Answered step by step

Verified Expert Solution

Question

1 Approved Answer

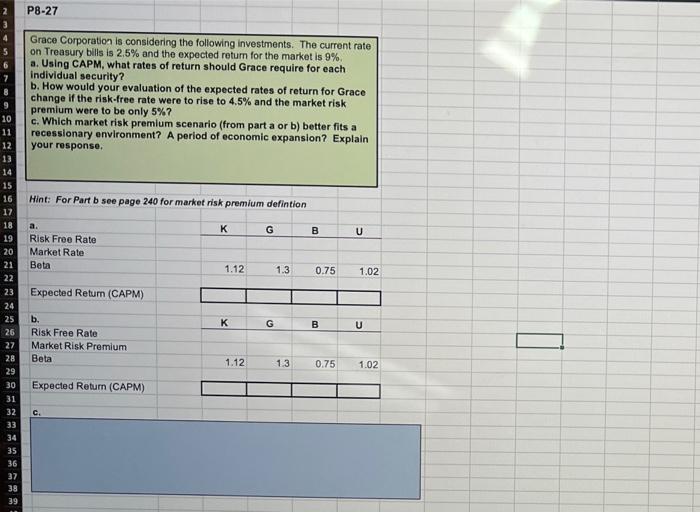

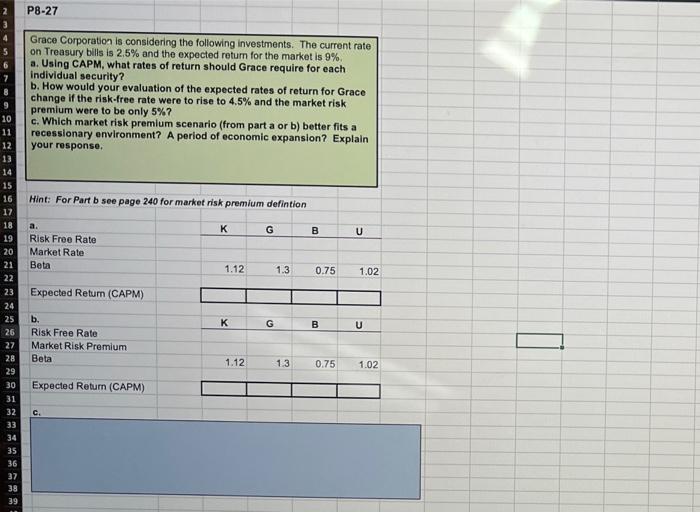

can you show me how to do this in excel, exaclty. new to this P8-27 Grace Corporation is considering the following investments. The current rate

can you show me how to do this in excel, exaclty. new to this

P8-27 Grace Corporation is considering the following investments. The current rate on Treasury bills is 2.5% and the expected return for the market is 9% a. Using CAPM, what rates of return should Grace require for each Individual security? b. How would your evaluation of the expected rates of return for Grace change if the risk-free rate were to rise to 4.5% and the market risk premium were to be only 5%? c. Which market risk premium scenario (from part a or b) better fits a recessionary environment? A period of economic expansion? Explain your response. Hint: For Part b see page 240 for market risk premium defintion 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 G OD B Risk Free Rate Market Rate Beta 1.12 1.3 0.75 1.02 Expected Return (CAPM) K G B U b. Risk Free Rate Market Risk Premium Beta 27 28 29 1.12 13 0.75 1.02 30 Expected Return (CAPM) C. 31 32 33 34 35 36 37 38 39

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started