Answered step by step

Verified Expert Solution

Question

1 Approved Answer

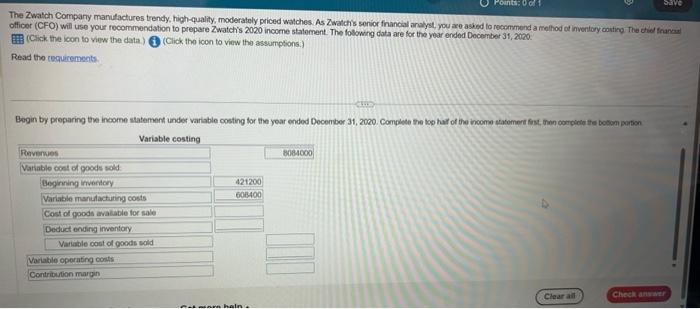

can you please solve. note : the solved parts are just example with different numbers. The Zwatch Company manulactures trendy, high-quality, moderately priced walches. As

can you please solve. note : the solved parts are just example with different numbers.

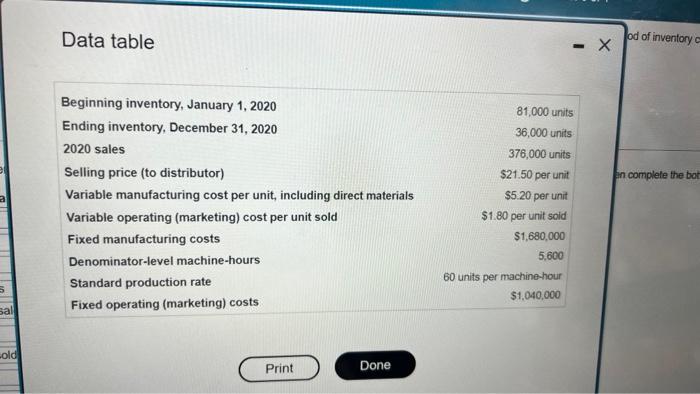

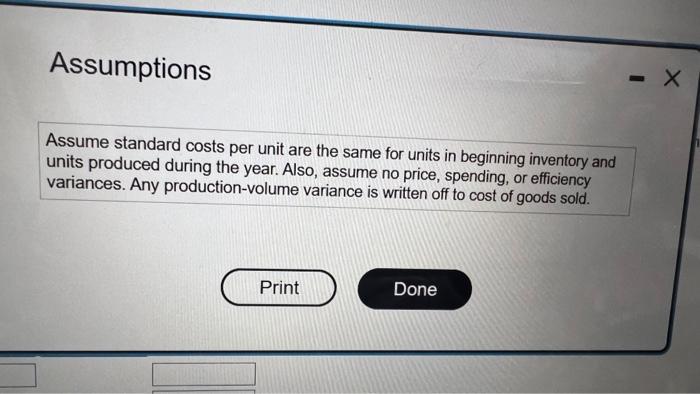

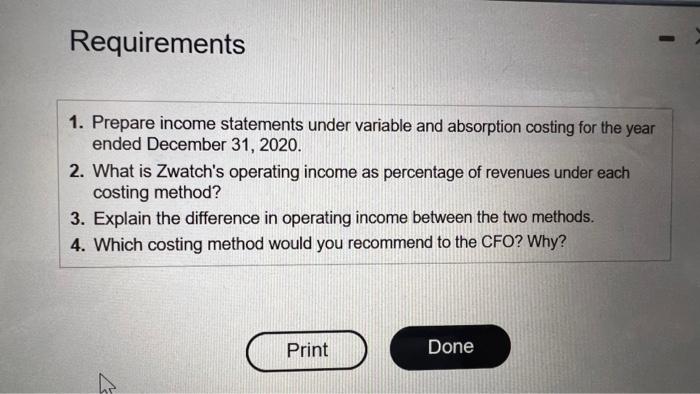

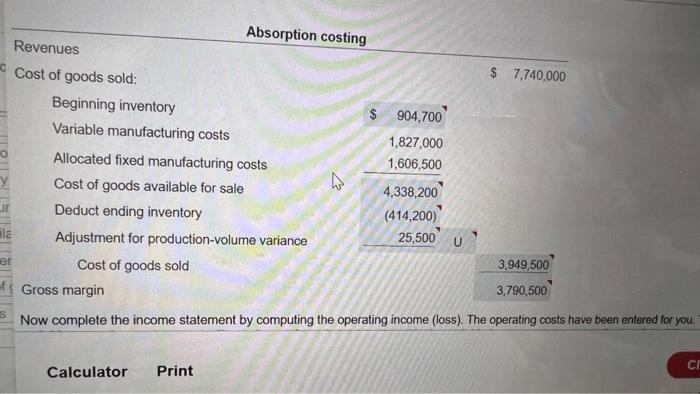

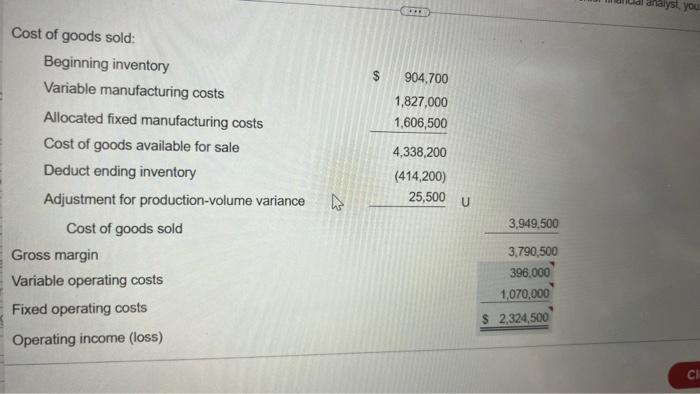

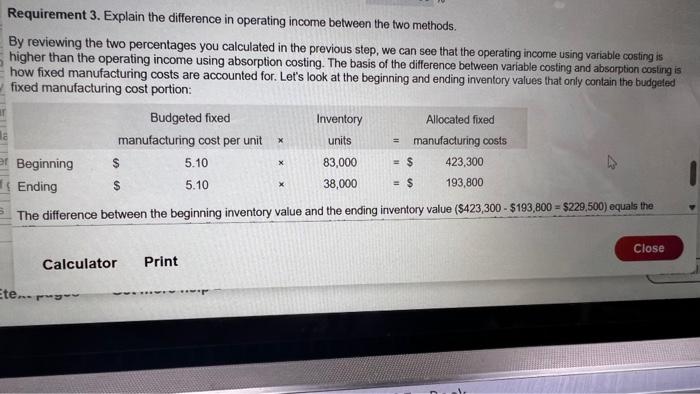

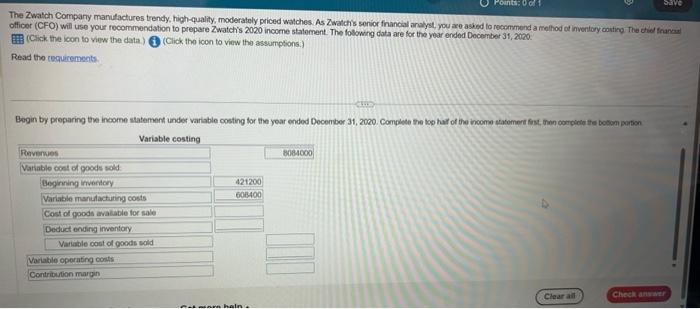

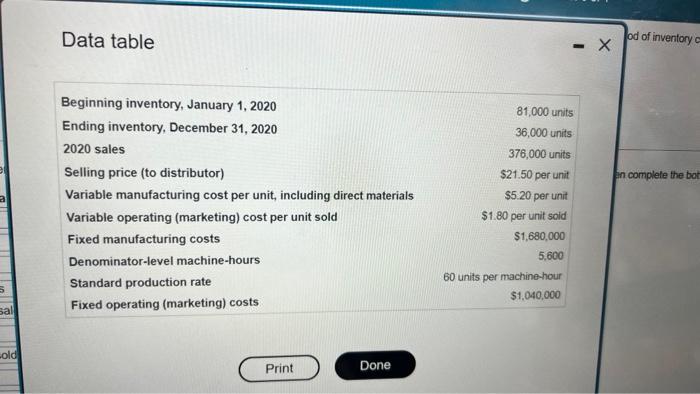

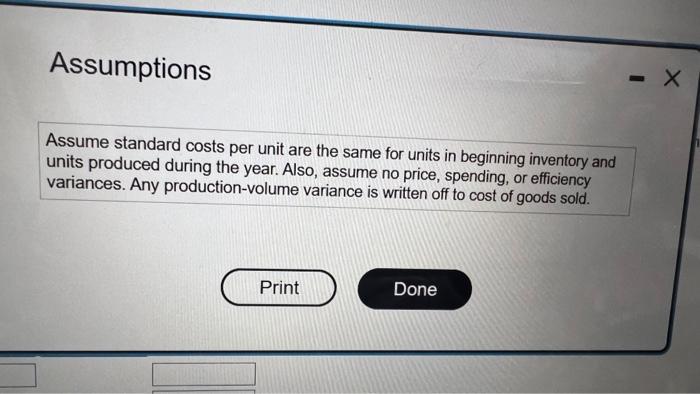

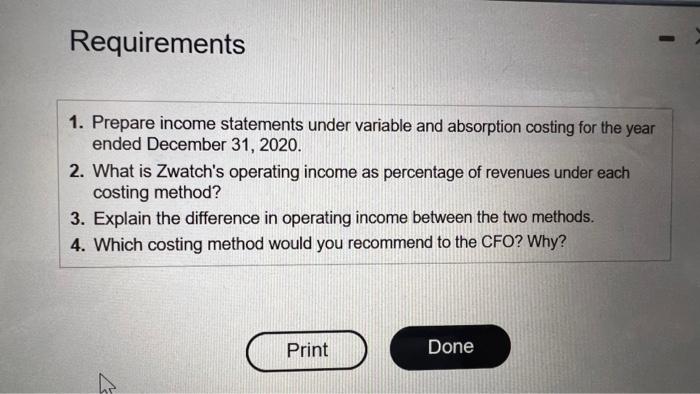

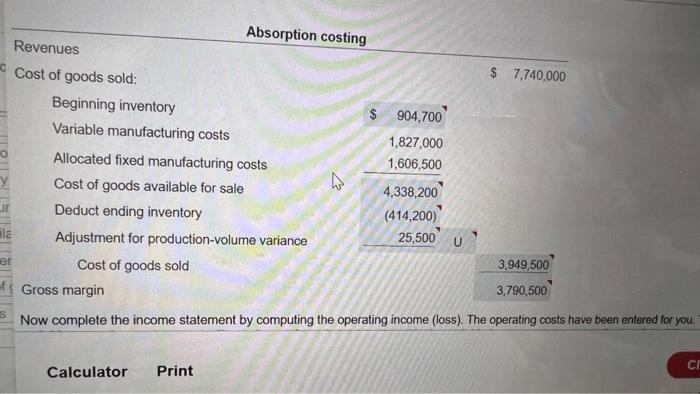

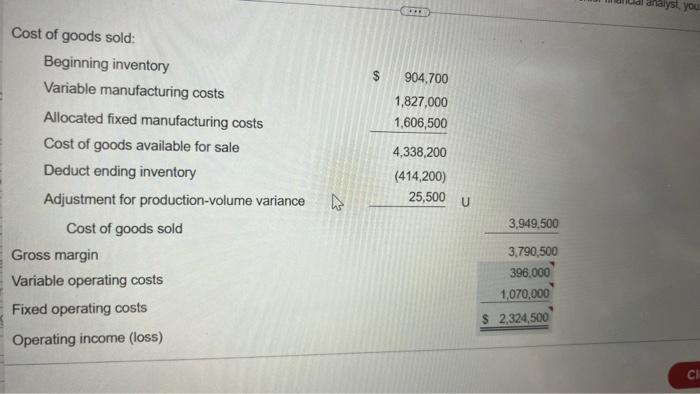

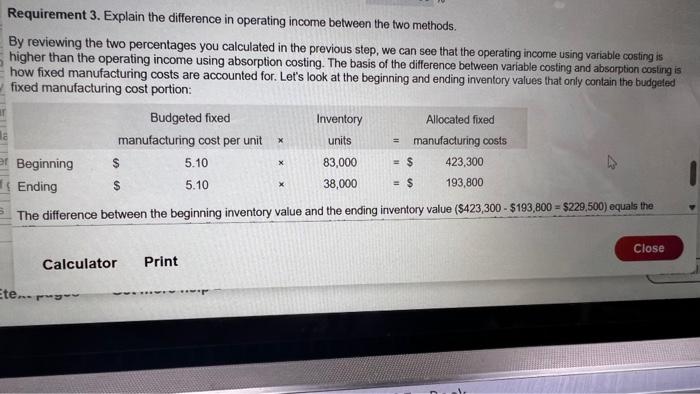

The Zwatch Company manulactures trendy, high-quality, moderately priced walches. As Zwatchis sorior financial analyst, you are asked to recemmend a meithod of inventory obitice the etied franar officer (CFO) witi use your rocommendation to prepare Zwatchis 2020 income statement. The folowing data are for the year ended Docenber 31,2020 . (Ciick the icon to view the data.) (Click the icon to view the assumptions.) Read tho reguirements. Data table