Answered step by step

Verified Expert Solution

Question

1 Approved Answer

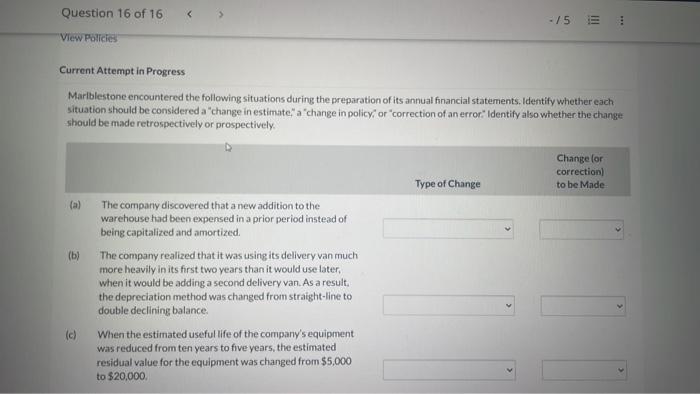

Can you solve this for intermediate accounting Marlblestone encountered the following situations during the preparation of its annual financial statements. Identify whether each situation should

Can you solve this for intermediate accounting

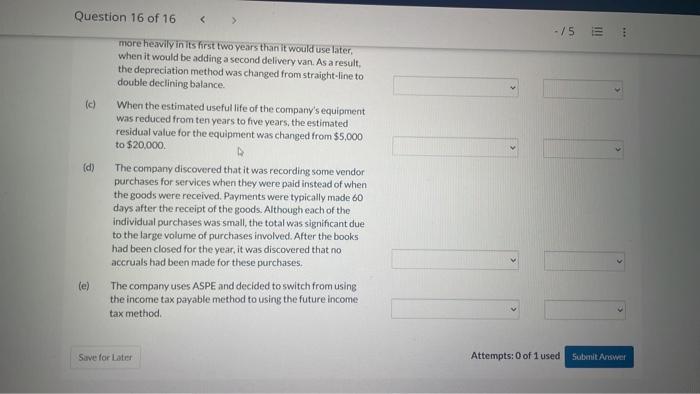

Marlblestone encountered the following situations during the preparation of its annual financial statements. Identify whether each situation should be considered a \"change in estimate,\" a \"change in policy, or \"correction of an error\" Identify also whether the change should be made retrospectively or prospectively. more heavily in its first two years than it would use later, when it would be adding a second delivery van. As a result, the depreciation method was changed from straight-line to double declining balance. (c) When the estimated useful life of the company's equipment was reduced from ten years to five years, the estimated residual value for the equipment was changed from \\( \\$ 5,000 \\) to \\( \\$ 20,000 \\). (d) The company discovered that it was recording some vendor purchases for services when they were paid instead of when the goods were received. Payments were typically made 60 days after the receipt of the goods. Although each of the individual purchases was small, the total was significant due to the large volume of purchases involved. After the books had been closed for the year, it was discovered that no. accruals had been made for these purchases. (e) The company uses ASPE and decided to switch from using the income tax payable method to using the future income tax method. Attempts: 0 of 1 used

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started