Can you put common size in percentage form

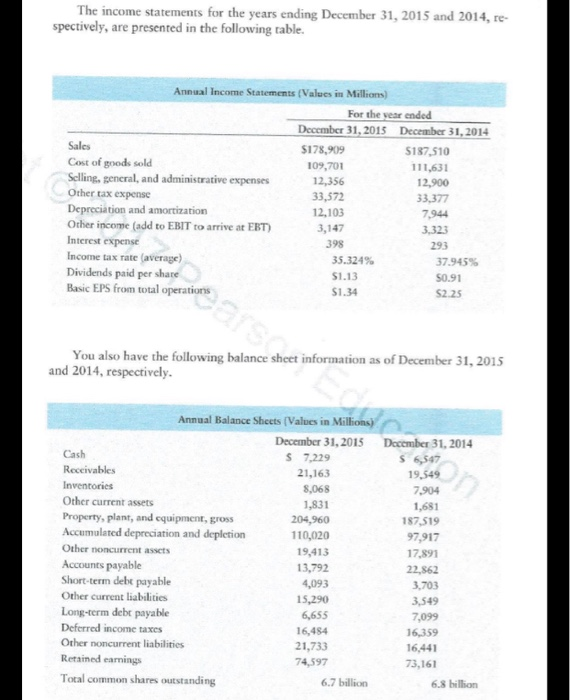

b. Create a spreadsheet similar to Table 3.2 to model the following: (1) A detailed, comparative balance sheet for Dayton, Inc., for the years ended December 31, 2015 and 2014. (2) A common-size balance sheet for Dayton, Inc., covering the years 2015 and 2014. The income statements for the years ending December 31, 2015 and 2014, re- spectively, are presented in the following table. Annual Income Statements (Values in Millions) For the year ended December 31, 2015 December 31, 2014 Sales $178,909 S187,510 Cost of goods sold 109,701 111,631 Selling general, and administrative expenses 12,356 12,900 Other tax expense 33,572 33,377 Depreciation and amortization 12,103 7,944 Other income (add to EBIT to arrive at EBT) 3,147 3,323 Interest expense 398 Income tax rate (average) 35.324% 37.945% Dividends paid per share $1.13 $0.91 Basic EPS from total operations $1.34 S2.25 293 You also have the following balance sheet information as of December 31, 2015 and 2014, respectively. Annual Balance Sheets (Values in Millions) December 31, 2015 Cash $ 7,229 Receivables 21,163 Inventories 8,068 Other current assets 1,831 Property, plant, and equipment, gross 204,960 Accumulated depreciation and depletion 110,020 Other noncurrent assets 19,413 Accounts payable 13,792 Short-term debt payable 4,093 Other current liabilities 15,290 Long-term debe payable 6,655 Deferred income taxes 16,484 Other noncurrent liabilities 21,733 Retained earnings 74,597 Tocal common shares outstanding 6.7 billion December 31, 2014 $ 6,547 19,549 7,904 1,681 187,519 97,917 17,891 22,862 3,703 3,549 7,099 16,359 16,441 73,161 6.8 billion b. Create a spreadsheet similar to Table 3.2 to model the following: (1) A detailed, comparative balance sheet for Dayton, Inc., for the years ended December 31, 2015 and 2014. (2) A common-size balance sheet for Dayton, Inc., covering the years 2015 and 2014. The income statements for the years ending December 31, 2015 and 2014, re- spectively, are presented in the following table. Annual Income Statements (Values in Millions) For the year ended December 31, 2015 December 31, 2014 Sales $178,909 S187,510 Cost of goods sold 109,701 111,631 Selling general, and administrative expenses 12,356 12,900 Other tax expense 33,572 33,377 Depreciation and amortization 12,103 7,944 Other income (add to EBIT to arrive at EBT) 3,147 3,323 Interest expense 398 Income tax rate (average) 35.324% 37.945% Dividends paid per share $1.13 $0.91 Basic EPS from total operations $1.34 S2.25 293 You also have the following balance sheet information as of December 31, 2015 and 2014, respectively. Annual Balance Sheets (Values in Millions) December 31, 2015 Cash $ 7,229 Receivables 21,163 Inventories 8,068 Other current assets 1,831 Property, plant, and equipment, gross 204,960 Accumulated depreciation and depletion 110,020 Other noncurrent assets 19,413 Accounts payable 13,792 Short-term debt payable 4,093 Other current liabilities 15,290 Long-term debe payable 6,655 Deferred income taxes 16,484 Other noncurrent liabilities 21,733 Retained earnings 74,597 Tocal common shares outstanding 6.7 billion December 31, 2014 $ 6,547 19,549 7,904 1,681 187,519 97,917 17,891 22,862 3,703 3,549 7,099 16,359 16,441 73,161 6.8 billion