Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you solve all the quistions 1 Why are budgets useful in the planning process? They provide management with information about the company's past performance

can you solve all the quistions

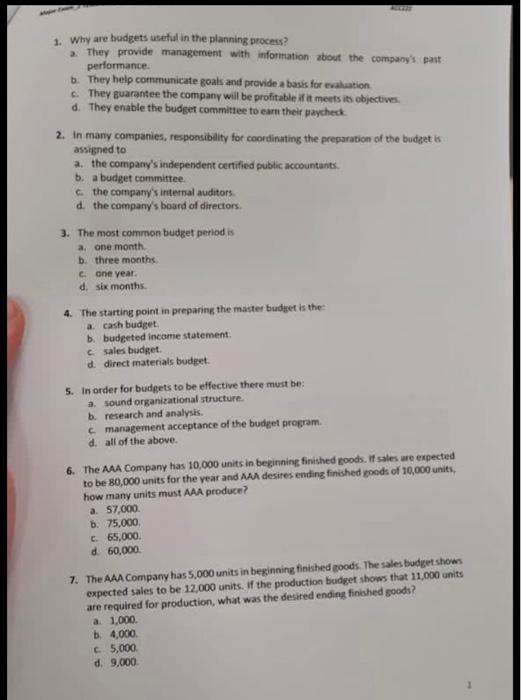

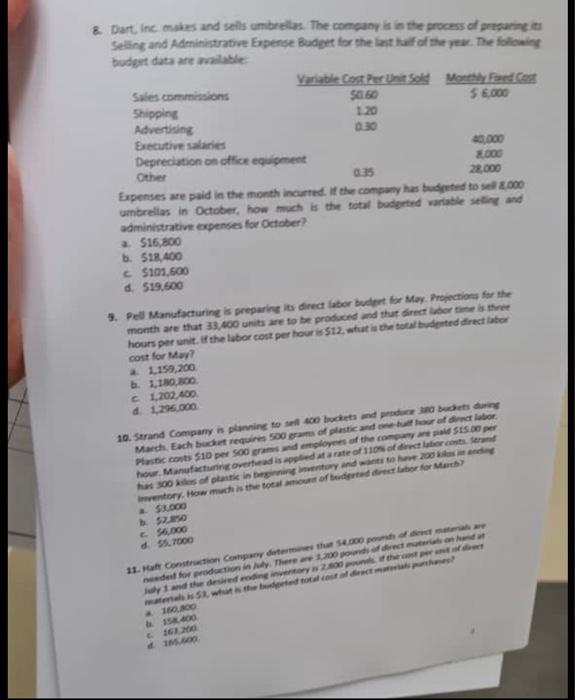

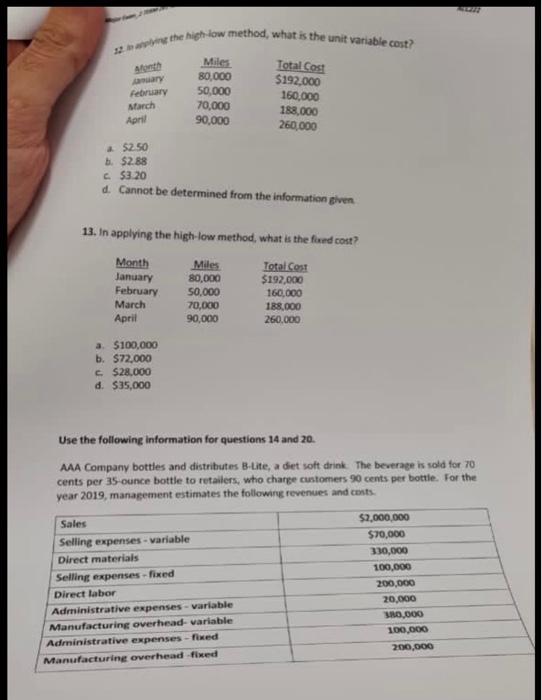

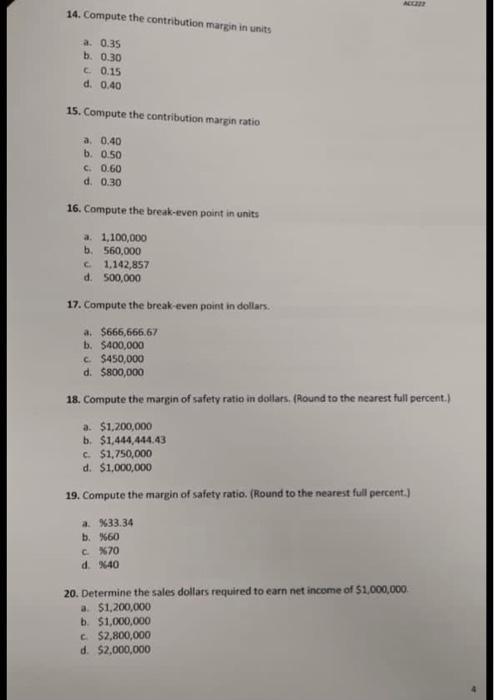

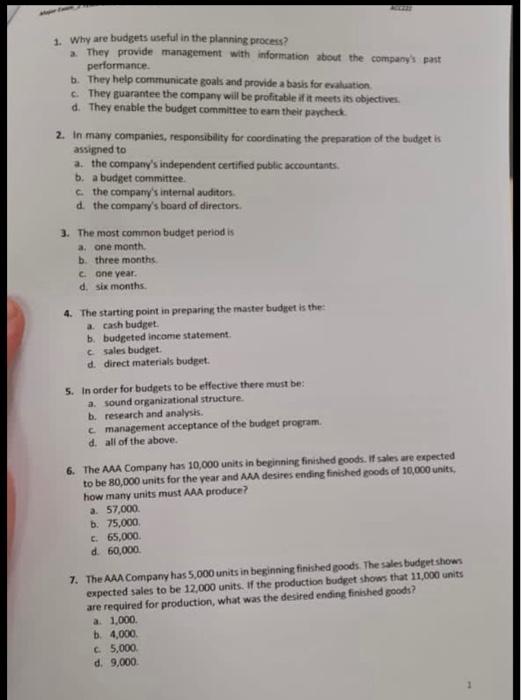

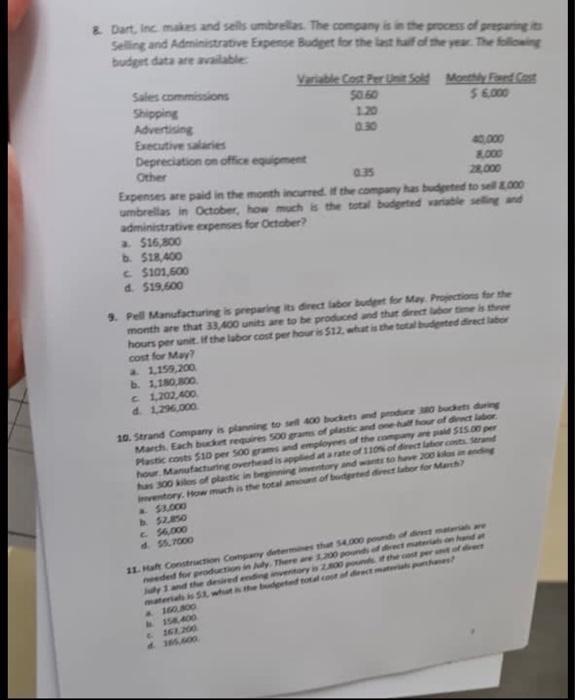

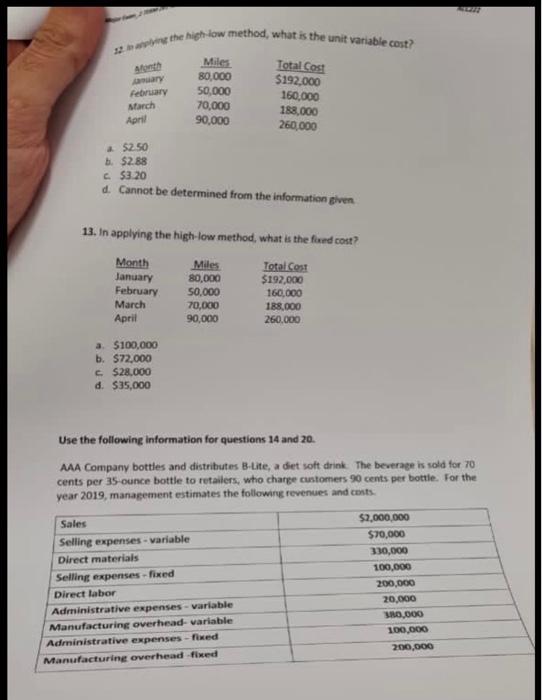

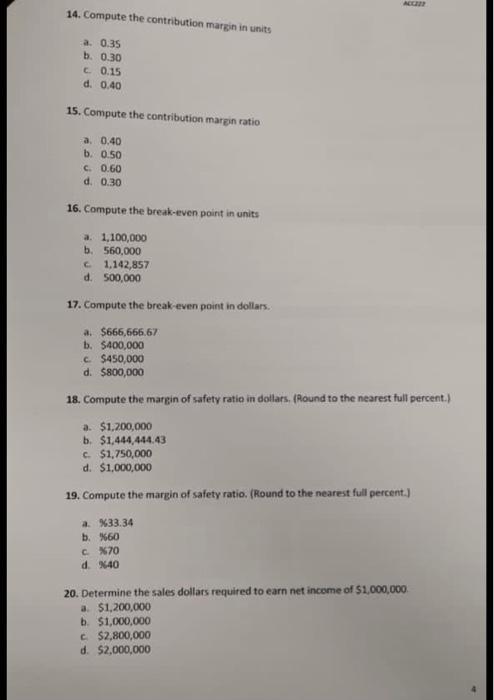

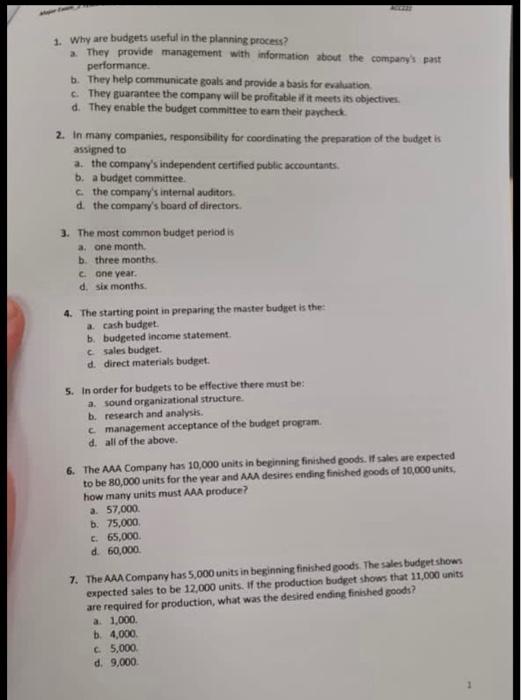

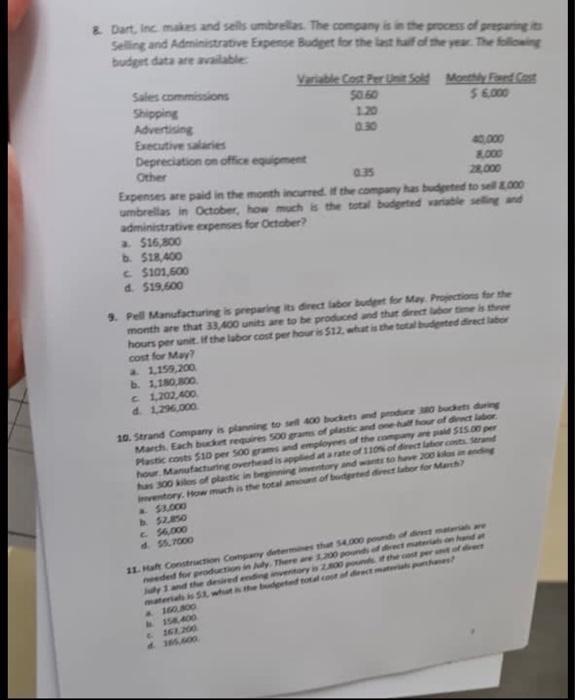

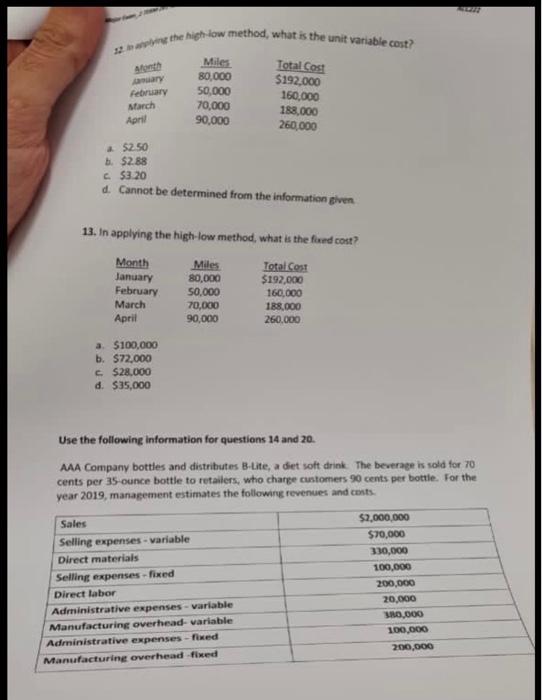

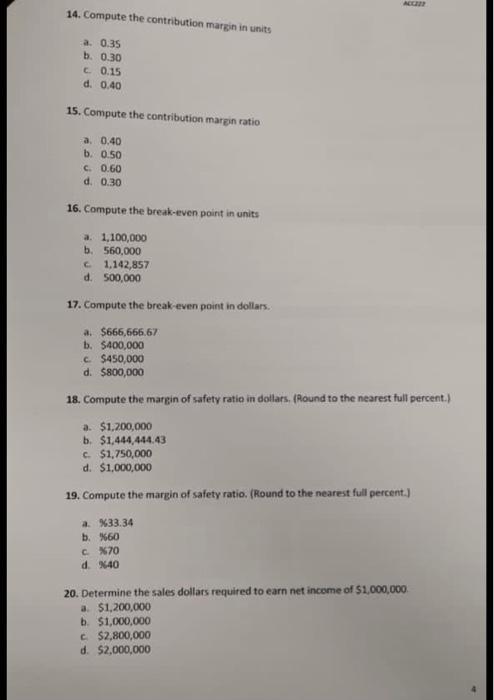

1 Why are budgets useful in the planning process? They provide management with information about the company's past performance b. They help communicate goals and provide a basis for evaluation They guarantee the company will be profitable if it meets its objectives. d. They enable the budget committee to earn their paycheck 2. In many companies, responsibility for coordinating the preparation of the budget is assigned to a. the company's independent certified public accountants. b. a budget committee the company's internal auditors. d the company's board of directors, 3. The most common budget period is a one month b. three months cone year. d. six months 4. The starting point in preparing the master budget is the a cash budget b. budgeted income statement sales budget d. direct materials budget 5. In order for budgets to be effective there must be: a. sound organizational structure. b. research and analysis. management acceptance of the budget program d. all of the above. 