Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you please solve required 1. and 2.? thank you! Problem H-6 Management Contracts The Blue Moon Hotel (BMH) owners desire to have The Wilson

can you please solve required 1. and 2.? thank you!

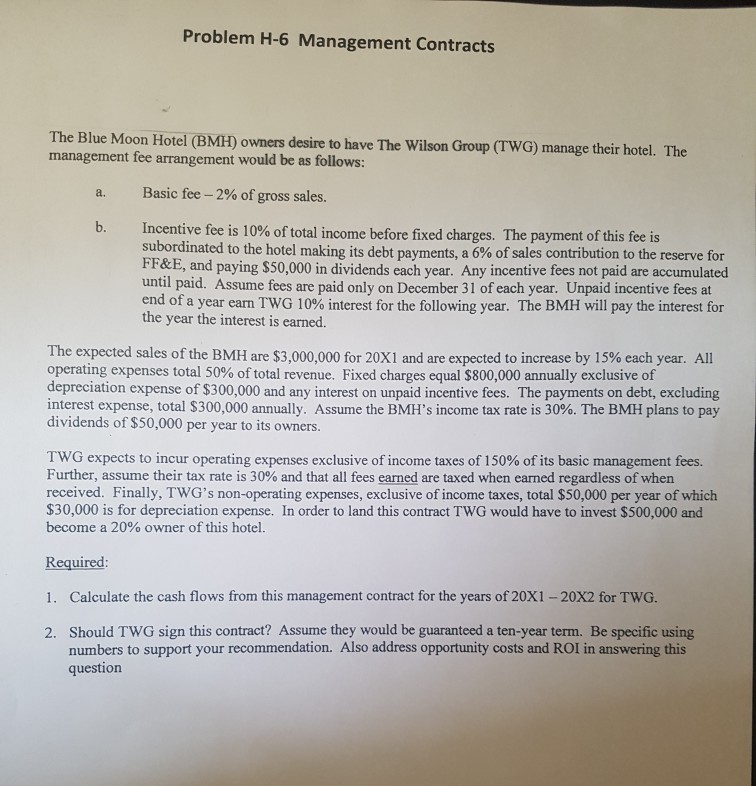

Problem H-6 Management Contracts The Blue Moon Hotel (BMH) owners desire to have The Wilson Group CTWG) manage their hotel. The management fee arrangement would be as follows: a. Basic fee-2% of gross sales. Incentive fee is 10% of total income before fixed charges. The payment of this fee is subordinated to the hotel making its debt payments, a 6% of sales contribution to the res erve for F&E, and paying $50,000 in dividends each year. Any incentive fees not paid are accumulated until paid. Assume fees are paid only on December 31 of each year. Unpaid incentive fees at end of a year earn 'TWG 10% interest for the following year. The BMH will pay the interest for the year the interest is earned. The expected sales of the BMH are $3,000,000 for 20X1 and are expected to increase by 15% each year. All operating expenses total 50% of total revenue. Fixed charges equal $800,000 annually exclusive of depreciation expense of $300,000 and any interest on unpaid incentive fees. The payments on debt, excluding interest expense, total $300,000 annually. Assume the BMH's income tax rate is 30%. The BMH plans to pay dividends of $50,000 per year to its owners. TWG expects to incur operating expenses exclusive of income taxes of 150% of its basic management fees. Further, assume their tax rate is 30% and that all fees earned are taxed when earned regardless of when received. Finally, TWG's non-operating expenses, exclusive of income taxes, total $50,000 per year of which $30,000 is for depreciation expense. In order to land this contract TWG would have to invest $500,000 and become a 20% owner of this hotel. Required 1. Calculate the cash flows from this management contract for the years of 20X1 -20X2 for TWG. 2. Should TWG sign this contract? Assume they would be guaranteed a ten-year term. Be specific using numbers to support your recommendation. Also address opportunity costs and ROI in answering thisStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started