Can you please solve QUESTION B

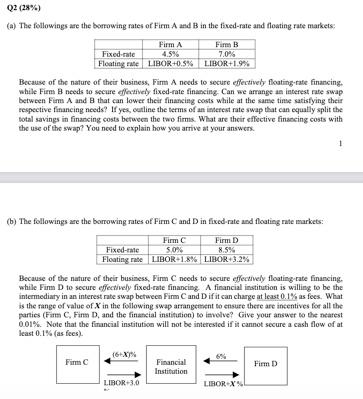

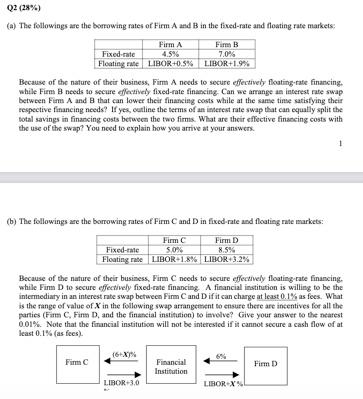

Q2 (28%) (a) The followings are the borrowing rates of Firm A and B in the fixed-rate and floating rate markets: Firm A Fimm B Fixed rate 4.5% 7.0% Floating Fate LIBOR40.5% LIBOR+1.9% Because of the nature of their business, Firm A needs to secure effectively floating-rate financing. while Firm needs to secure efectively fixed-rate financing Can we arrange an interest rate swap between Firm A and B that can lower their financing costs while at the same time satisfying their respective financing needs? If yes, outline the terms of an interest rate swap that can equally split the total savings in financing costs between the two firms. What are their effective financing costs with the use of the swap? You need to explain how you arrive at your answers 1 (b) The followings are the borrowing rates of Firm C and Din fixed rate and floating rate markets: Firm C Firm D Fixed-rate 5.0% 8.5% Floating rate LIBOR 1.6% LIBOR 3.2% Because of the nature of their business, Firm needs to secure effectively floating rate financing while Fin Dto secure effectively fixed-rate financing A financial institution is willing to be the intermediary in an interest rate swap between Fim Cand Difit can charge at least 0.1% as foes. What is the range of value of X in the following swap arrangement to ensure there are incentives for all the parties (Firm Fim D, and the financial institution) to involve? Give your answer to the nearest 0.01%. Note that the financial institution will not be interested if it cannot secure a cash flow of at least 0.1% (as fees 16 Firm C Financial Institution Fim D LIBOR-3.0 LIBORX Q2 (28%) (a) The followings are the borrowing rates of Firm A and B in the fixed-rate and floating rate markets: Firm A Fimm B Fixed rate 4.5% 7.0% Floating Fate LIBOR40.5% LIBOR+1.9% Because of the nature of their business, Firm A needs to secure effectively floating-rate financing. while Firm needs to secure efectively fixed-rate financing Can we arrange an interest rate swap between Firm A and B that can lower their financing costs while at the same time satisfying their respective financing needs? If yes, outline the terms of an interest rate swap that can equally split the total savings in financing costs between the two firms. What are their effective financing costs with the use of the swap? You need to explain how you arrive at your answers 1 (b) The followings are the borrowing rates of Firm C and Din fixed rate and floating rate markets: Firm C Firm D Fixed-rate 5.0% 8.5% Floating rate LIBOR 1.6% LIBOR 3.2% Because of the nature of their business, Firm needs to secure effectively floating rate financing while Fin Dto secure effectively fixed-rate financing A financial institution is willing to be the intermediary in an interest rate swap between Fim Cand Difit can charge at least 0.1% as foes. What is the range of value of X in the following swap arrangement to ensure there are incentives for all the parties (Firm Fim D, and the financial institution) to involve? Give your answer to the nearest 0.01%. Note that the financial institution will not be interested if it cannot secure a cash flow of at least 0.1% (as fees 16 Firm C Financial Institution Fim D LIBOR-3.0 LIBORX