Can you provide equations for the budgeted selling price per unit in the first problem? Thanks!

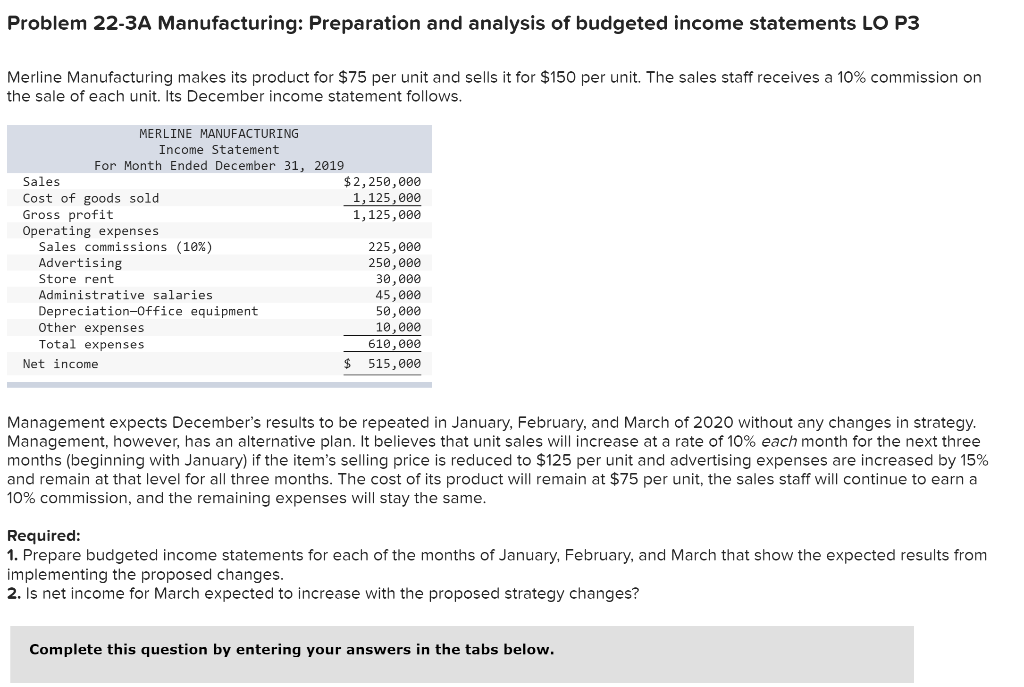

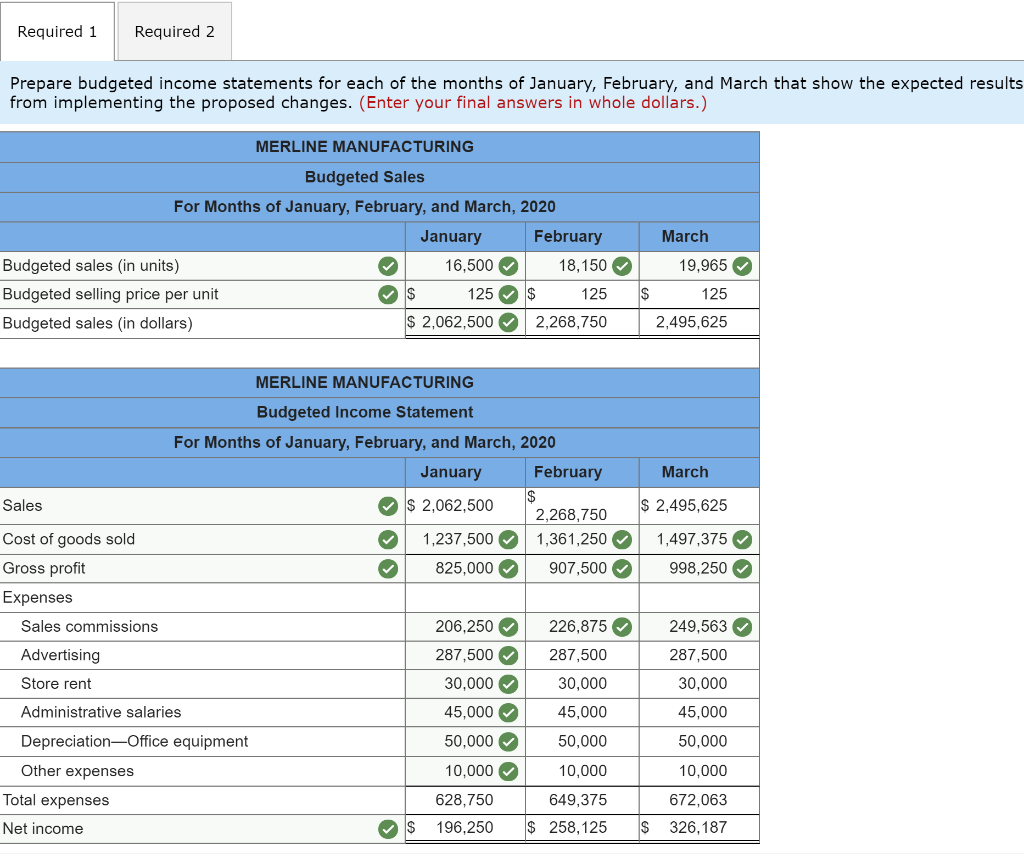

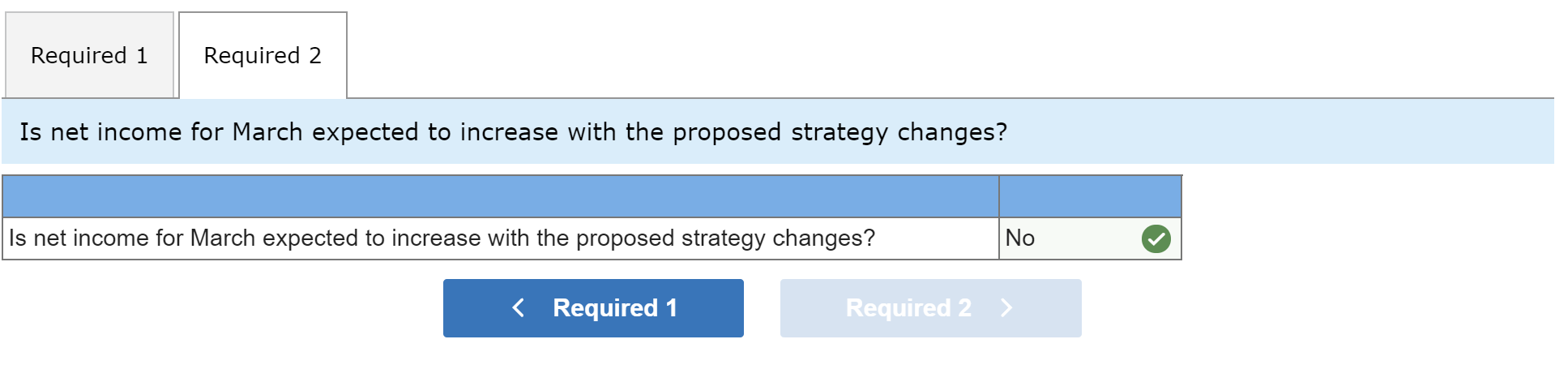

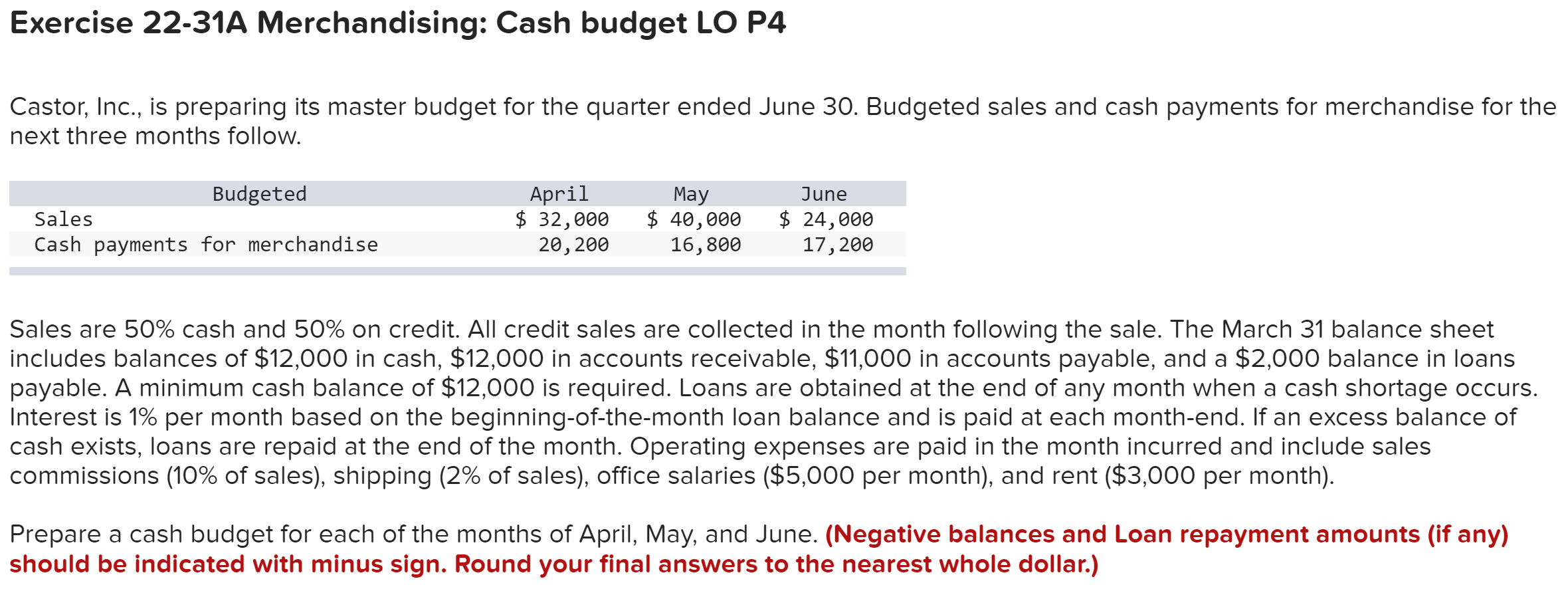

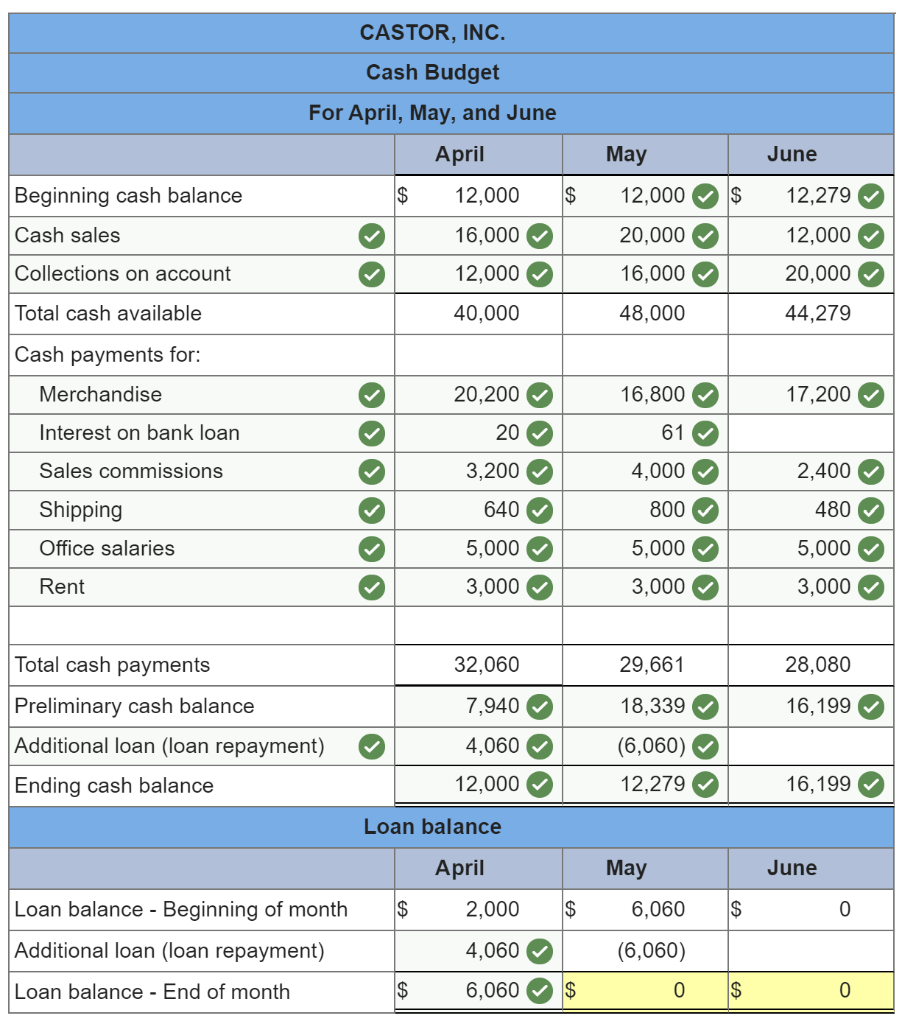

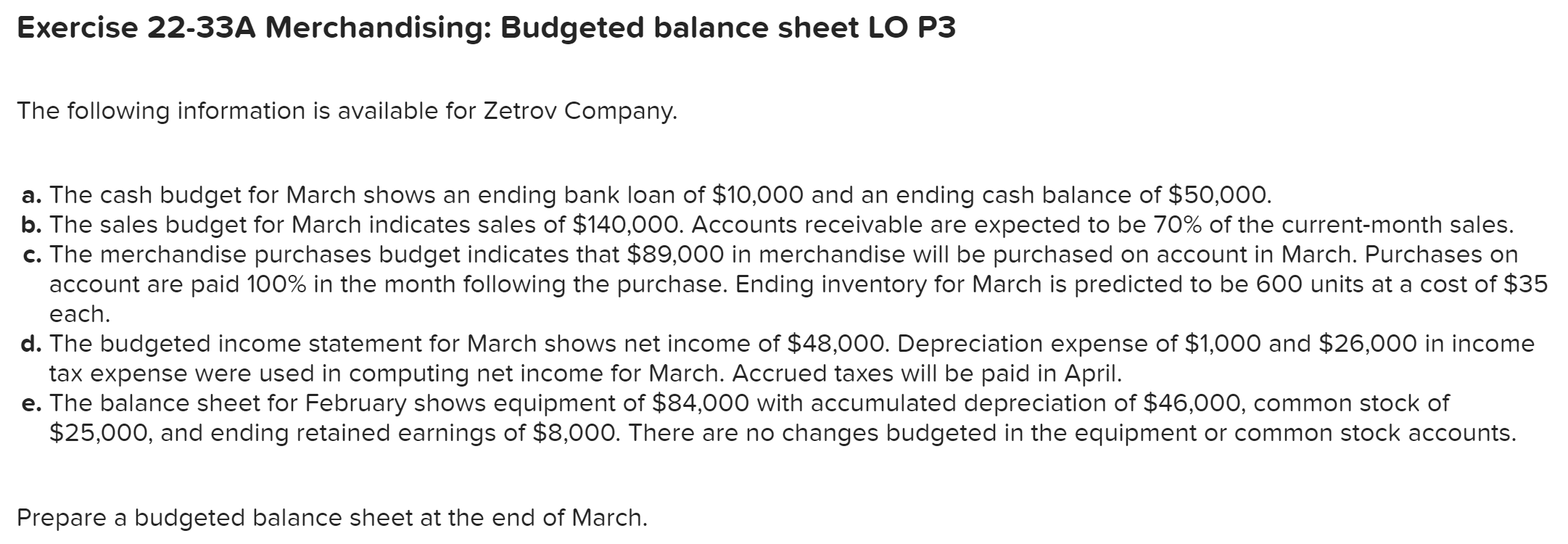

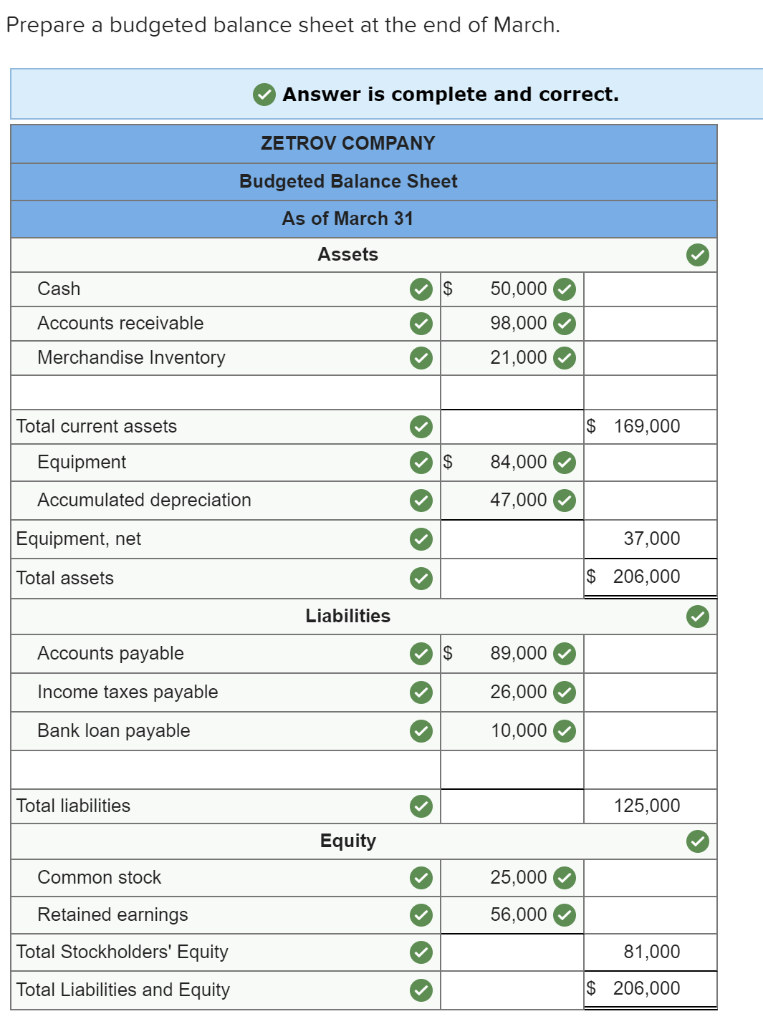

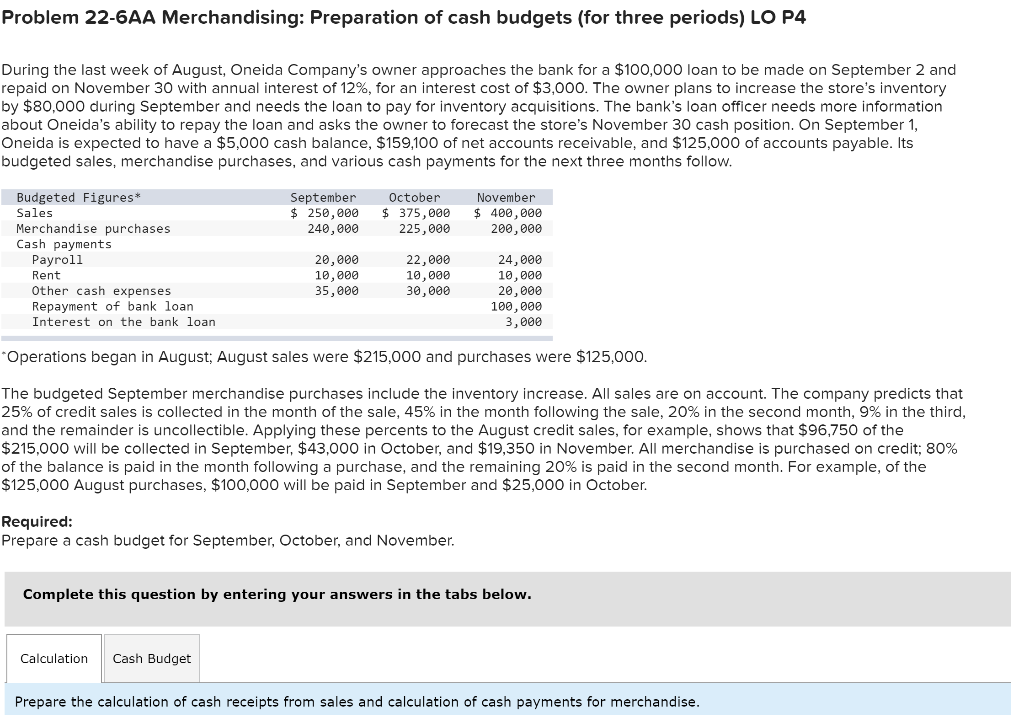

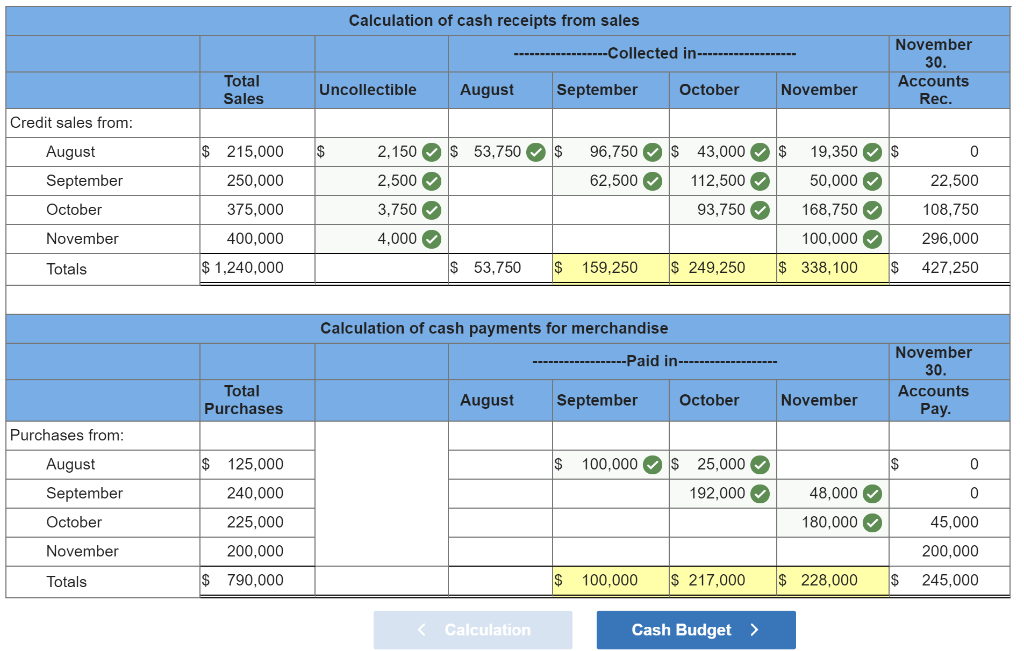

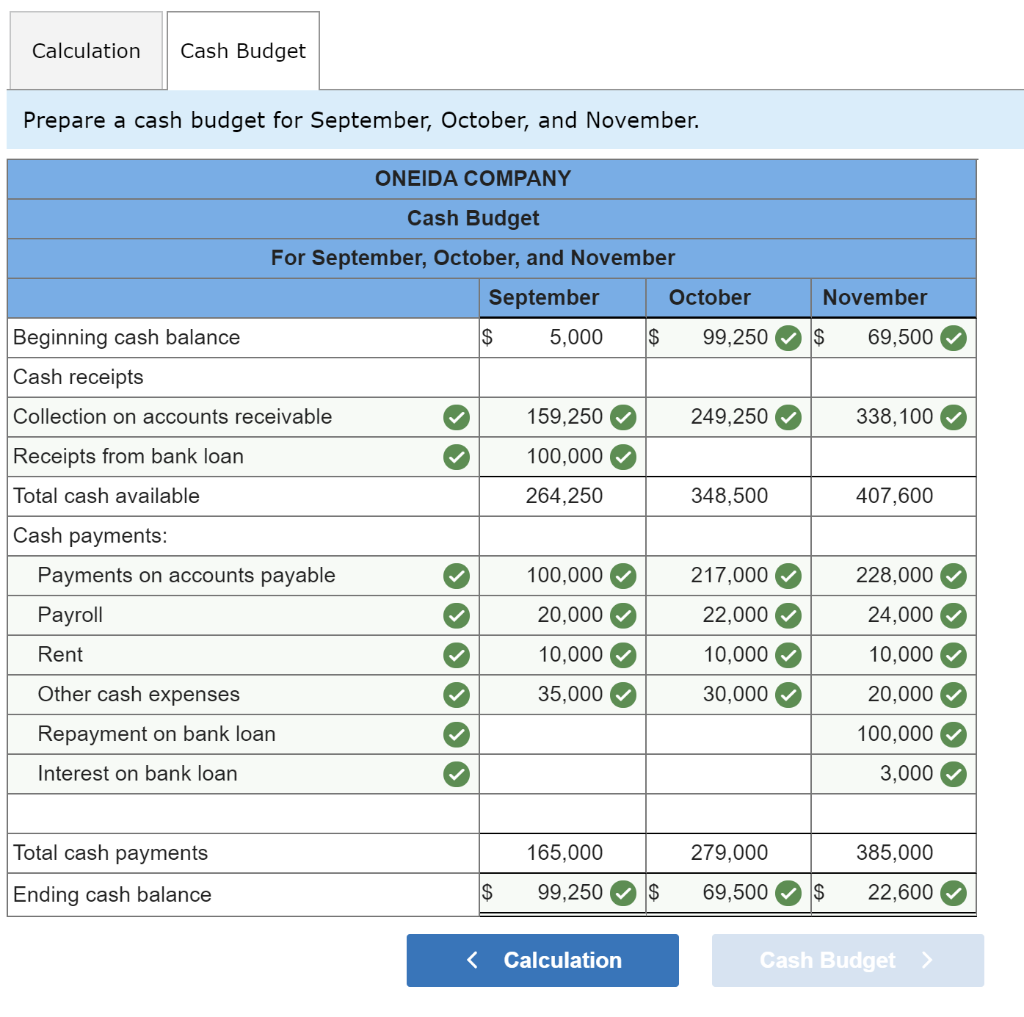

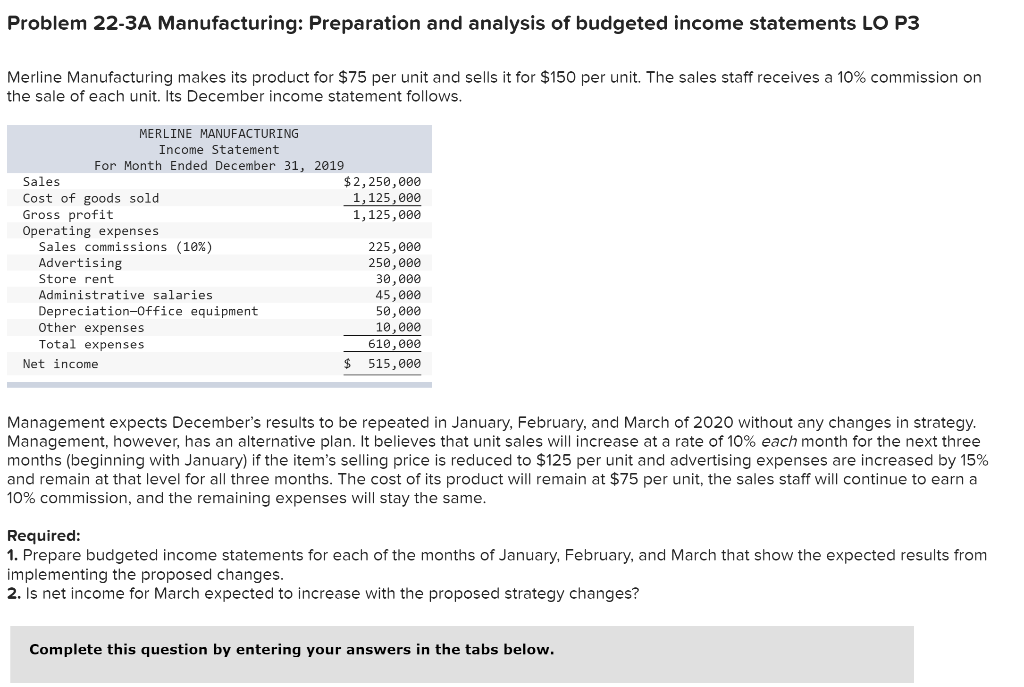

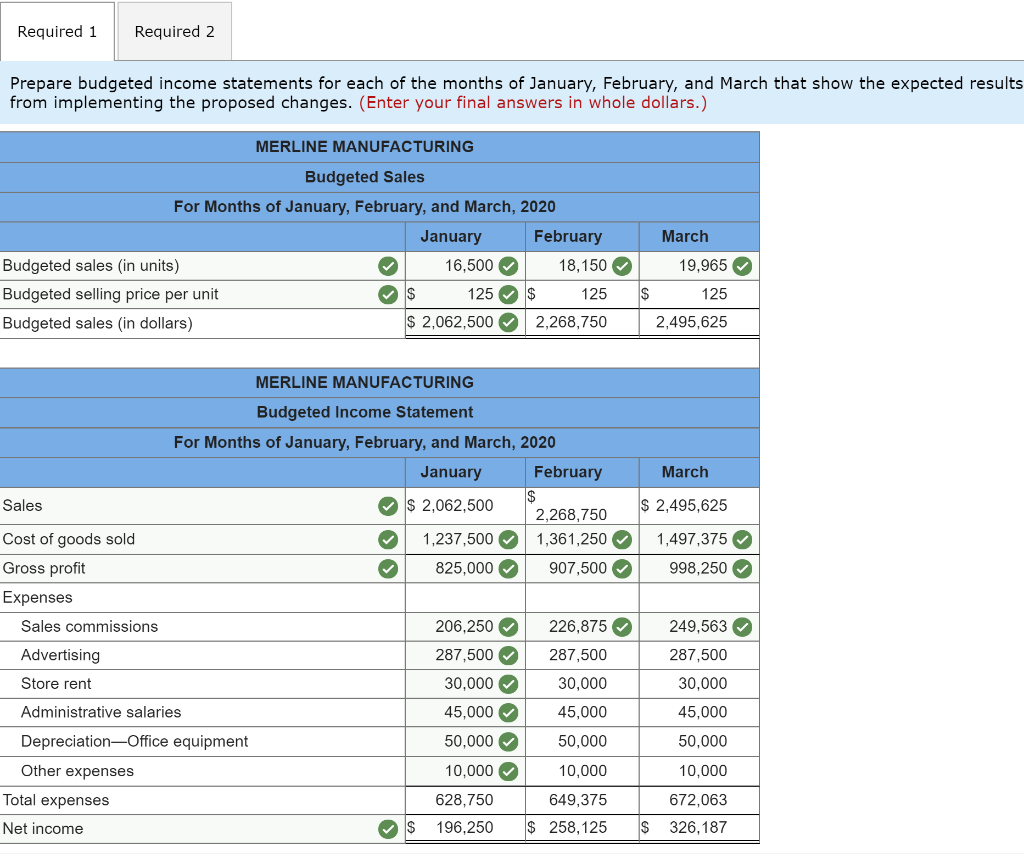

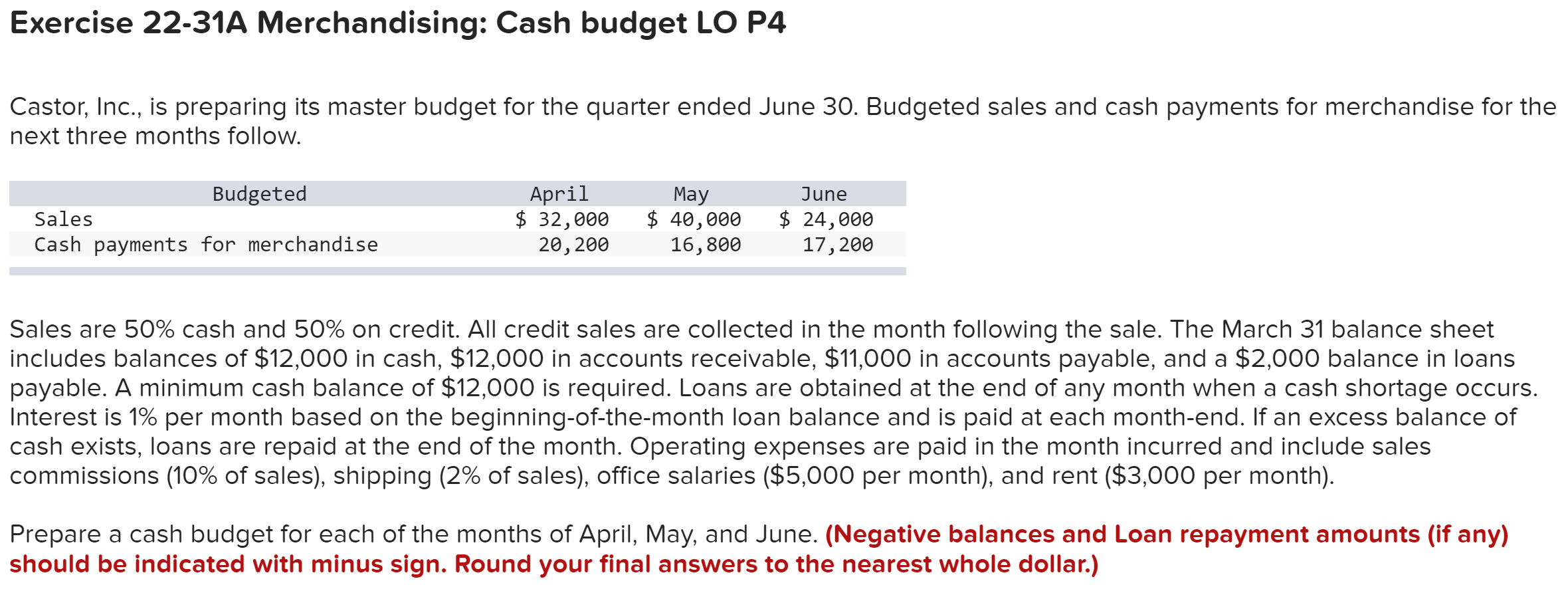

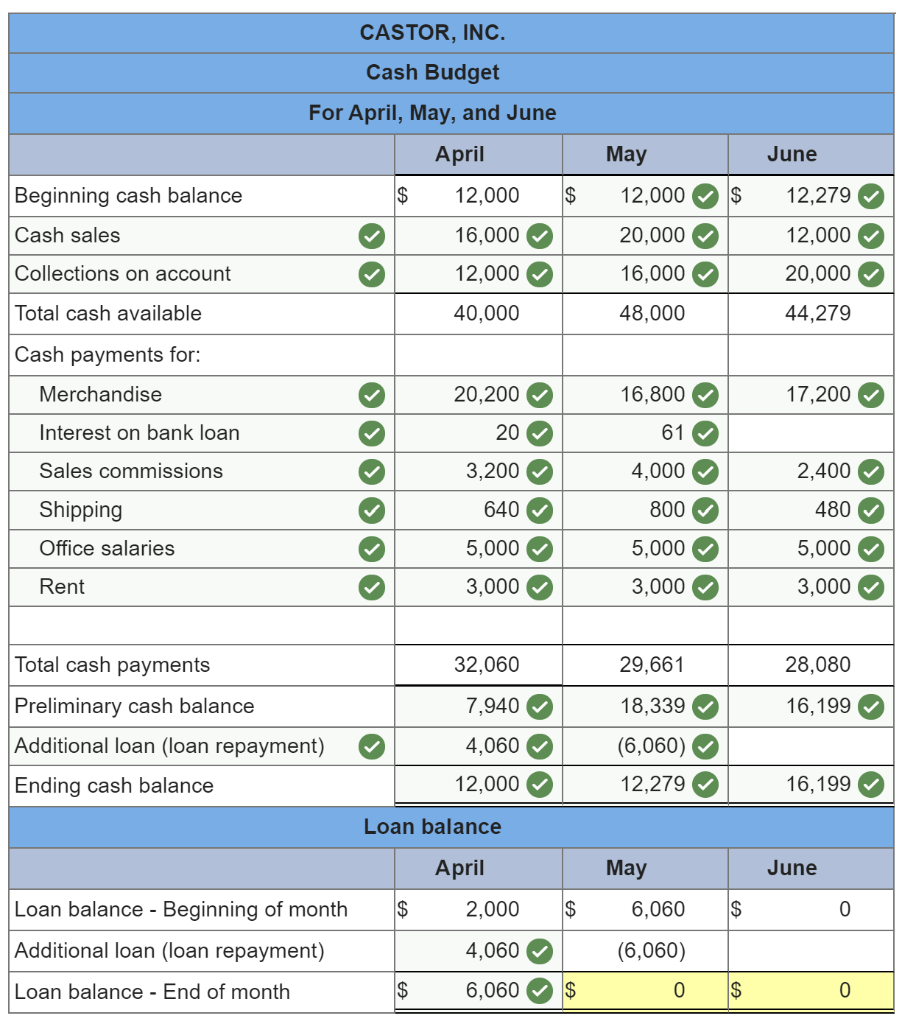

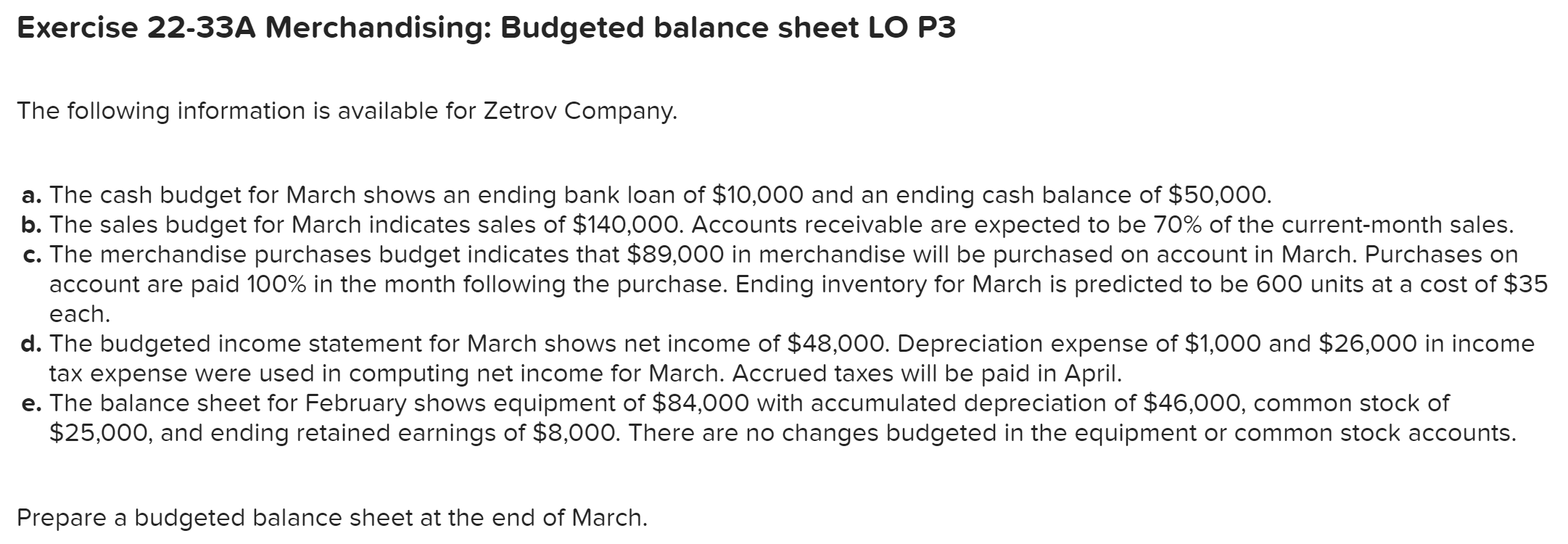

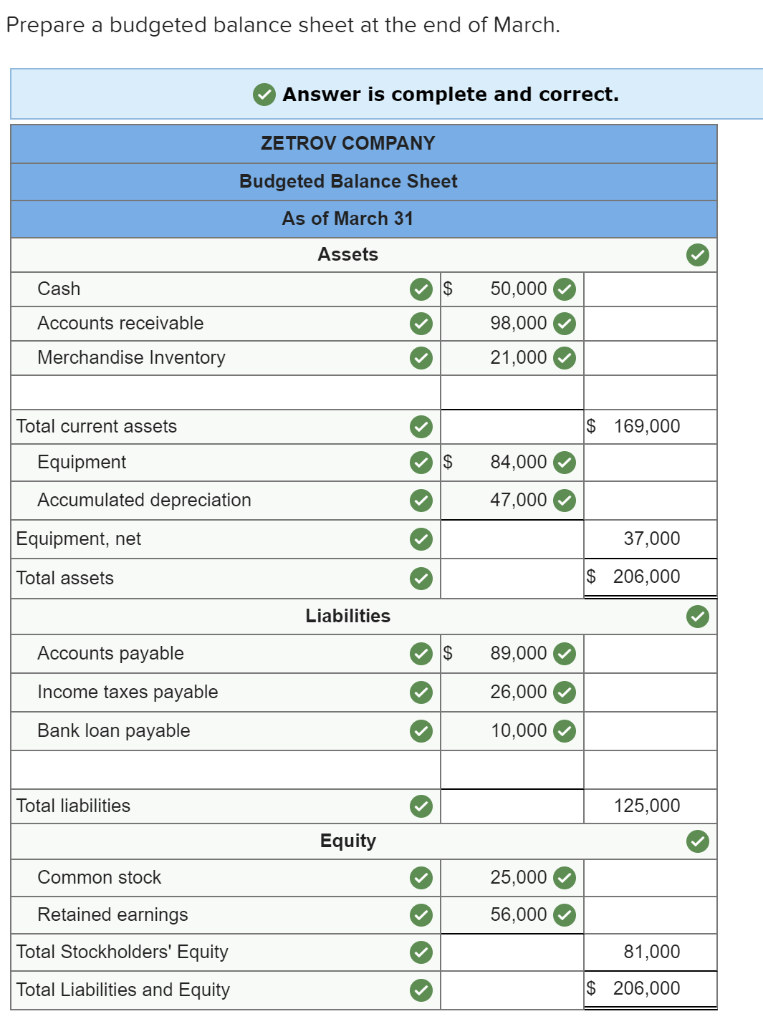

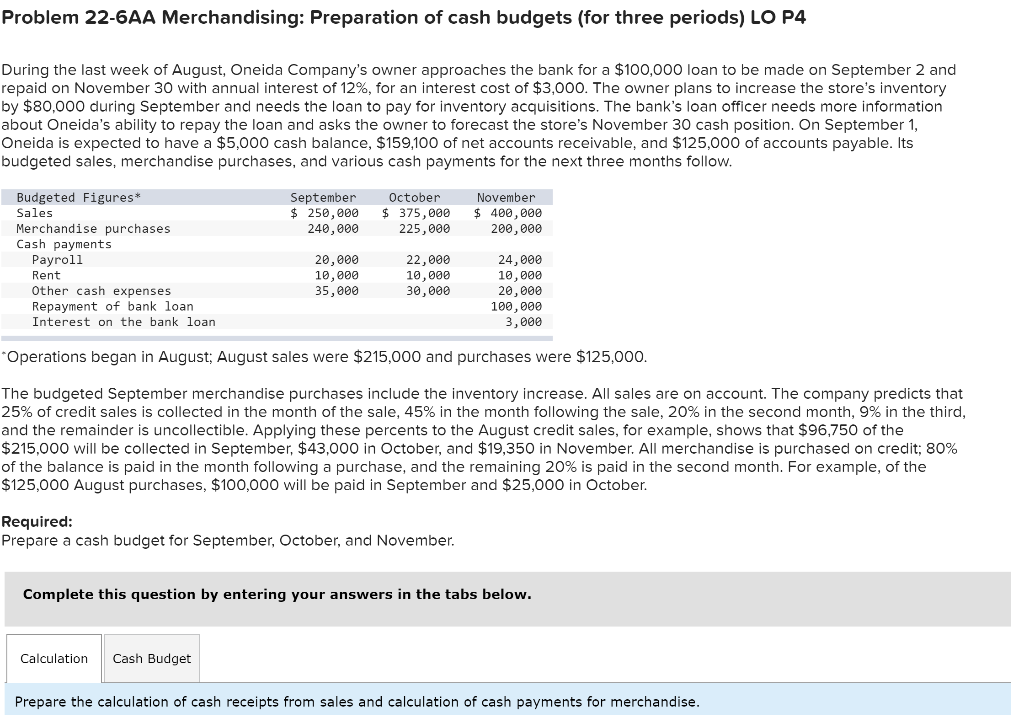

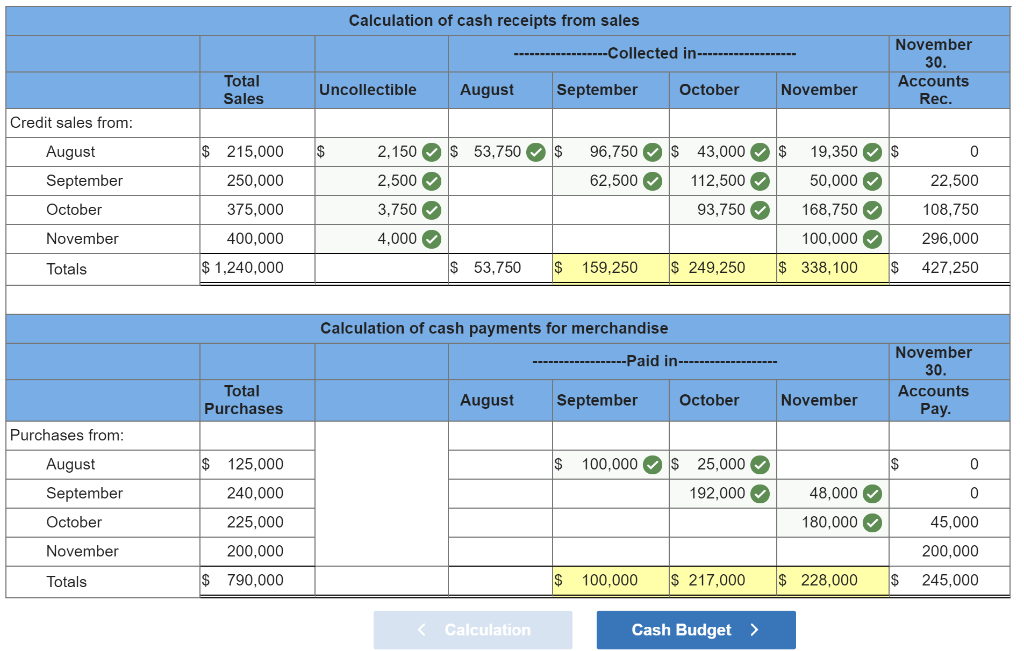

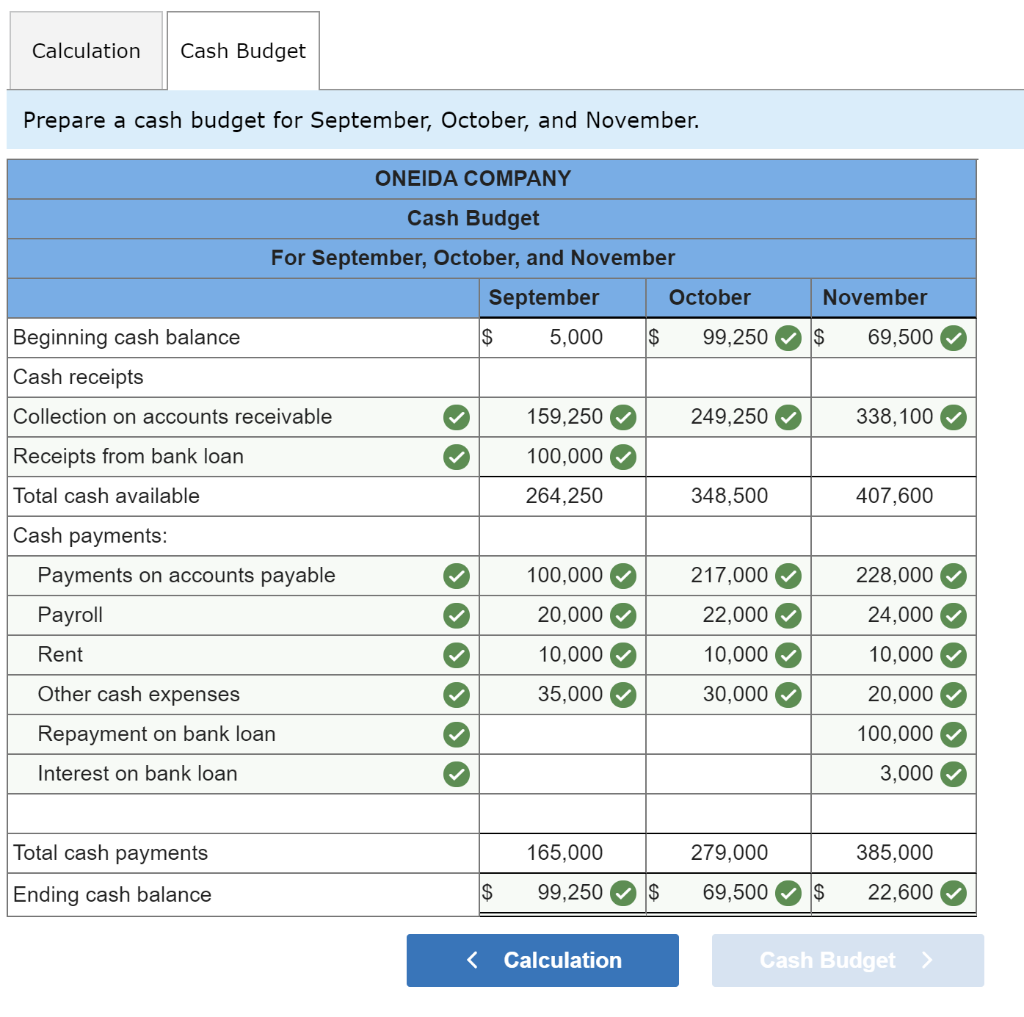

Problem 22-3A Manufacturing: Preparation and analysis of budgeted income statements LO P3 Merline Manufacturing makes its product for $75 per unit and sells it for $150 per unit. The sales staff receives a 10% commission on the sale of each unit. Its December income statement follows. oss profit MERLINE MANUFACTURING Income Statement For Month Ended December 31, 2019 Sales $2,250,000 Cost of goods sold 1,125,000 Gross 1,125,000 Operating expenses Sales commissions (10%) 225,000 250,000 Store