6. The AAA Company has 10,000 units in beginning finished goods. If sales are expected to be 80,000 units for the year and AAA desires ending finished goods of 10,000 units, how many units must AAA produce? a 57.000 b. 75,000 c. 65,000 d 60,000 7. The AAA Company has 5,000 units in beginning finished goods. The sales budget shows expected sales to be 12,000 units. If the production budget shows that 11,000 units are required for production, what was the desired ending finished goods? a 1,000 b4,000 c. 5,000 d. 9,000 & Dart, Inc males and sells umbrellas. The company is in the process of preguntas Seling and Administrative Expense Budget for the last of the year. The following budget data are able Variable Cost Per Unit Sold My Frost Sales commissions 50 60 56.000 Shipping Advertising Executive Sales Depreciation on office equipment Hood Other was 22.000 Expenses are paid in the month incurred the company has buted to se.000 umbrellas in October, how much is the total baderted variable sing and administrative expenses for October 516,800 b. $18.400 5101,500 d. 519.500 5. Pell Manufacturing is preparing its direct labor det for May Projections for the month are that 33.400 units are to be produced and that director is the hours per unit. If the labor cost per hour is $12. what is the total dented direct labor cost for May 1159,200 b.1.18 1,202.400 d1296.000 10. Strand Company is planning to sell 400 budete bude March. Each budt require 500 meter of bor Plastic costs $10 per 500 and employees