Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you provide step by step calculations HISO2 Finalment 1121221)- p Search (Alt+C Draw Design Layout aferences Mailings Review View Help IU 14 A A

can you provide step by step calculations

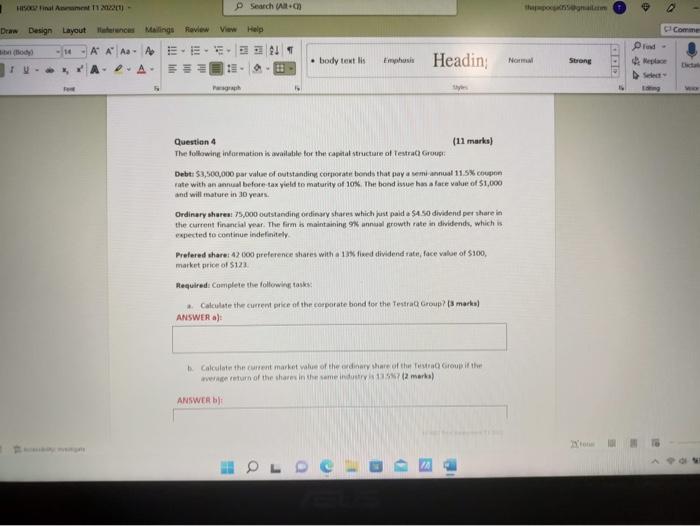

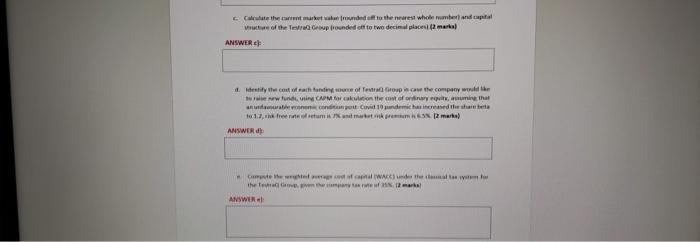

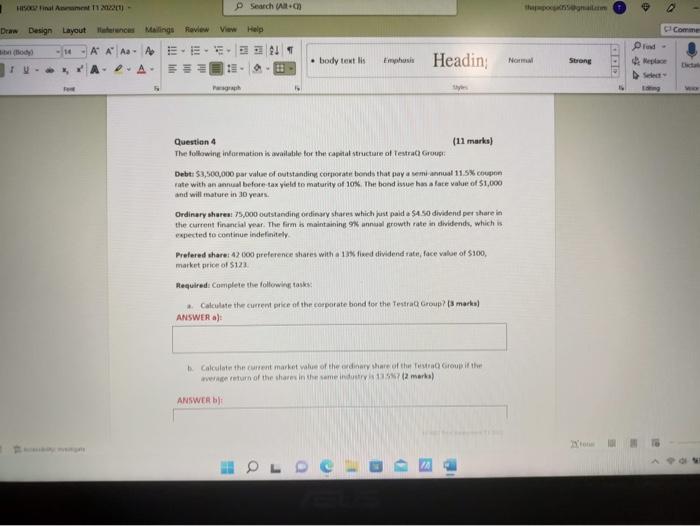

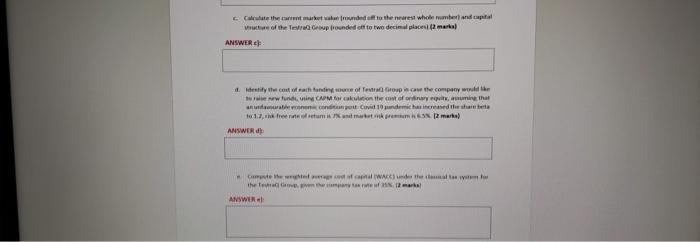

HISO2 Finalment 1121221)- p Search (Alt+C Draw Design Layout aferences Mailings Review View Help IU 14 A A A A E ENT A A Paraph body text lis Emphasis Headin Question 4 The following information is available for the capital structure of Testra Group: styles (11 marks) Debt: $3,500,000 par value of outstanding corporate bonds that pay a semi-annual 11.5% coupon rate with an annual before-tax yield to maturity of 10%. The bond issue has a face value of $1,000 and will mature in 30 years. OL De D Ordinary shares: 75,000 outstanding ordinary shares which just paid a $4.50 dividend per share in the current financial year. The firm is maintaining 9% annual growth rate in dividends, which is expected to continue indefinitely Prefered share: 42 000 preference shares with a 13% fixed dividend rate, face value of $100, market price of $123 Required: Complete the following tasks: a. Calculate the current price of the corporate bond for the Testra Group? (3 marks) ANSWER a): b. Calculate the current market value of the ordinary share of the TestraQ Group if the average return of the shares in the same industry is 13.5%67 (2 marks) ANSWER b): hapapoca@gmail.com Normal Strong to H 4 Prind HE Select- Edking > a Comme Dicta Calculate the current market vakan (rounded off to the nearest whole mamber) and capital ructure of the TestraQ Group (rounded off to two decimal places) (2 marks) ANSWER d. dentify the cost of each funding some of Testra Group in case the company would like to raise new funds, using CAPM for calculation the cost of ordinary equity, auming that anundamurable economic condition post Covid 10 pandemic has increased the share beta to 1.7, free rate of return is 7% and market ik premium 63% [2 marks) ANSWER Compute the sghted average cod of capital (WACC) under the classical tas system for the testrap, given the company tax rate of 25% (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started