rent 30,000 Administrative salaries 45,000 Depreciation-office equipment Other expenses 10,000 Total expenses 610,000 Net income $ 515,000 Advertising 50,000 Management expects December's results to be repeated in January, February, and March of 2020 without any changes in strategy. Management, however, has an alternative plan. It believes that unit sales will increase at a rate of 10% each month for the next three months (beginning with January) if the item's selling price is reduced to $125 per unit and advertising expenses are increased by 15% and remain at that level for all three months. The cost of its product will remain at $75 per unit, the sales staff will continue to earn a 10% commission, and the remaining expenses will stay the same. Required: 1. Prepare budgeted income statements for each of the months of January, February, and March that show the expected results from implementing the proposed changes. 2. Is net income for March expected to increase with the proposed strategy changes? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare budgeted income statements for each of the months of January, February, and March that show the expected results from implementing the proposed changes. (Enter your final answers in whole dollars.) MERLINE MANUFACTURING March Budgeted Sales For Months of January, February, and March, 2020 January February Budgeted sales (in units) 16,500 18,150 Budgeted selling price per unit $ 125 $ 125 Budgeted sales (in dollars) $ 2,062,500 2,268,750 19,965 $ 125 2,495,625 MERLINE MANUFACTURING Budgeted Income Statement For Months of January, February, and March, 2020 January February March Sales $ 2,062,500 $ 2,495,625 2,268,750 1,361,250 1,497,375 1,237,500 825,000 907,500 998,250 206,250 226,875 249,563 Cost of goods sold Gross profit Expenses Sales commissions Advertising Store rent Administrative salaries Depreciation Office equipment 287,500 287,500 287,500 30,000 30,000 30,000 45,000 45,000 45,000 50,000 50,000 50,000 10,000 10,000 10,000 Other expenses Total expenses Net income 628,750 196,250 649,375 $ 258,125 672,063 $ 326,187 Required 1 Required 2 Is net income for March expected to increase with the proposed strategy changes? Is net income for March expected to increase with the proposed strategy changes? No Exercise 22-31A Merchandising: Cash budget LO P4 Castor, Inc., is preparing its master budget for the quarter ended June 30. Budgeted sales and cash payments for merchandise for the next three months follow. Budgeted Sales Cash payments for merchandise April $ 32,000 20,200 May $ 40,000 16,800 June $ 24,000 17, 200 Sales are 50% cash and 50% on credit. All credit sales are collected in the month following the sale. The March 31 balance sheet includes balances of $12,000 in