Can you prepare a identity statement for this firm and write 3 sentamces tgat explain the onservations regarding the firms use of cash.

prepare an identity statment. thank you

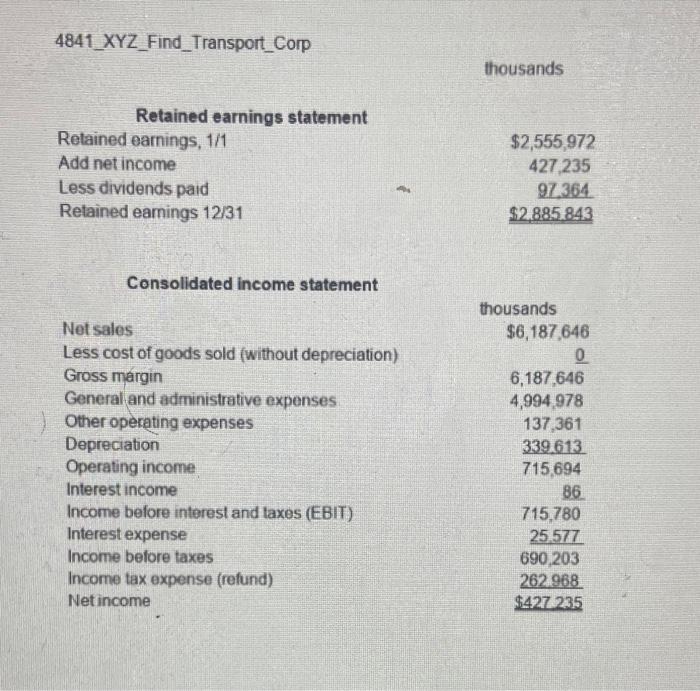

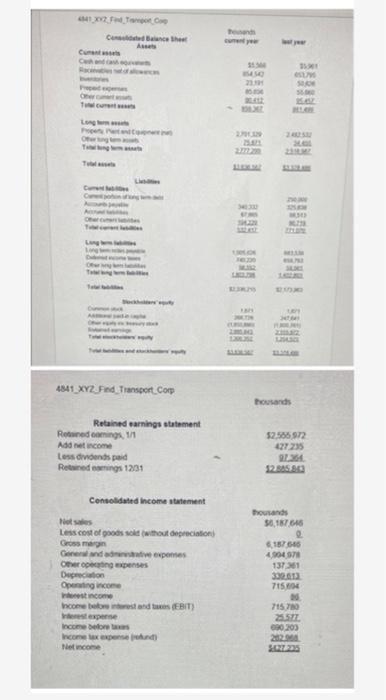

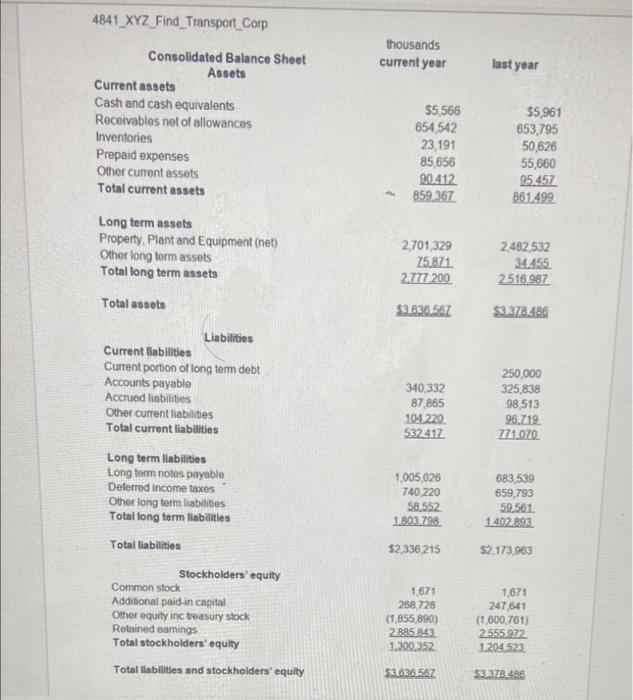

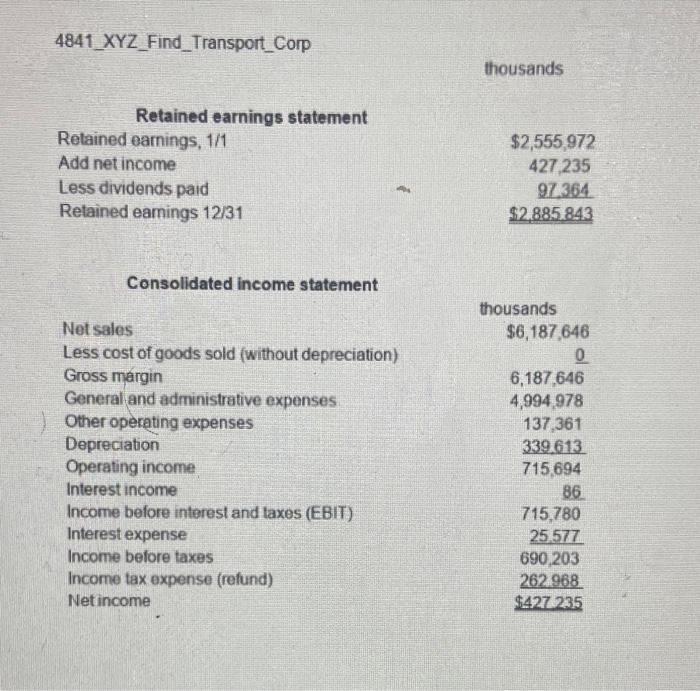

4841_XYZ_Find_Transport_Corp thousands Retained earnings statement Retained earnings, 1/1 Add net income Less dividends paid Retained earnings 12/31 $2,555,972 427 235 97 364 $2.885.843 Consolidated income statement Net sales Less cost of goods sold (without depreciation) Gross margin General and administrative expenses Other operating expenses Depreciation Operating income Interest income Income before interest and taxes (EBIT) Interest expense Income before taxes Income tax expense (refund) Net income thousands $6,187,646 0 6,187.646 4,994.978 137 361 339.613 715 694 86 715,780 25.577. 690,203 262.968 $427235 Credence that A . HE Oy 4841_XYZ Fed Transport Corp housands Retained varnings statement Recoming 1/1 Add net income Less dividend paid Reted comings 1291 52566972 127 235 9234 12345. Consolidated Income statement es Less cost of goods sold without depreciation Grossman Generative expenses Othering expenses Duction Operating income income Income before and me (EBIT) thousands 50.167.646 618766 4904978 13731 330.013 71504 Income before Income tax expense rund encore 715 70 257 090203 2020 SR 4841_XYZ Find Transport Corp thousands current year last year Consolidated Balance Sheet Assets Current assets Cash and cash equivalents Receivables net of allowances Inventories Prepaid expenses Other