Can you solve this please..

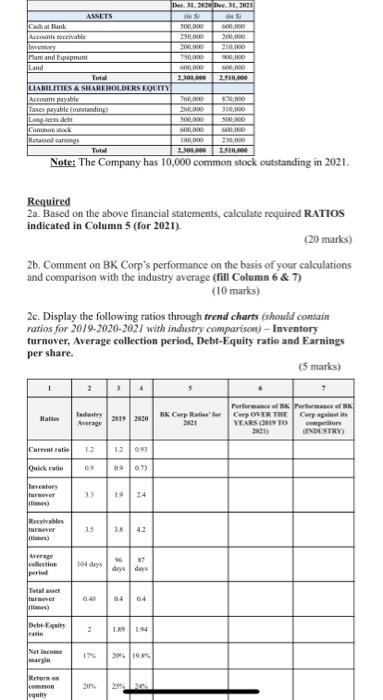

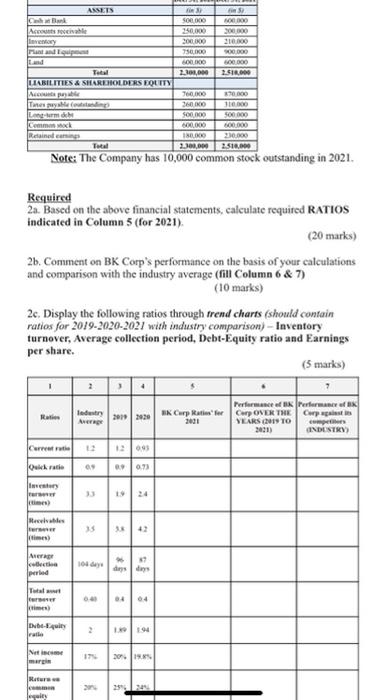

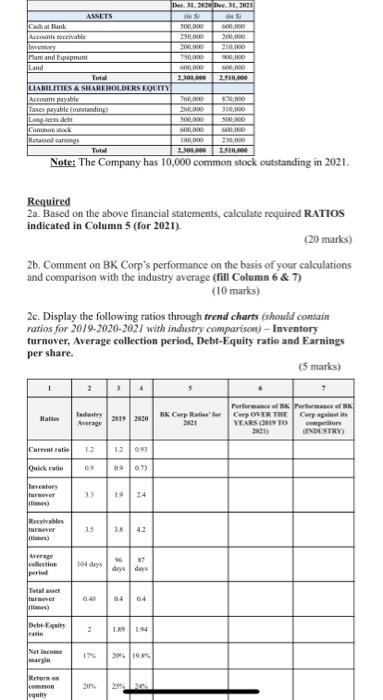

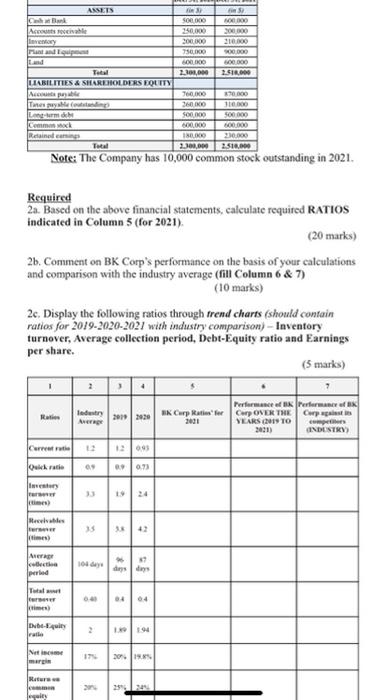

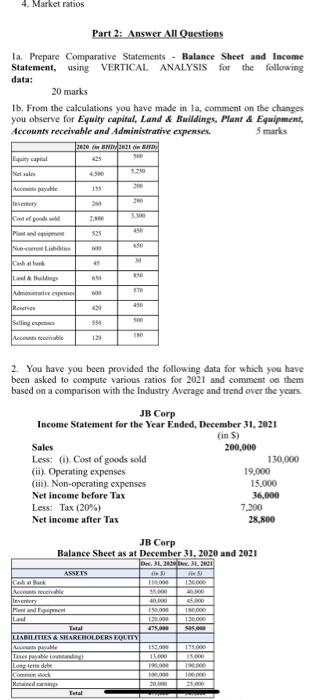

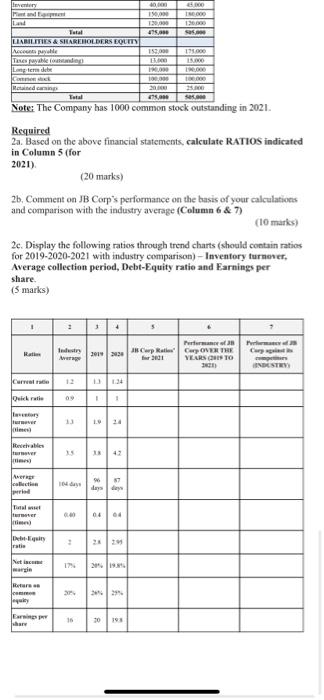

Dhee 11, 2011 ASSETS Catalank SOLDO 600,00 As receive ISO 200.000 ly 300 200,000 rantand up TS Land 600,000 Tu 110 2010.10 LIABILITIES & SHAREHOLDERS EQUITY Accounts payable TWO 0000 Taxes payable standing) 30 310,000 Lemn de SOLE SO, Cock GOLD 0,00 Rotated camp INO 230,000 To 23, 210,00 Note: The Company has 10,000 common stock outstanding in 2021. Required 2a. Based on the above financial statements, calculate required RATIOS indicated in Columns (for 2021). (20 marks 2b. Comment on BK Corp's performance on the basis of your calculations and comparison with the industry average (fill Column 6 & 7) (10 marks) 2c. Display the following ratios through trend charts should contain ratios for 2019-2020-2021 with industry comparison) - Inventory turnover, Average collection period, Debt-Equity ratio and Earnings per share. (5 marks) 1 2 3 Hati fadesty Average 2019 2020 BK Corp Rates for Pour Corp OTR THE Carpet YEARS (2019 TO cum 2030 INDUSTRY) Curre 12 12093 Quick ratio 0903 Investor hrer times) 13 Receives Juner ) 3.82 AVERY collectie days des Toalet ver J) Debet 2 Net income 2019 Reme 28 loquity ASSETS CB A Levy Plantando SOLO 1500 300K 75BLIKO SOLO 2.300,000 200.000 21 000 WOOD 2.518,000 LIABILITIES & SHAREHOLDERS BOLITY Tines y Lantum Cemax Retained Total TO 370 360KO 110.000 SOBO 500 000 RO 1800 210.000 2.300,000 2.510.000 WOOD Note: The Company has 10,000 common stock outstanding in 2021. Required 2a. Based on the above financial statements, calculate required RATIOS indicated in Column 5 (for 2021) (20 marks) 26. Comment on BK Corp's performance on the basis of your calculations and comparison with the industry average (fill Column 6 & 7) (10 marks) 2c. Display the following ratios through frend charts (should contain ratios for 2019-2020-2021 with industry comparison) - Inventory turnover, Average collection period, Debt-Equity ratio and Earnings per share. (5 marks) 1 Rati Industry 3292228 Curp Ratinfo Performance of performance of Curp OVER THE Cwpa YEARS (2019 TO cum INDUSTRY Cerruti 12,95 i 33 24 times Receivables times) 15 ** Average tech period 101 day 7 dins Tul 04 times) byly rul 2 1194 30 Here ity 4. Market ratios Part 2: Answer All Questions la Prepare Comparative Statements - Balance Sheet and Income Statement, using VERTICAL ANALYSIS for the following data: 20 marks 1b. From the calculations you have made in la, comment on the changes you observe for Equity capital, Land & Buildings, Plant & Equipment, Accounts receivable and Administrative expenses. 5 marks 2070 BYBEL in den Equity capital 500 Ne sal 4500 155 he Ayude 2. 