od of inventory c en complete the bot Assumptions Assume standard costs per unit are the same for units in beginning inventory and units produced during the year. Also, assume no price, spending, or efficiency variances. Any production-volume variance is written off to cost of goods sold. Requirements 1. Prepare income statements under variable and absorption costing for the year ended December 31, 2020. 2. What is Zwatch's operating income as percentage of revenues under each costing method? 3. Explain the difference in operating income between the two methods. 4. Which costing method would you recommend to the CFO? Why? Revenues Absorption costing 7,740,000 790,500949,500 Now complete the income statement by computing the operating income (loss). The operating costs have been entered for you. Cost of goods sold: Beginning inventory Variable manufacturing costs Allocated fixed manufacturing costs Cost of goods available for sale Deduct ending inventory Adjustment for production-volume variance $904,7001,827,0001,606,5004,338,200(414,200)25,500 Cost of goods sold Gross margin Variable operating costs Fixed operating costs Operating income (loss) Requirement 3. Explain the difference in operating income between the two methods. By reviewing the two percentages you calculated in the previous step, we can see that the operating income using variable costing is higher than the operating income using absorption costing. The basis of the difference between variable costing and absorption costung is how fixed manufacturing costs are accounted for. Let's look at the beginning and ending inventory values that only contain the budgeled fixed manufacturing cost portion: The difference between the beginning inventory value and the ending inventory value ($423,300$193,800=$229,500) equals the The Zwatch Company manulactures trendy, high-quality, moderately priced walches. As Zwatchis sorior financial analyst, you are asked to recemmend a meithod of inventory obitice the etied franar officer (CFO) witi use your rocommendation to prepare Zwatchis 2020 income statement. The folowing data are for the year ended Docenber 31,2020 . (Ciick the icon to view the data.) (Click the icon to view the assumptions.) Read tho reguirements. Data table od of inventory c en complete the bot Assumptions Assume standard costs per unit are the same for units in beginning inventory and units produced during the year. Also, assume no price, spending, or efficiency variances. Any production-volume variance is written off to cost of goods sold. Requirements 1. Prepare income statements under variable and absorption costing for the year ended December 31, 2020. 2. What is Zwatch's operating income as percentage of revenues under each costing method? 3. Explain the difference in operating income between the two methods. 4. Which costing method would you recommend to the CFO? Why? Revenues Absorption costing 7,740,000 790,500949,500 Now complete the income statement by computing the operating income (loss). The operating costs have been entered for you. Cost of goods sold: Beginning inventory Variable manufacturing costs Allocated fixed manufacturing costs Cost of goods available for sale Deduct ending inventory Adjustment for production-volume variance $904,7001,827,0001,606,5004,338,200(414,200)25,500 Cost of goods sold Gross margin Variable operating costs Fixed operating costs Operating income (loss) Requirement 3. Explain the difference in operating income between the two methods. By reviewing the two percentages you calculated in the previous step, we can see that the operating income using variable costing is higher than the operating income using absorption costing. The basis of the difference between variable costing and absorption costung is how fixed manufacturing costs are accounted for. Let's look at the beginning and ending inventory values that only contain the budgeled fixed manufacturing cost portion: The difference between the beginning inventory value and the ending inventory value ($423,300$193,800=$229,500) equals the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started