SES. hour Manufacturing overhead is app rate of hades of integy and tory. How much is the total oferecutor for Marc SLOGO 52.0 54.000 d55.700D 11. Conto Company that Sport eded for prodily. There 200 pdf IND the high low method, what is the unit variable cost? A February March Miles 80,000 50,000 70,000 90,000 Total Cost $192,000 160,000 188,000 260,000 April $2.50 b. $2.88 $3.20 d. Cannot be determined from the information given 13. In applying the high-low method, what is the fund cost? Month Miles Total Cost January 80,000 $192,000 February 50.000 160,000 March 70,000 188.000 April 90,000 260.000 a $100,000 b. $72,000 $28.000 d. $35,000 Use the following information for questions 14 and 20. AAA Company bottles and distributes B-Lite, a diet soft drink. The beverage is sold for 70 cents per 35-ounce bottle to retailers, who charge customers 90 cents per bottle. For the year 2019, management estimates the following revenues and costs. Sales Selling expenses variable Direct materials Selling expenses fixed Direct labor Administrative expenses variable Manufacturing overhead-variable Administrative expenses - Fixed Manufacturing overhead fixed $2,000,000 $70,000 330,000 100,000 200,000 20.000 380,000 100.000 200,000 ACET 14. Compute the contribution margin in units a 0.35 b. 0.30 c.0.15 d. 0.40 15. Compute the contribution margin ratio a. 0.40 b. 0.50 c. 0.60 d. 0.30 16. Compute the break-even point in units a. 1,100,000 b. 560,000 1,142,857 d. 500,000 17. Compute the break even point in dollars. a. $666,666.67 b. $400,000 c. $450,000 d. $800,000 18. Compute the margin of safety ratio in dollars. (Round