Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you somebody help me how i would put this in finianical calucator and write out each formula for all questions? i really need to

Can you somebody help me how i would put this in finianical calucator and write out each formula for all questions? i really need to know how to do for the exam tomorrow?

Can you somebody help me how i would put this in finianical calucator and write out each formula for all questions? i really need to know how to do for the exam tomorrow?

I dont know how to put these answers into the calucator and which formula to use. Thats my question! please somebody help me, i have exam tomorrow!

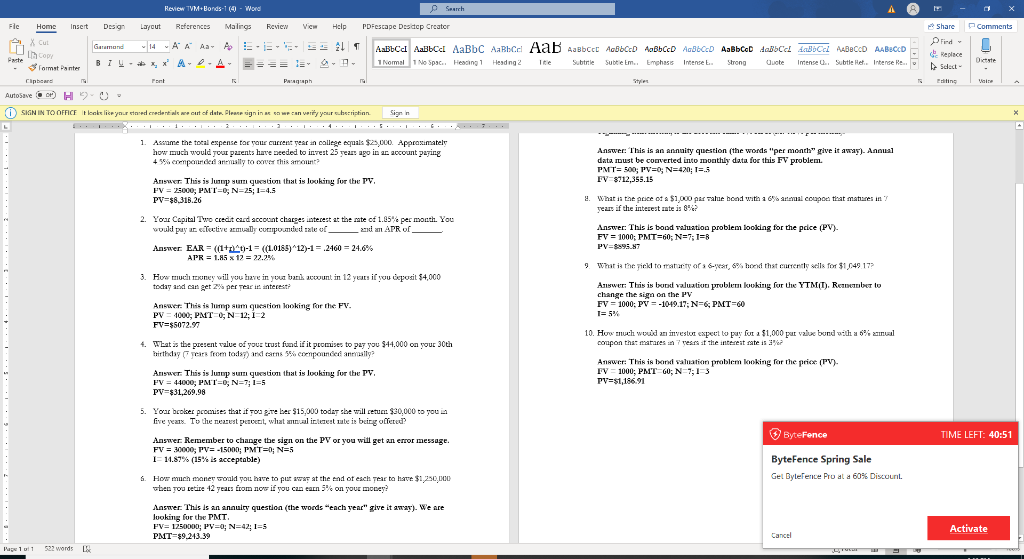

A - X File Home Insert Review VC Help Pescage Desep Creator she comments Review TV-Bond - Word Design Layout References Maling Gramed AAA- A - BILA...A Aboca Aalbcd AaBC ABC AaB ACE ABCD ABCD ABCD AalbCD de BC ABCD ABCD ... 1 mong 1 ng2 te S iche Suche Sun - 3 format Painter AutoSave D H90 SIGN IN TO OFFICE kyn n a w gniwan yuran in 1. Asume the total expense to year in college equal $25000Approximatele how much would your parents have beeded to invest 25 years ago in account paying +55 pounded to the ). Annual Answer: This is an annuairy question the words per monthrive it data ust be converted to monthly data for this problem PMT=500, PVO; N=420; 1= FV8712,355.15 Anwer This is Jumpsum quum that is looking for the PV = 2500, PMTON 251 4. PV=$8.316.26 a bond with a c ontattare in What is the price of a $1.000 years if the interest rate is 89 2. Your Capital Twe credit ad account Chanes latest at the rate of 1.05 per month. You would pay a t mually c u tate of APR of Answer: This is boond valuation problem looking for the price (PV) FV = 1000: PMT=50; N=7; 1=8 PV=8895.87 Answer: EAR-((1+ 0-1 - ((1.0165) 12)-1 = 2460 = 24.6% APRINS 12 = 22.2% 9 What is their to marry of bond that rently well for $11.49 17 3. How much money will you have in your bank wount in 12 yas if you exposit $4,000 today and can get 2% per interest Answer: This is bond valuation problem looking for the YTMT), Rebelo change the sign on the PV FV = 1000: PV = -1019.17: N 6, PMT60 Annur: This is lump sum union looking for the FV. PV-1000, PMT ON 12: 1 2 FV-$5072.9 10. How much would an investur expect to pay for a $1,000 pat value bond with a 6% tual coupon the maraes ver the interest rate is 4. What is the present value of your trust fundit promises to pay you $44,000 on Your 30th birthday from today and compounded any Anwer. This is Juan um u m that is locking for the TV PV = 44000, PMTN-71-5 PV-531,269.98 Annwer: This is ond valuation problem koking for the price (PV) FV = 1000; PMT 60;N 7,13 PV=$1,186.91 5. Yoar bolos proces that Eve To the are bes $15,000 today she will return $30.000 to you wat e r is but oled ByteFence TIME LEFT: 40:51 Answer Remember to change the sign on the PV or you will get an error message. FV = 000 P PMTONES 