Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you solve this for me please? Question 1 On 31 December 20X3, Investor plc held the following two investments: 1. 90% of the ordinary

Can you solve this for me please?

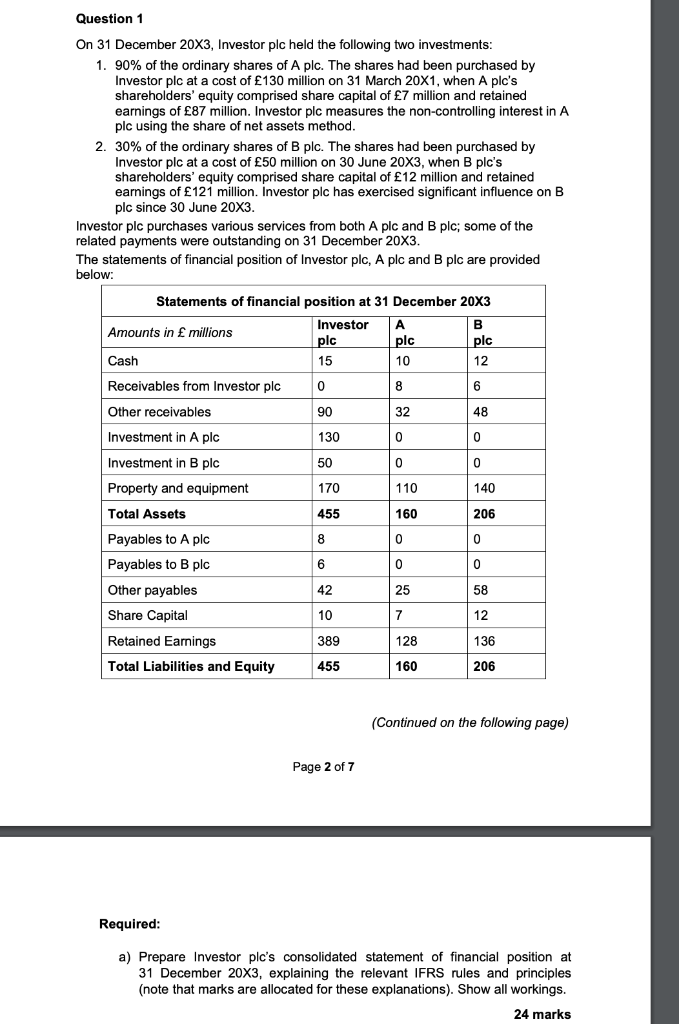

Question 1 On 31 December 20X3, Investor plc held the following two investments: 1. 90% of the ordinary shares of A plc. The shares had been purchased by Investor plc at a cost of 130 million on 31 March 20X1, when A plc's shareholders' equity comprised share capital of 7 million and retained earnings of 87 million. Investor plc measures the non-controlling interest in A plc using the share of net assets method. 2. 30% of the ordinary shares of B plc. The shares had been purchased by Investor plc at a cost of 50 million on 30 June 20X3, when B plc's shareholders' equity comprised share capital of 12 million and retained earnings of 121 million. Investor plc has exercised significant influence on B plc since 30 June 20X3. Investor plc purchases various services from both A plc and B plc; some of the related payments were outstanding on 31 December 20X3. The statements of financial position of Investor plc, A plc and B plc are provided below: plc Statements of financial position at 31 December 20X3 Amounts in millions Investor A B plc Cash R 15 10 12 Receivables from Investor plc Other receivables 90 32 4 8 Investment in A plc 13000 Investment in B plc 500 0 Property and equipment 170 Total Assets 455 160 206 Payables to A plc Payables to B plc 0 0 Other payables 42 25 58 Share Capital 10 7 12 Retained Earnings 389 136 Total Liabilities and Equity 455 160 206 140 (Continued on the following page) Page 2 of 7 Required: a) Prepare Investor ple's consolidated statement of financial position at 31 December 20X3, explaining the relevant IFRS rules and principles (note that marks are allocated for these explanations). Show all workings. 24 mars 24 marksStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started