to the nearest full percent.) a. $1,200,000 b. $1,444,444.43 c. $1,750,000 d. $1,000,000 19. Compute the margin of safety ratio. (Round to the nearest full percent.) a %33.34 b. %60 CX70 d. %40 20. Determine the sales dollars required to earn net income of $1,000,000 a $1,200,000 b. $1,000,000 $2,800,000 d. $2,000,000 1 Why are budgets useful in the planning process? They provide management with information about the company's past performance b. They help communicate goals and provide a basis for evaluation They guarantee the company will be profitable if it meets its objectives. d. They enable the budget committee to earn their paycheck 2. In many companies, responsibility for coordinating the preparation of the budget is assigned to a. the company's independent certified public accountants. b. a budget committee the company's internal auditors. d the company's board of directors, 3. The most common budget period is a one month b. three months cone year. d. six months 4. The starting point in preparing the master budget is the a cash budget b. budgeted income statement sales budget d. direct materials budget 5. In order for budgets to be effective there must be: a. sound organizational structure. b. research and analysis. management acceptance of the budget program d. all of the above. 6. The AAA Company has 10,000 units in beginning finished goods. If sales are expected to be 80,000 units for the year and AAA desires ending finished goods of 10,000 units, how many units must AAA produce? a 57.000 b. 75,000 c. 65,000 d 60,000 7. The AAA Company has 5,000 units in beginning finished goods. The