Answered step by step

Verified Expert Solution

Question

1 Approved Answer

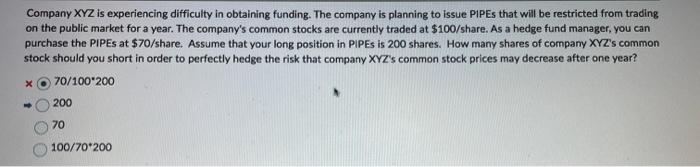

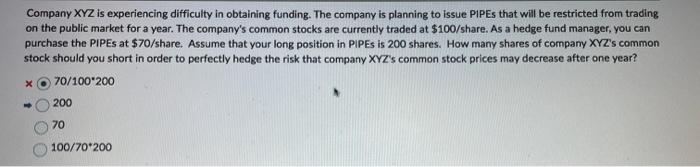

can you please show the work and explain why the answer is 200 Company XYZ is experiencing difficulty in obtaining funding. The company is planning

can you please show the work and explain why the answer is 200

Company XYZ is experiencing difficulty in obtaining funding. The company is planning to issue PPPEs that will be restricted from trading on the public market for a year. The company's common stocks are currently traded at $100/ share. As a hedge fund manager, you can purchase the PIPEs at $70/ share. Assume that your long position in PIPEs is 200 shares. How many shares of company XYZ's common stock should you short in order to perfectly hedge the risk that company XYZ 's common stock prices may decrease after one year? 70/1002002007100100/70200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started