Answered step by step

Verified Expert Solution

Question

1 Approved Answer

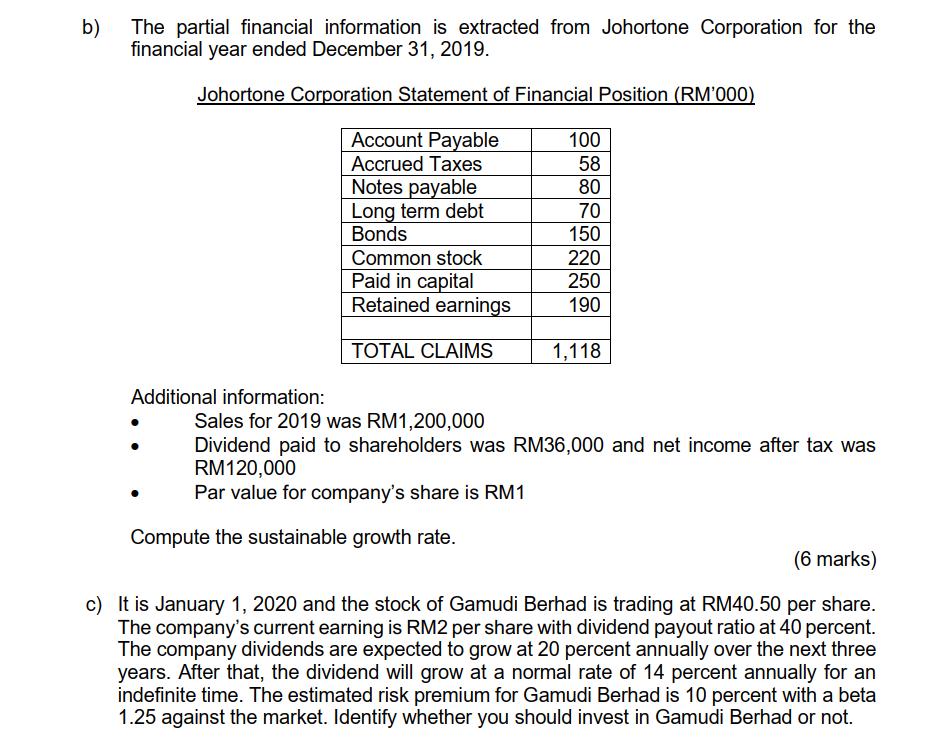

b) The partial financial information is extracted from Johortone Corporation for the financial year ended December 31, 2019. Johortone Corporation Statement of Financial Position

b) The partial financial information is extracted from Johortone Corporation for the financial year ended December 31, 2019. Johortone Corporation Statement of Financial Position (RM'000) Account Payable Accrued Taxes Additional information: Notes payable Long term debt Bonds Common stock Paid in capital Retained earnings TOTAL CLAIMS 100 58 80 Compute the sustainable growth rate. 70 150 220 250 190 1,118 Sales for 2019 was RM1,200,000 Dividend paid to shareholders was RM36,000 and net income after tax was RM120,000 Par value for company's share is RM1 (6 marks) c) It is January 1, 2020 and the stock of Gamudi Berhad is trading at RM40.50 per share. The company's current earning is RM2 per share with dividend payout ratio at 40 percent. The company dividends are expected to grow at 20 percent annually over the next three years. After that, the dividend will grow at a normal rate of 14 percent annually for an indefinite time. The estimated risk premium for Gamudi Berhad is 10 percent with a beta 1.25 against the market. Identify whether you should invest in Gamudi Berhad or not.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

b Sustainable Growth Rate of Johortone Corporation The sustainable growth rate SGR for Johortone Corporation can be calculated using the following for...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started