sales budget shows expected sales to be 12,000 units. If the production budget shows that 11,000 units are required for production, what was the desired ending finished goods? a 1,000 b4,000 c. 5,000 d. 9,000 & Dart, Inc. makes and sells umbrellas. The company is in the process of pregat Selling and Administrative Expense Budget for the last of the year. The follo budget data are available VariableCost PerUnit Sol Mostly cost Sales commissions 50 50 5 6.000 Shipping Advertising Executive Sales Depreciation on office equipment 2000 Other 35 22.000 Expenses are paid in the month incurred the company has budgeted to sell 2.000 umbrellas in October, how much is the total budgeted ware selling and administrative expenses for October 516,800 $18.400 5101,600 d. 519.600 5. Pell Manufacturing is preparing it direct labor budget for May. Projections for the month are that 33.400 units are to be produced and that directories the hours per unit. If the labor cost per hour is $12. what is the total dented direct later cost for May 1159,200 b. 11 NO C1,202.400 d129.000 10. Strand Company is planning to 400 bucets debut de March. Each budet requires 500 grams of plastic hour of cor Pustic costs $10 per 500 and employees hour Manufacturing overhead is app rate of es of plastic integrada story. How much is the total ofrector for March SOGO 54.000 d55.700D IL Controw Company has pode eded for produs in Aly Theron and the deserys 2.0 IND . the high low method, what is the unit variable cost? A February March Miles 80,000 50,000 70,000 90,000 Total Cost $192,000 160,000 188,000 260,000 April $2.50 b. $2.88 $3.20 