310 Celodi 450 525 es Cat 45 390 and Building wa 570 450 RTV Sex 950 | Acress reemas | 1.21 2. You have you been provided the following data for which you have been asked to compute various ratios for 2021 and comment on them based on a comparison with the Industry Average and trend over the years JB Corp Income Statement for the Year Ended, December 31, 2021 (in ) Sales 200,000 Less: 0. Cost of goods sold 130,000 (ii). Operating expenses 19,000 (in). Non-operating expenses 15.000 Net income before Tax 36,000 Less: Tax (20%) 7.200 Net income after Tax 28.800 JB Corp Balance Sheef as at December 31, 2020 and 2021 Des. 3. 2030. 31. 21 130.000 Cash Necesible Invey 1. 150,00 120.000 95.000 Land Total LIABILITIES & STAREHOLDERS ROLLY Avale Tases and Los dibe 1537 1 1. 200 Total every 40 19.00 130.00 15.00 IND 136 Sos. Total LIABILITIES & SHAREHOLDERS EQUITY Apyle Tenes uvable de Le debe 159.000 BO 11.00 ISO 0.00 sex.com Retained in Note: The Company has 1000 common stock outstanding in 2021. Required 2. Based on the above financial statements, calculate RATIOS indicated in Column 5 (for 2021) (20 marks) 2b. Comment on JB Corp's performance on the basis of your calculations and comparison with the industry average (Column 6 & 7) (10 marks) 2c. Display the following ratios through trend charts (should contain ratios for 2019-2020-2021 with industry comparison) - Inventory turnerer, Average collection period, Debt-Equity ratio and Earnings per share (5 marks) 1 Ram Industry 2012 IKCwp RC OVER THE YEARS ORS TO Curre i rutie 13 24 Revelables 13 42 inimese AMERE Aalaattam pred days rever J) 04 ratie retic margin 16 2018 Dhee 11, 2011 ASSETS Catalank SOLDO 600,00 As receive ISO 200.000 ly 300 200,000 rantand up TS Land 600,000 Tu 110 2010.10 LIABILITIES & SHAREHOLDERS EQUITY Accounts payable TWO 0000 Taxes payable standing) 30 310,000 Lemn de SOLE SO, Cock GOLD 0,00 Rotated camp INO 230,000 To 23, 210,00 Note: The Company has 10,000 common stock outstanding in 2021. Required 2a. Based on the above financial statements, calculate required RATIOS indicated in Columns (for 2021). (20 marks 2b. Comment on BK Corp's performance on the basis of your calculations and comparison with the industry average (fill Column 6 & 7) (10 marks) 2c. Display the following ratios through trend charts should contain ratios for 2019-2020-2021 with industry comparison) - Inventory turnover, Average collection period, Debt-Equity ratio and Earnings per share. (5 marks) 1 2 3 Hati fadesty Average 2019 2020 BK Corp Rates for Pour Corp OTR THE Carpet YEARS (2019 TO cum 2030 INDUSTRY) Curre 12 12093 Quick ratio 0903 Investor hrer times) 13 Receives Juner ) 3.82 AVERY collectie days des Toalet ver J) Debet 2 Net income 2019 Reme 28 loquity ASSETS CB A Levy Plantando SOLO 1500 300K 75BLIKO SOLO 2.300,000 200.000 21 000 WOOD 2.518,000 LIABILITIES & SHAREHOLDERS BOLITY Tines y Lantum Cemax Retained Total TO 370 360KO 110.000 SOBO 500 000 RO 