Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you please solve this with proper calculation. Current Attempt in Progress On January 1, 2020, the accounting records of Bramble Lte included a debit

can you please solve this with proper calculation.

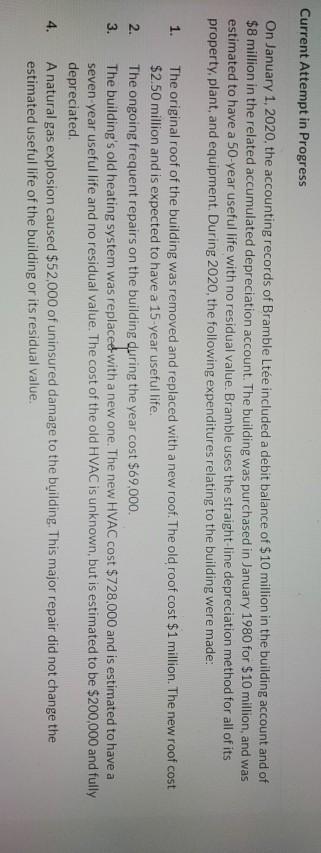

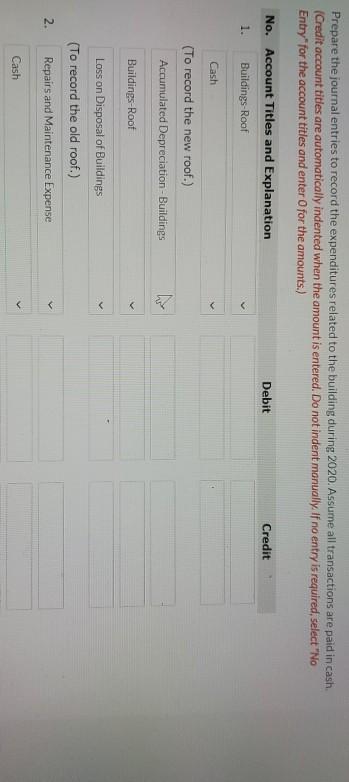

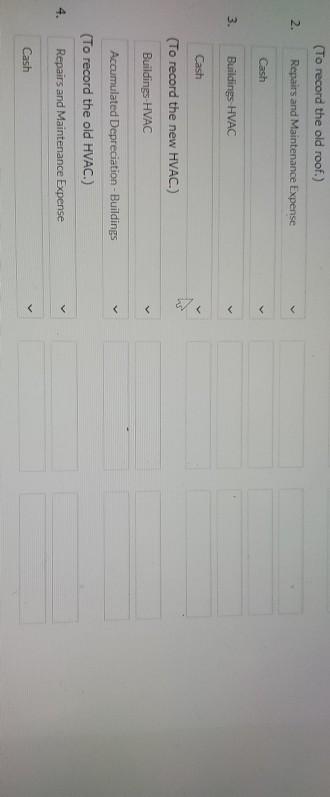

Current Attempt in Progress On January 1, 2020, the accounting records of Bramble Lte included a debit balance of $ 10 million in the building account and of $8 million in the related accumulated depreciation account. The building was purchased in January 1980 for $10 million, and was estimated to have a 50-year useful life with no residual value. Bramble uses the straight line depreciation method for all of its property, plant, and equipment. During 2020, the following expenditures relating to the building were made: 1. 2. 3. The original roof of the building was removed and replaced with a new roof. The old roof cost $1 million. The new roof cost $2.50 million and is expected to have a 15-year useful life. The ongoing frequent repairs on the building during the year cost $69,000. The building's old heating system was replaced with a new one. The new HVAC cost $728.000 and is estimated to have a seven year useful life and no residual value. The cost of the old HVAC is unknown, but is estimated to be $200,000 and fully depreciated A natural gas explosion caused $52,000 of uninsured damage to the building. This major repair did not change the estimated useful life of the building or its residual value. 4. Prepare the journal entries to record the expenditures related to the building during 2020. Assume all transactions are paid in cash. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Debit Credit No. Account Titles and Explanation 1. Buildings-Roof Cash Loss on Disposal of Buildings (To record the old roof.) Repairs and Maintenance Expense 2. Cash (To record the old roof.) Repairs and Maintenance Expense 2. > Cash > 3. Buildings HVAC Accumulated Depreciation - Buildings (To record the old HVAC.) Repairs and Maintenance Expense > 4.Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started