can you please solve questions 5 and 6. please solve quickly

can you please solve questions 5 and 6. please solve quickly

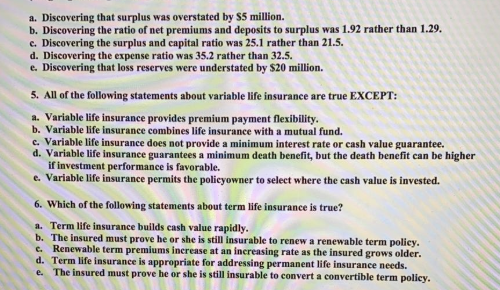

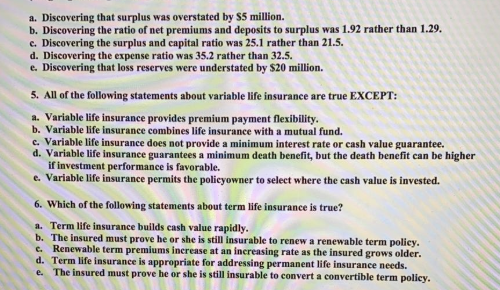

a. Discovering that surplus was overstated by $5 million. b. Discovering the ratio of net premiums and deposits to surplus was 1.92 rather than 1.29. c. Discovering the surplus and capital ratio was 25.1 rather than 21.5. d. Discovering the expense ratio was 35.2 rather than 32.5. e. Discovering that loss reserves were understated by $20 million. 5. All of the following statements about variable life insurance are true EXCEPT: a. Variable life insurance provides premium payment flexibility. b. Variable life insurance combines life insurance with a mutual fund. c. Variable life insurance does not provide a minimum interest rate or cash value guarantee. d. Variable life insurance guarantees a minimum death benefit, but the death benefit can be higher if investment performance is favorable. e. Variable life insurance permits the policyowner to select where the cash value is invested. 6. Which of the following statements about term life insurance is true? a. Term life insurance builds cash value rapidly. b. The insured must prove he or she is still insurable to renew a renewable term policy. c. Renewable term premiums inerease at an increasing rate as the insured grows older. d. Term life insurance is appropriate for addressing permanent life insurance needs. e. The insured must prove he or she is still insurable to convert a convertible term policy. a. Discovering that surplus was overstated by $5 million. b. Discovering the ratio of net premiums and deposits to surplus was 1.92 rather than 1.29. c. Discovering the surplus and capital ratio was 25.1 rather than 21.5. d. Discovering the expense ratio was 35.2 rather than 32.5. e. Discovering that loss reserves were understated by $20 million. 5. All of the following statements about variable life insurance are true EXCEPT: a. Variable life insurance provides premium payment flexibility. b. Variable life insurance combines life insurance with a mutual fund. c. Variable life insurance does not provide a minimum interest rate or cash value guarantee. d. Variable life insurance guarantees a minimum death benefit, but the death benefit can be higher if investment performance is favorable. e. Variable life insurance permits the policyowner to select where the cash value is invested. 6. Which of the following statements about term life insurance is true? a. Term life insurance builds cash value rapidly. b. The insured must prove he or she is still insurable to renew a renewable term policy. c. Renewable term premiums inerease at an increasing rate as the insured grows older. d. Term life insurance is appropriate for addressing permanent life insurance needs. e. The insured must prove he or she is still insurable to convert a convertible term policy

can you please solve questions 5 and 6. please solve quickly

can you please solve questions 5 and 6. please solve quickly