Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you show step by step how to get to the answer Use the information for the following problem(s). risk arising from the sale. To

Can you show step by step how to get to the answer

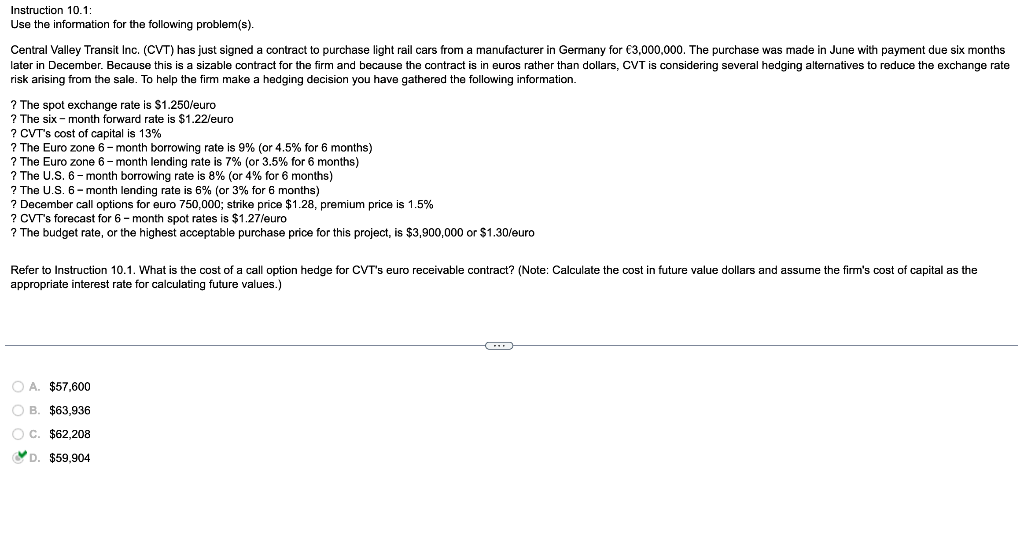

Use the information for the following problem(s). risk arising from the sale. To help the firm make a hedging decision you have gathered the following information. ? The spot exchange rate is $1.250/ euro ? The six - month forward rate is $1.22 leuro ? CVT's cost of capital is 13% ? The Euro zone 6 - month borrowing rate is 9% (or 4.5% for 6 months) ? The Euro zone 6 - month lending rate is 7% (or 3.5% for 6 months) ? The U.S. 6 - month borrowing rate is 8% (or 4% for 6 months) ? The U.S. 6- month lending rate is 6% (or 3% for 6 months) ? December call options for euro 750,000 ; strike price $1.28, premium price is 1.5% ? CVT's forecast for 6 - month spot rates is $1.27/ euro ? The budget rate, or the highest acceptable purchase price for this project, is $3,900,000 or $1,30/ euro appropriate interest rate for calculating future values.) A. $57,600 B. $63,936 C. $62,208 D. $59,904Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started