cash, $12,000 in accounts receivable, $11,000 in accounts payable, and a $2,000 balance in loans payable. A minimum cash balance of $12,000 is required. Loans are obtained at the end of any month when a cash shortage occurs. Interest is 1% per month based on the beginning-of-the-month loan balance and is paid at each month-end. If an excess balance of cash exists, loans are repaid at the end of the month. Operating expenses are paid in the month incurred and include sales commissions (10% of sales), shipping (2% of sales), office salaries ($5,000 per month), and rent ($3,000 per month). Prepare a cash budget for each of the months of April, May, and June. (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign. Round your final answers to the nearest whole dollar.) CASTOR, INC. Cash Budget For April, May, and June April May June Beginning cash balance $ 12,000 $ 12,000 $ 12,279 Cash sales 16,000 20,000 12,000 20,000 Collections on account 12,000 16,000 Total cash available 40,000 48,000 44,279 Cash payments for: Merchandise 20,200 16,800 > 17,200 > Interest on bank loan 20 61 Sales commissions > 3,200 4,000 2,400 640 800 480 Shipping Office salaries 5,000 5,000 5,000 Rent 3,000 3,000 3,000 Total cash payments 32,060 29.661 28,080 Preliminary cash balance 7,940 18,339 16,199 Additional loan (loan repayment) 4,060 (6,060) Ending cash balance 12,000 12,279 16,199 Loan