Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you please show your work, thank you! Patton Dyes manufactures colorings, primarily for textiles. Information on the work in process follows: - Beginning inventory,

Can you please show your work, thank you!

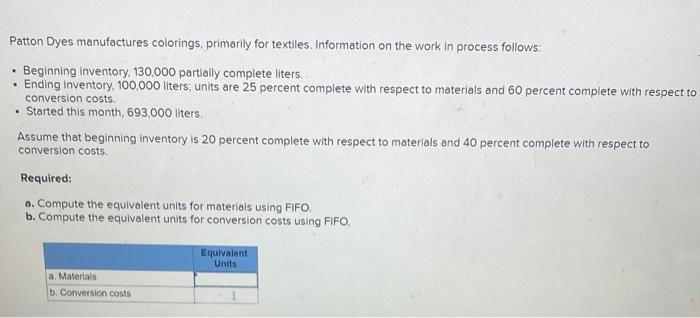

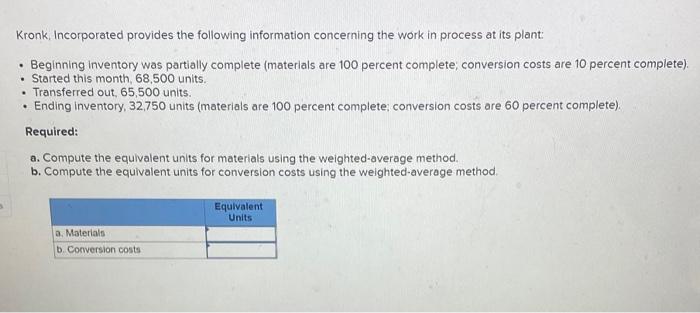

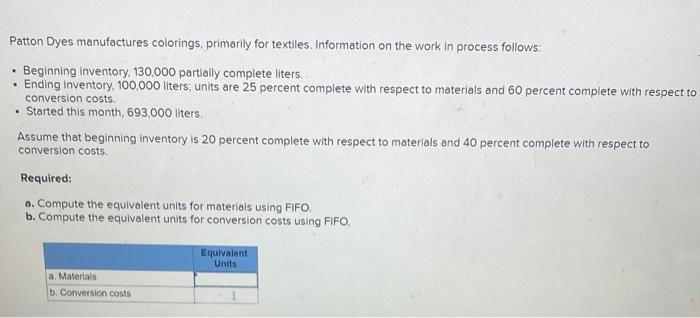

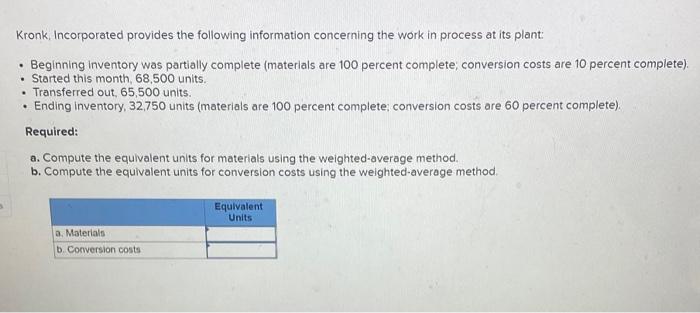

Patton Dyes manufactures colorings, primarily for textiles. Information on the work in process follows: - Beginning inventory, 130,000 partially complete liters: - Ending inventory, 100,000 liters; units are 25 percent complete with respect to materials and 60 percent complete with respect to conversion costs. - Started this month, 693,000 liters. Assume that beginning inventory is 20 percent complete with respect to materials and 40 percent complete with respect to conversion costs. Required: a. Compute the equivalent units for materials using FIFO. b. Compute the equivalent units for conversion costs using FIFO. Kronk, Incorporated provides the following information concerning the work in process at its plant: - Beginning inventory was partially complete (materials are 100 percent complete; conversion costs are 10 percent complete). - Started this month, 68,500 units. - Transferred out, 65,500 units. - Ending inventory, 32,750 units (materials are 100 percent complete: conversion costs are 60 percent complete). Required: a. Compute the equivalent units for materials using the weighted-average method. b. Compute the equivalent units for conversion costs using the weighted-average method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started