1059% (15% acceptable) ByteFence Spring Sale Get yleense P al 60% Discount 5. How much mone w you 12 a d o o hace to now if you can the aid of each year to have $1 20 BOD on your mone? Answer: This is an annuiry question (the words each year give it away). We are Looking for the PMT. PV=1250000, PY=; N=42;15 PNT 99.243.39 Activate Cancel 11522 A - X File Home Insert Review VC Help Pescage Desep Creator she comments Review TV-Bond - Word Design Layout References Maling Gramed AAA- A - BILA...A Aboca Aalbcd AaBC ABC AaB ACE ABCD ABCD ABCD AalbCD de BC ABCD ABCD ... 1 mong 1 ng2 te S iche Suche Sun - 3 format Painter AutoSave D H90 SIGN IN TO OFFICE kyn n a w gniwan yuran in 1. Asume the total expense to year in college equal $25000Approximatele how much would your parents have beeded to invest 25 years ago in account paying +55 pounded to the ). Annual Answer: This is an annuairy question the words per monthrive it data ust be converted to monthly data for this problem PMT=500, PVO; N=420; 1= FV8712,355.15 Anwer This is Jumpsum quum that is looking for the PV = 2500, PMTON 251 4. PV=$8.316.26 a bond with a c ontattare in What is the price of a $1.000 years if the interest rate is 89 2. Your Capital Twe credit ad account Chanes latest at the rate of 1.05 per month. You would pay a t mually c u tate of APR of Answer: This is boond valuation problem looking for the price (PV) FV = 1000: PMT=50; N=7; 1=8 PV=8895.87 Answer: EAR-((1+ 0-1 - ((1.0165) 12)-1 = 2460 = 24.6% APRINS 12 = 22.2% 9 What is their to marry of bond that rently well for $11.49 17 3. How much money will you have in your bank wount in 12 yas if you exposit $4,000 today and can get 2% per interest Answer: This is bond valuation problem looking for the YTMT), Rebelo change the sign on the PV FV = 1000: PV = -1019.17: N 6, PMT60 Annur: This is lump sum union looking for the FV. PV-1000, PMT ON 12: 1 2 FV-$5072.9 10. How much would an investur expect to pay for a $1,000 pat value bond with a 6% tual coupon the maraes ver the interest rate is 4. What is the present value of your trust fundit promises to pay you $44,000 on Your 30th birthday from today and compounded any Anwer. This is Juan um u m that is locking for the TV PV = 44000, PMTN-71-5 PV-531,269.98 Annwer: This is ond valuation problem koking for the price (PV) FV = 1000; PMT 60;N 7,13 PV=$1,186.91 5. Yoar bolos proces that Eve To the are bes $15,000 today she will return $30.000 to you wat e r is but oled ByteFence TIME LEFT: 40:51 Answer Remember to change the sign on the PV or you will get an error message. FV = 000 P PMTONES 1059% (15% acceptable) ByteFence Spring Sale Get yleense P al 60% Discount 5. How much mone w you 12 a d o o hace to now if you can the aid of each year to have $1 20 BOD on your mone? Answer: This is an annuiry question (the words each year give it away). We are Looking for the PMT. PV=1250000, PY=; N=42;15 PNT 99.243.39 Activate Cancel 11522Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started