balance April May June Loan balance - Beginning of month $ 2,000 $ 6,060 $ 0 Additional loan (loan repayment) 4,060 (6,060) Loan balance - End of month $ 6,060 $ 0 $ 0 Exercise 22-33A Merchandising: Budgeted balance sheet LO P3 The following information is available for Zetrov Company. a. The cash budget for March shows an ending bank loan of $10,000 and an ending cash balance of $50,000. b. The sales budget for March indicates sales of $140,000. Accounts receivable are expected to be 70% of the current-month sales. c. The merchandise purchases budget indicates that $89,000 in merchandise will be purchased on account in March. Purchases on account are paid 100% in the month following the purchase. Ending inventory for March is predicted to be 600 units at a cost of $35 each. d. The budgeted income statement for March shows net income of $48,000. Depreciation expense of $1,000 and $26,000 in income tax expense were used in computing net income for March. Accrued taxes will be paid in April. e. The balance sheet for February shows equipment of $84,000 with accumulated depreciation of $46,000, common stock of $25,000, and ending retained earnings of $8,000. There are no changes budgeted in the equipment or common stock accounts. Prepare a budgeted balance sheet at the end of March. Prepare a budgeted balance sheet at the end of March. Answer is complete and correct. ZETROV COMPANY Budgeted Balance Sheet As of March 31 Assets Cash $ 50,000 Accounts receivable 98,000 Merchandise Inventory 21,000 Total current assets $ 169,000 >> $ 84,000 Equipment Accumulated depreciation 47,000 Equipment, net 37,000 Total assets $ 206,000 Liabilities Accounts payable $ 89,000 Income taxes payable 26,000 Bank loan payable 10,000 Total liabilities > 125,000 Equity Common stock 3 25,000 56,000 Retained earnings Total Stockholders' Equity Total Liabilities and Equity 81,000 $ 206,000 Problem 22-6AA Merchandising: Preparation of cash budgets (for three periods) LO P4 During the last week of August, Oneida Company's owner approaches the bank for a $100,000 loan to be made on September 2 and repaid on November 30 with annual interest of 12%, for an interest cost of $3,000. The owner plans to increase the store's inventory by $80,000 during September and needs the loan to pay for inventory acquisitions. The bank's loan officer needs more information about Oneida's ability to repay the loan and asks the owner to forecast the store's November 30 cash position. On September 1, Oneida is expected to have a $5,000 cash balance, $159,100 of net accounts receivable, and $125,000 of accounts payable. Its budgeted sales, merchandise purchases, and various cash payments for the next three months follow. September $ 250,000 240,000 October $ 375,000 225,000 November $ 