d. Cannot be determined from the information given 13. In applying the high-low method, what is the fund cost? Month Miles Total Cost January 80,000 $192,000 February 50.000 160,000 March 70,000 188.000 April 90,000 260.000 a $100,000 b. $72,000 $28.000 d. $35,000 Use the following information for questions 14 and 20. AAA Company bottles and distributes B-Lite, a diet soft drink. The beverage is sold for 70 cents per 35-ounce bottle to retailers, who charge customers 90 cents per bottle. For the year 2019, management estimates the following revenues and costs. Sales Selling expenses variable Direct materials Selling expenses fixed Direct labor Administrative expenses variable Manufacturing overhead-variable Administrative expenses - Fixed Manufacturing overhead fixed $2,000,000 $70,000 330,000 100,000 200,000 20.000 380,000 100.000 200,000 ACET 14. Compute the contribution margin in units a 0.35 b. 0.30 c.0.15 d. 0.40 15. Compute the contribution margin ratio a. 0.40 b. 0.50 c. 0.60 d. 0.30 16. Compute the break-even point in units a. 1,100,000 b. 560,000 1,142,857 d. 500,000 17. Compute the break even point in dollars. a. $666,666.67 b. $400,000 c. $450,000 d. $800,000 18. Compute the margin of safety ratio in dollars. (Round to the nearest full percent.) a. $1,200,000 b. $1,444,444.43 c. $1,750,000 d. $1,000,000 19. Compute the margin of safety ratio. (Round to the nearest full percent.) a %33.34 b. %60 CX70 d. %40 20. Determine the sales dollars required to earn net income of $1,000,000 a $1,200,000 b. $1,000,000 $2,800,000 d. $2,000,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started