Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you please solve this question as fast as you can I need it urgently 4. Hard Hat Brick company with a tax rate of

can you please solve this question as fast as you can I need it urgently

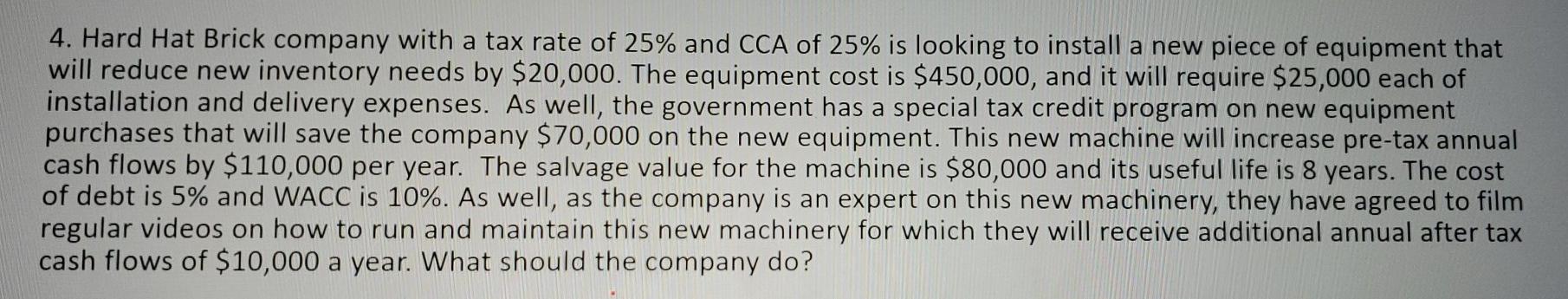

4. Hard Hat Brick company with a tax rate of 25% and CCA of 25% is looking to install a new piece of equipment that will reduce new inventory needs by $20,000. The equipment cost is $450,000, and it will require $25,000 each of installation and delivery expenses. As well, the government has a special tax credit program on new equipment purchases that will save the company $70,000 on the new equipment. This new machine will increase pre-tax annual cash flows by $110,000 per year. The salvage value for the machine is $80,000 and its useful life is 8 years. The cost of debt is 5% and WACC is 10%. As well, as the company is an expert on this new machinery, they have agreed to film regular videos on how to run and maintain this new machinery for which they will receive additional annual after tax cash flows of $10,000 a year. What should the company do? 4. Hard Hat Brick company with a tax rate of 25% and CCA of 25% is looking to install a new piece of equipment that will reduce new inventory needs by $20,000. The equipment cost is $450,000, and it will require $25,000 each of installation and delivery expenses. As well, the government has a special tax credit program on new equipment purchases that will save the company $70,000 on the new equipment. This new machine will increase pre-tax annual cash flows by $110,000 per year. The salvage value for the machine is $80,000 and its useful life is 8 years. The cost of debt is 5% and WACC is 10%. As well, as the company is an expert on this new machinery, they have agreed to film regular videos on how to run and maintain this new machinery for which they will receive additional annual after tax cash flows of $10,000 a year. What should the company doStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started