400,000 200,000 Budgeted Figures* Sales Merchandise purchases Cash payments Payroll Rent Other cash expenses Repayment of bank loan Interest on the bank loan 20,000 10,000 35,000 22,000 10,000 30,000 24,000 10,000 20,000 100,000 3,000 *Operations began in August; August sales were $215,000 and purchases were $125,000. The budgeted September merchandise purchases include the inventory increase. All sales are on account. The company predicts that 25% of credit sales is collected in the month of the sale, 45% in the month following the sale, 20% in the second month, 9% in the third, and the remainder is uncollectible. Applying these percents to the August credit sales, for example, shows that $96,750 of the $215,000 will be collected in September, $43,000 in October, and $19,350 in November. All merchandise is purchased on credit; 80% of the balance is paid in the month following a purchase, and the remaining 20% is paid in the second month. For example, of the $125,000 August purchases, $100,000 will be paid in September and $25,000 in October Required: Prepare a cash budget for September, October, and November. Complete this question by entering your answers in the tabs below. Calculation Cash Budget Prepare the calculation of cash receipts from sales and calculation of cash payments for merchandise. Calculation of cash receipts from sales ----Collected in------ November 30. Accounts Rec. Total Sales Uncollectible August September October November $ 215,000 $ 2,150 $ 53,750 $ 96.750 IS 43,000 $ 19,350 $ 0 Credit sales from: August September October 2,500 62,500 112,500 50,000 22,500 250,000 375,000 93,750 168,750 3,750 4,000 108,750 296,000 November 400,000 100,000 Totals $ 1,240,000 $ 53,750 $ 159,250 $ 249,250 $ 338,100 427,250 Calculation of cash payments for merchandise ---Paid in November 30. Accounts Pay. Total Purchases August September October November Purchases from: $ 125,000 $ 100,000 $ 25,000 $ 0 August September 240,000 192,000 48,000 0 October 225,000 180,000 45,000 November 200,000 200,000 Totals $ 790,000 $ 100,000 $ 217,000 $ 228,000 $ 245,000 Calculation Cash Budget Prepare a cash budget for September, October, and November. ONEIDA COMPANY Cash Budget For September, October, and November September October $ 5,000 $ 99,250 November Beginning cash balance $ 69,500 Cash receipts 249,250 338,100 Collection on accounts receivable Receipts from bank loan 159,250 100,000 Total cash available 264,250 348,500 407,600 Cash payments: Payments on accounts payable 100,000 217,000 228,000 Payroll 20,000 22,000 24,000 Rent 10,000 10,000 10,000 Other cash expenses 35,000 30,000 20,000 Repayment on bank loan 100,000 Interest on bank loan 3,000 Total cash payments 165,000 279,000 385,000 Ending cash balance $ 99,250 $ 69,500 $ 22,600