Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you please show the step by step work! and answer all parts please Use the 2012 marginal tax rates in the table below to

can you please show the step by step work! and answer all parts please

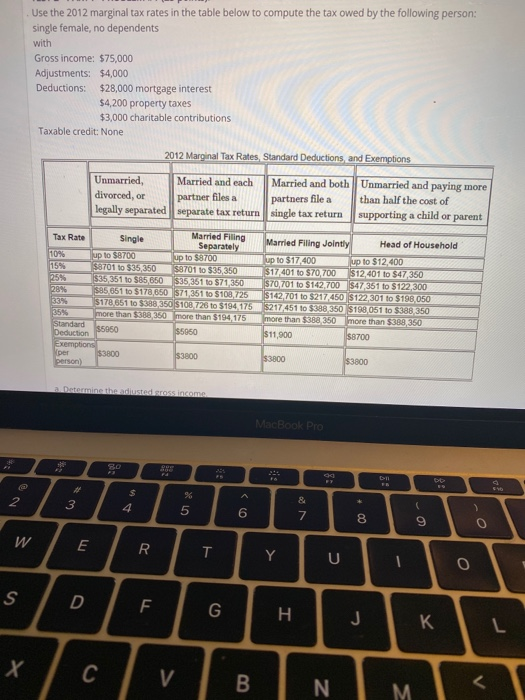

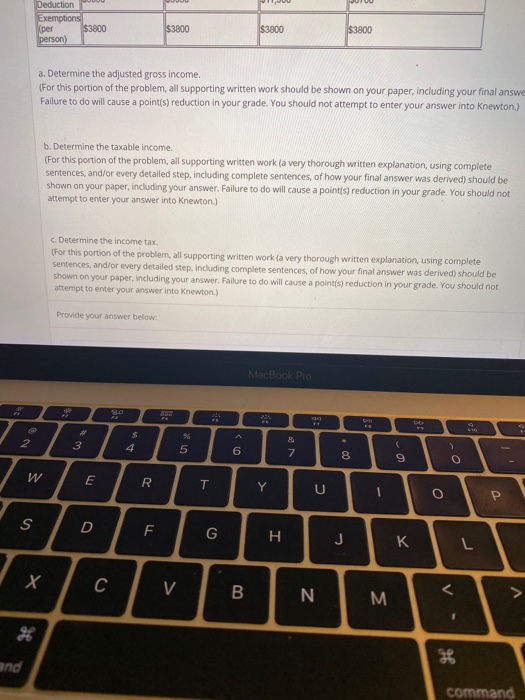

Use the 2012 marginal tax rates in the table below to compute the tax owed by the following person: single female, no dependents with Gross income: $75,000 Adjustments: $4,000 Deductions: $28,000 mortgage interest $4,200 property taxes $3,000 charitable contributions Taxable credit: None 2012 Marginal Tax Rates Standard Deductions and Exemptions Unmarried, divorced, or legally separated Married and each partner files a separate tax return Married and both partners file a single tax return Unmarried and paying more than half the cost of supporting a child or parent 25% Tax Rate Single Married Filing Separately 10% up to $8700 up to $8700 15% $8701 to $35,350 $8701 to $35,350 535 351 to $85,650 $35351 to $71350 28% $85 661 to $178,650 $71,351 to $108.725 63% 5178,651 to $388,350 $ 108,728 to $194,175 more than $3 310 more than $1794 175 Standard Deduction $5050 $5060 Exemptions 53800 3800 person) Married Filing Jointly Head of Household Up to $17.400 up to $12,400 $17401 to $70 700512401 to $47350 70 701 to $142.700 547351 to $122.300 5 142701 to $217450 S122 301 to $198.050 $217,451 to $388,350 $198.051 to $388 350 more than $388 350 more than $388,350 $11,900 $8700 Vpet $3800 $3800 Determine the dustedress income No Pro Deduction Exemptions per $3800 person) $3800 $3800 $3800 a. Determine the adjusted gross income. (For this portion of the problem, all supporting written work should be shown on your paper, including your final answe Failure to do will cause a point(s) reduction in your grade. You should not attempt to enter your answer into Knewton.) b. Determine the taxable income. (For this portion of the problem, all supporting written work (a very thorough written explanation, using complete sentences, and/or every detailed step, including complete sentences, of how your final answer was derived) should be shown on your paper, including your answer. Failure to do will cause a points) reduction in your grade. You should not attempt to enter your answer into Knewton) c. Determine the income tax. (For this portion of the problem, all supporting written work (a very thorough written explanation, using complete sentences, and/or every detailed step, including complete sentences of how your final answer was derived) should be shown on your paper, including your answer. Failure to do will cause a point(s) reduction in your grade. You should not attempt to enter your answer into Knewton.) Provide your answer below and command Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started