1800 210.000 2.300,000 2.510.000 WOOD Note: The Company has 10,000 common stock outstanding in 2021. Required 2a. Based on the above financial statements, calculate required RATIOS indicated in Column 5 (for 2021) (20 marks) 26. Comment on BK Corp's performance on the basis of your calculations and comparison with the industry average (fill Column 6 & 7) (10 marks) 2c. Display the following ratios through frend charts (should contain ratios for 2019-2020-2021 with industry comparison) - Inventory turnover, Average collection period, Debt-Equity ratio and Earnings per share. (5 marks) 1 Rati Industry 3292228 Curp Ratinfo Performance of performance of Curp OVER THE Cwpa YEARS (2019 TO cum INDUSTRY Cerruti 12,95 i 33 24 times Receivables times) 15 ** Average tech period 101 day 7 dins Tul 04 times) byly rul 2 1194 30 Here ity 4. Market ratios Part 2: Answer All Questions la Prepare Comparative Statements - Balance Sheet and Income Statement, using VERTICAL ANALYSIS for the following data: 20 marks 1b. From the calculations you have made in la, comment on the changes you observe for Equity capital, Land & Buildings, Plant & Equipment, Accounts receivable and Administrative expenses. 5 marks 2070 BYBEL in den Equity capital 500 Ne sal 4500 155 he Ayude 2. 310 Celodi 450 525 es Cat 45 390 and Building wa 570 450 RTV Sex 950 | Acress reemas | 1.21 2. You have you been provided the following data for which you have been asked to compute various ratios for 2021 and comment on them based on a comparison with the Industry Average and trend over the years JB Corp Income Statement for the Year Ended, December 31, 2021 (in ) Sales 200,000 Less: 0. Cost of goods sold 130,000 (ii). Operating expenses 19,000 (in). Non-operating expenses 15.000 Net income before Tax 36,000 Less: Tax (20%) 7.200 Net income after Tax 28.800 JB Corp Balance Sheef as at December 31, 2020 and 2021 Des. 3. 2030. 31. 21 130.000 Cash Necesible Invey 1. 150,00 120.000 95.000 Land Total LIABILITIES & STAREHOLDERS ROLLY Avale Tases and Los dibe 1537 1 1. 200 Total every 40 19.00 130.00 15.00 IND 136 Sos. Total LIABILITIES & SHAREHOLDERS EQUITY Apyle Tenes uvable de Le debe 159.000 BO 11.00 ISO 0.00 sex.com Retained in Note: The Company has 1000 common stock outstanding in 2021. Required 2. Based on the above financial statements, calculate RATIOS indicated in Column 5 (for 2021) (20 marks) 2b. Comment on JB Corp's performance on the basis of your calculations and comparison with the industry average (Column 6 & 7) (10 marks) 2c. Display the following ratios through trend charts (should contain ratios for 2019-2020-2021 with industry comparison) - Inventory turnerer, Average collection period, Debt-Equity ratio and Earnings per share (5 marks) 1 Ram Industry 2012 IKCwp RC OVER THE YEARS ORS TO Curre i rutie 13 24 Revelables 13 42 inimese AMERE Aalaattam pred days rever J) 04 ratie retic margin 16 2018