Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you show the answer using the buttons on a financial calculater? 11. (a) Assume that you want to buy a new car and your

Can you show the answer using the buttons on a financial calculater?

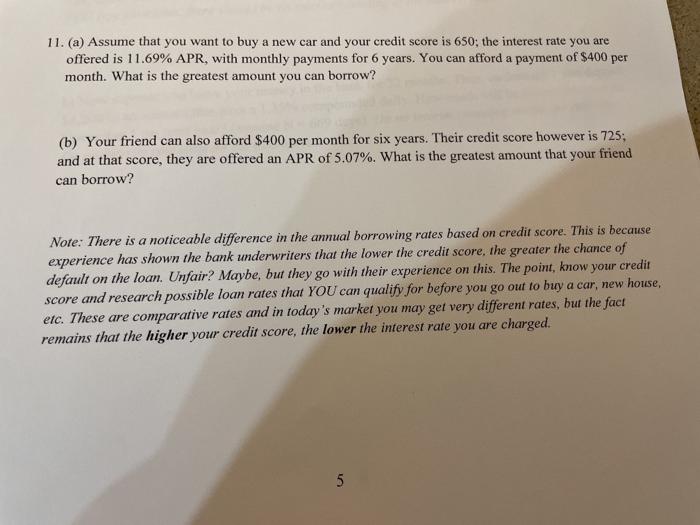

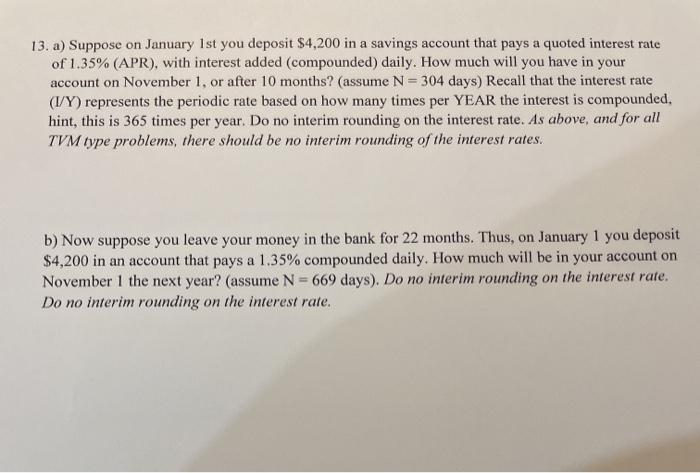

11. (a) Assume that you want to buy a new car and your credit score is 650; the interest rate you are offered is 11.69% APR, with monthly payments for 6 years. You can afford a payment of $400 per month. What is the greatest amount you can borrow? (b) Your friend can also afford $400 per month for six years. Their credit score however is 725; and at that score, they are offered an APR of 5.07%. What is the greatest amount that your friend can borrow? Note: There is a noticeable difference in the annual borrowing rates based on credit score. This is because experience has shown the bank underwriters that the lower the credit score, the greater the chance of default on the loan. Unfair? Maybe, but they go with their experience on this. The point, know your credit score and research possible loan rates that YOU can qualify for before you go out to buy a car, new house, etc. These are comparative rates and in today's market you may get very different rates, but the fact remains that the higher your credit score, the lower the interest rate you are charged. 5 13. a) Suppose on January 1st you deposit $4,200 in a savings account that pays a quoted interest rate of 1.35% (APR), with interest added (compounded) daily. How much will you have in your account on November 1, or after 10 months? (assume N= 304 days) Recall that the interest rate (1/Y) represents the periodic rate based on how many times per YEAR the interest is compounded, hint, this is 365 times per year. Do no interim rounding on the interest rate. As above, and for all TVM type problems, there should be no interim rounding of the interest rates. b) Now suppose you leave your money in the bank for 22 months. Thus, on January 1 you deposit $4,200 in an account that pays a 1.35% compounded daily. How much will be in your account on November 1 the next year? (assume N-669 days). Do no interim rounding on the interest rate. Do no interim rounding on the interest rate Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started