. (Lydia is an atheist.) 8. Lydia's employer provides all employees with a health care plan. It reimburses for 50 percent of all prescriptions, dental and vision fees for the employee, the employee's spouse and all children under 18 years of age. The family's 2019 medical expenses, all of which were paid by Lydia, were as follows: 9. Lydia Prescriptions Lydia Botox treatments Mark Dentist's fees for root canals (3) Mark Hair replacement procedures Barry- Dentist's fees, including $1,000 for a tooth replacement Mary Doctor's fees for treatment for depression Mary Prescriptions Mary Liposuction treatment for her upper arms Harry-Physiotherapy Harry-Fees for prescription glasses and contact lenses $2,500 1,400 7,200 3,700 2,100 8,400 3,900 4,200 1,500 2,200 Required: A. Determine Lydia's minimum Net Income For Tax Purposes for the 2019 taxation year. B. Determine Lydia's minimum Taxable Income for the 2019 taxation year. C. Based on your answer in Part B, determine Lydia's federal Tax Payable for the 2019 taxa- tion year. Assignment Problem Four - 7 (Comprehensive Tax Payable) Lydia Hines is a translator who works for a consulting firm in Ottawa. Her 2019 salary is $73,500, from which her employer, a Canadian controlled private company, deducts maximum CPP and El contributions. Also deducted is an RPP contribution of $2,600. The employer makes a matching contribution. Her employment compensation does not include any commission income Lydia's husband, Mark is the beneficiary of a trust. Mark's mother was extremely wealthy and when she died, she left her assets to a trust for her children and her grandchildren. Mark will eventually inherit much of the estate. As a result, he no longer works for pay and devotes much of his time to volunteer work. His 2019 Net Income For Tax Purposes is 58,600. AIl of this income is from the trust. The couple have three children aged 15, 20, and 22 who live with them. The 15 year old, Barry, is in good health and has 2019 Net Income For Tax Purposes of $9,400 from the trust. The 20 year old, Mary, is dependent on her family because of mental health issues. However she does not qualify for the disability tax credit.' Her 2019 Net Income For Tax Purposes of $3,100 is from the trust The 22 year old, Harry, attends university on a full time basis in Vancouver for 8 months of the year. Lydia pays his tuition of $11,300, his textbook costs of $ 1,250 and his residence fees of $8,000. Harry's 2019 Net Income For Tax Purposes of $14,100 is from the trust. He has agreed to transfer the maximum tuition amount to Lydia Other Information: To reward Lydia for her outstanding work, and as an incentive to stay with the company, her employer has awarded her a bonus of $10,000. Of this total, $4,000 will be paid in 2020, with the remaining $6,000 payable in 2023. 1. 2. Lydia received options to purchase 200 shares of her employer's stock at a price of $72 per share last year. At the time the options were granted, the fair market value of the shares was $74 per share. During May, 2019, when the shares hada fair market value of $90 per share, Lydia exercises all of these options. She is still holding these shares at the end of the year Lydia is provided with an automobile by her employer. The automobile was leased on February 1, 2019 at a monthly rate of $565, a figure which includes a payment for insur ance of $75 per month. The automobile is driven a total of 36,000 kilometers, 32,000 of which were employment related. It was available to her from February 1 to the end of the year. The employer did not provide an automobile during the month of January 3. 4. During 2019, Lydia spent $5,600 on employment related meals and entertainment with clients of her employer. Her employer reimbursed $3,200 of these costs. 5 During 2019, Lydia receives several gifts from her employer: As is the case for all of the company's employees, Lydia receives a $150 gift certifi- cate that can be used for merchandise at a local department store. In recognition of her 10 years of service, Lydia receives a Visconti fountain pen she has been coveting. The retail value of this pen is $1,000. At Christmas, all of the company's employees receive a gift basket of holiday treats. The retail value of these gift baskets is $200. Lydia's husband, Mark is the beneficiary of a trust. Mark's mother was extremely wealthy and when she died, she left her assets to a trust for her children and her grandchildren. Markwill eventually inherit much of the estate. As a result, he no longer works for pay and devotes this income is from the trust The couple have three children aged 15, 20, and 22 who live with them. The 15 year old, Barry, is in good health and has 2019 Net Income For Tax Purposes of $9,400 from the trust. The 20 year old, Mary, is dependent on her family because of mental health issues. However she does not qualify for the disability tax credit.' Her 2019 Net Income For Tax Purposes of $3,100 is from the trust. The 22 year old, Harry, attends university on a full time basis in Vancouver for 8 months of the year. Lydia pays his tuition of $11,300, his textbook costs of $1,250 and his residence fees of $8,000 Harry's 2019 Net Income For Tax Purposes of $14,100 is from the trust. He has agreed to transfer the maximum tuition amount to Lydia. Other Information: To reward Lydia for her outstanding work, and as an incentive to stay with the company her employer has awarded her a bonus of $10,000. Of this total, $4,000 will be paid in 2020, with the remaining $6,000 payable in 2023. 1. Lydia received options to purchase 200 shares of her employer's stock at a price of $72 per share last year. At the time the options were granted, the fair market value of the 2. $90 per share, Lydia exercises all of these options. She is still hlding these shares at the end of the year. 3. Lydia is provided with an automobile by her employer. The automobile was leased on February 1, 2019 at a monthly rate of $565, a figure which includes a payment for insur- ance of $75 per month. The automobile is driven a total of 36,000 kilometers, 32,000 of which were emplayment related. It was available to her from February 1 to the end of the year. The employer did not provide an automobile during the month of January 4. During 2019, Lydia spent $5,600 on employment related meals and entertain ment with clients of her employer. Her employer reimbursed $3,200 of these costs. 5. During 2019, Lydia receives several gifts from her employer: As is the case for all of the companysemployees, Lydia receives a $150 gift certifi cate that can be used for merchandise at a local department store. In recognition of her 10 years of service, Lydia receives a Visconti founta in pen she has been coveting. The retail value of this pen is $1,000. treats. The retail value of these gift bas kets is $200. 6. After years of accumulating savings and living in rental units, Lydia and Mark purchase a residence. The cost of the house is $380,000 and, to assist with the purchase, Lydia's employer provides a $100,000 interest free loan. The loan was granted on May 1, 2019 and will have to be repaid on April 30, 2024. Assume the prescribed rate is percent throughout the year 2019. 7. Because of the nature of her employment, Lydia is required to pay annual professional dues of $350 During 2019, Lydia makes her annual contribution of $2,000 to a registered charity, The No Hope Of Salvation Army. (Lydia is an atheist.) 8. Lydia's employer provides all employees with a health care plan. It reimburses for 50 percent of all prescriptions, dental and vision fees for the employee, the employee's spouse and all children under 18 years of age. The family's 2019 medical expenses, all of which were paid by Lydia, were as follows: 9. Lydia Prescriptions Lydia Botox treatments Mark Dentist's fees for root canals (3) Mark Hair replacement procedures Barry- Dentist's fees, including $1,000 for a tooth replacement Mary Doctor's fees for treatment for depression Mary Prescriptions Mary Liposuction treatment for her upper arms Harry-Physiotherapy Harry-Fees for prescription glasses and contact lenses $2,500 1,400 7,200 3,700 2,100 8,400 3,900 4,200 1,500 2,200 Required: A. Determine Lydia's minimum Net Income For Tax Purposes for the 2019 taxation year. B. Determine Lydia's minimum Taxable Income for the 2019 taxation year. C. Based on your answer in Part B, determine Lydia's federal Tax Payable for the 2019 taxa- tion yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started