current assets Total current assets $5,566 654 542 23,191 85,656 90.412 859 367 $5,961 653,795 50,626 55,860 95457 861,499 Long term assets Property. Plant and Equipment (net) Other long term assets Total long term assets 2,701,329 75.871 2777 200 2,482,532 34.455 2 516.987 Total assets $3,638.507 $32782486 Liabilities Current liabilities Current portion of long term debt Accounts payable Accrued liabilities Other current liabilities Total current liabilities 340 332 87 865 104.220 532417 250,000 325,838 98,513 96.719 771.070 1,005 026 740 220 58.552 1803.798 683,539 659,793 59.561 1402.893 $2,336 215 $2.173,963 Long term liabilities Long term notes payable Deferred income taxes Other long term liabilities Total long term liabilities Total liabilities Stockholders' equity Common stock Additional paid in capital Other equity inc treasury stock Retnined comings Total stockholders' equity Total liabilities and stockholders' equity 1,671 268 728 (1.855,890) 2885 843 1.300.352 1,871 247 641 (1.600,761) 2555972 1.204.523 $3.636.567 $32782486 4841_XYZ_Find_Transport_Corp thousands Retained earnings statement Retained earnings, 1/1 Add net income Less dividends paid Retained earnings 12/31 $2,555,972 427 235 97 364 $2.885.843 Consolidated income statement Net sales Less cost of goods sold (without depreciation) Gross margin General and administrative expenses Other operating expenses Depreciation Operating income Interest income Income before interest and taxes (EBIT) Interest expense Income before taxes Income tax expense (refund) Net income thousands $6,187,646 0 6,187.646 4,994.978 137 361 339.613 715 694 86 715,780 25.577. 690,203 262.968 $427235