Answered step by step

Verified Expert Solution

Question

1 Approved Answer

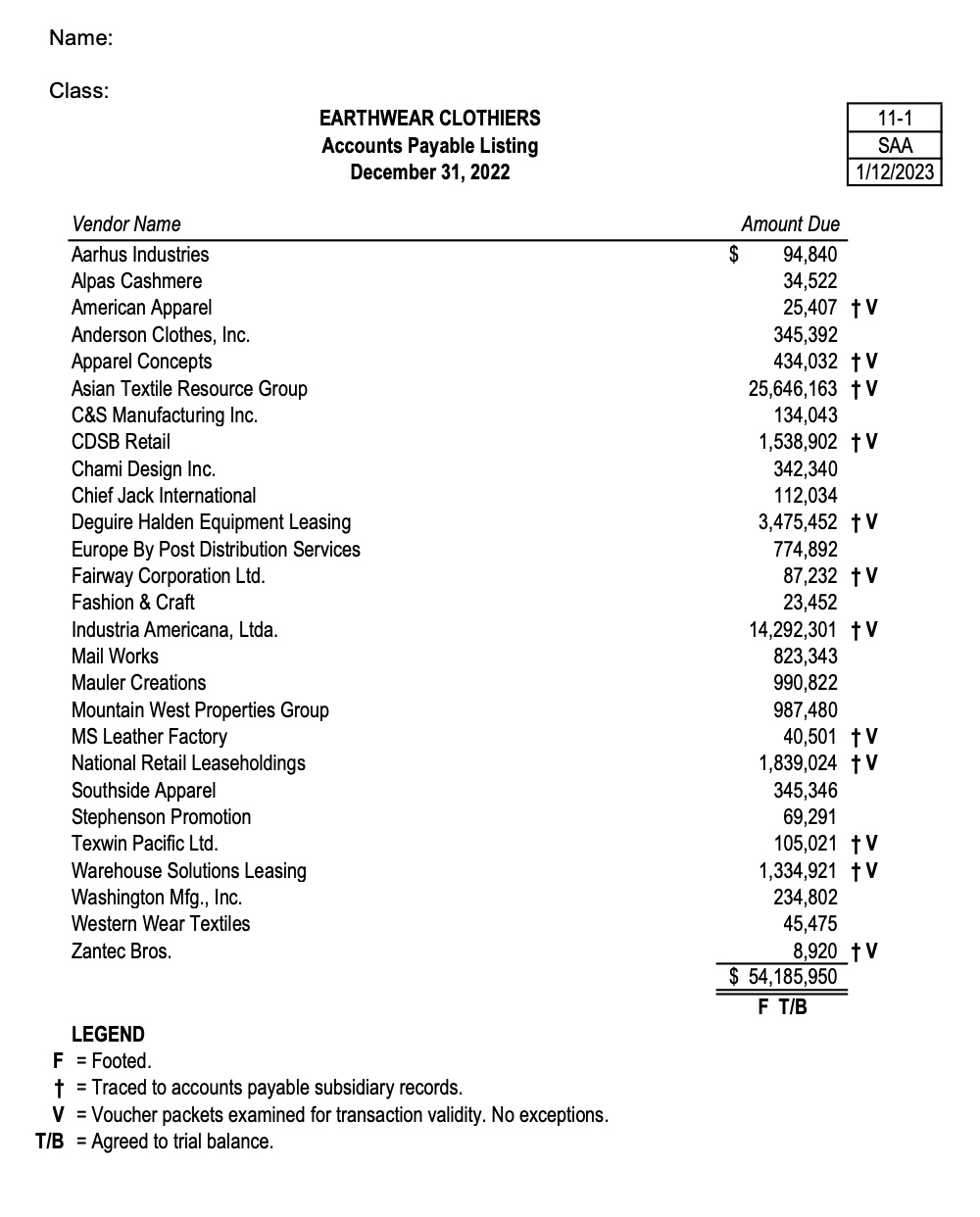

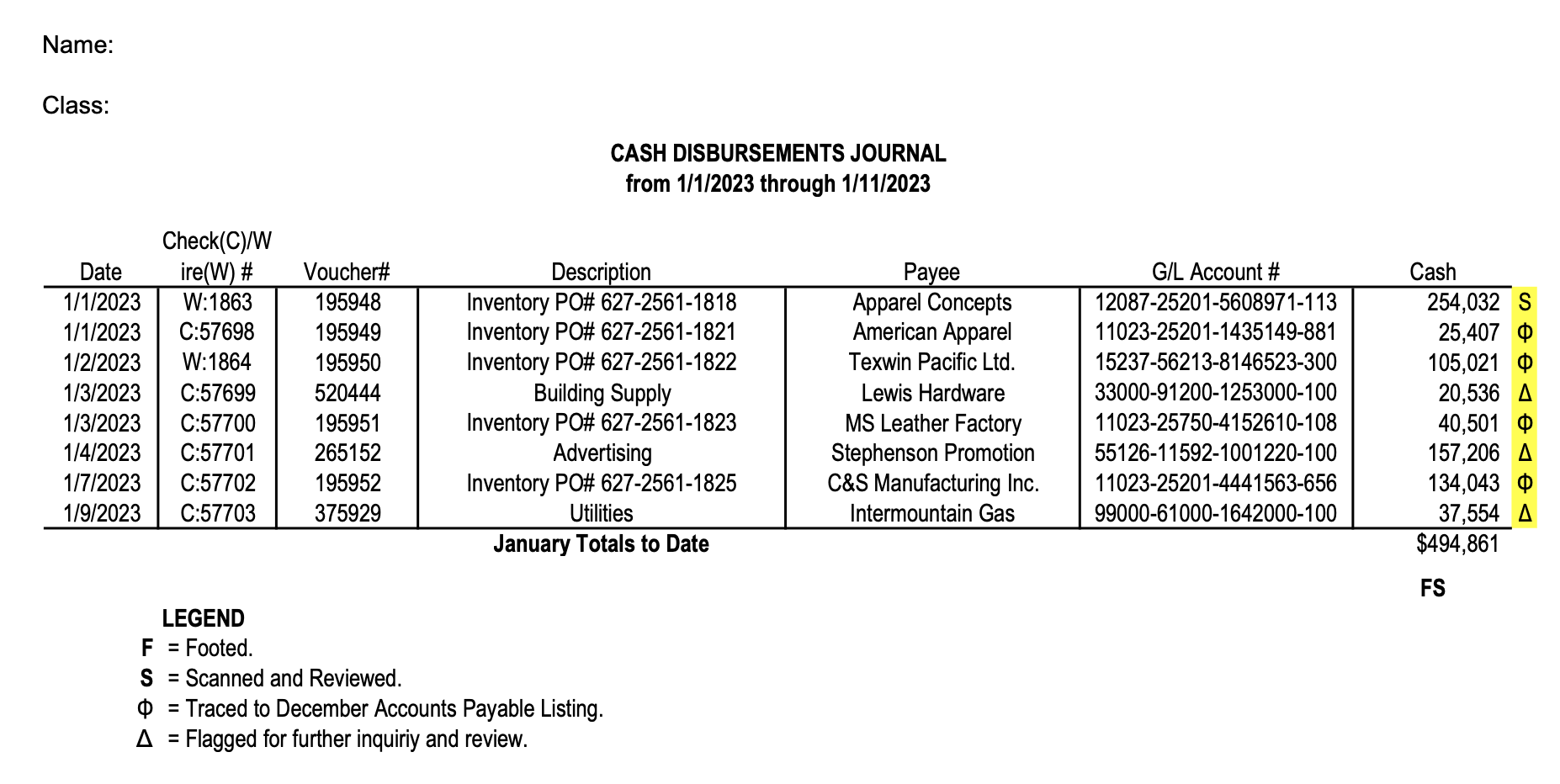

Can you use the proper tick marks from the legend to mark if the amounts tied and if they did not, why didn't they? EARTHWEAR

Can you use the proper tick marks from the legend to mark if the amounts tied and if they did not, why didn't they?

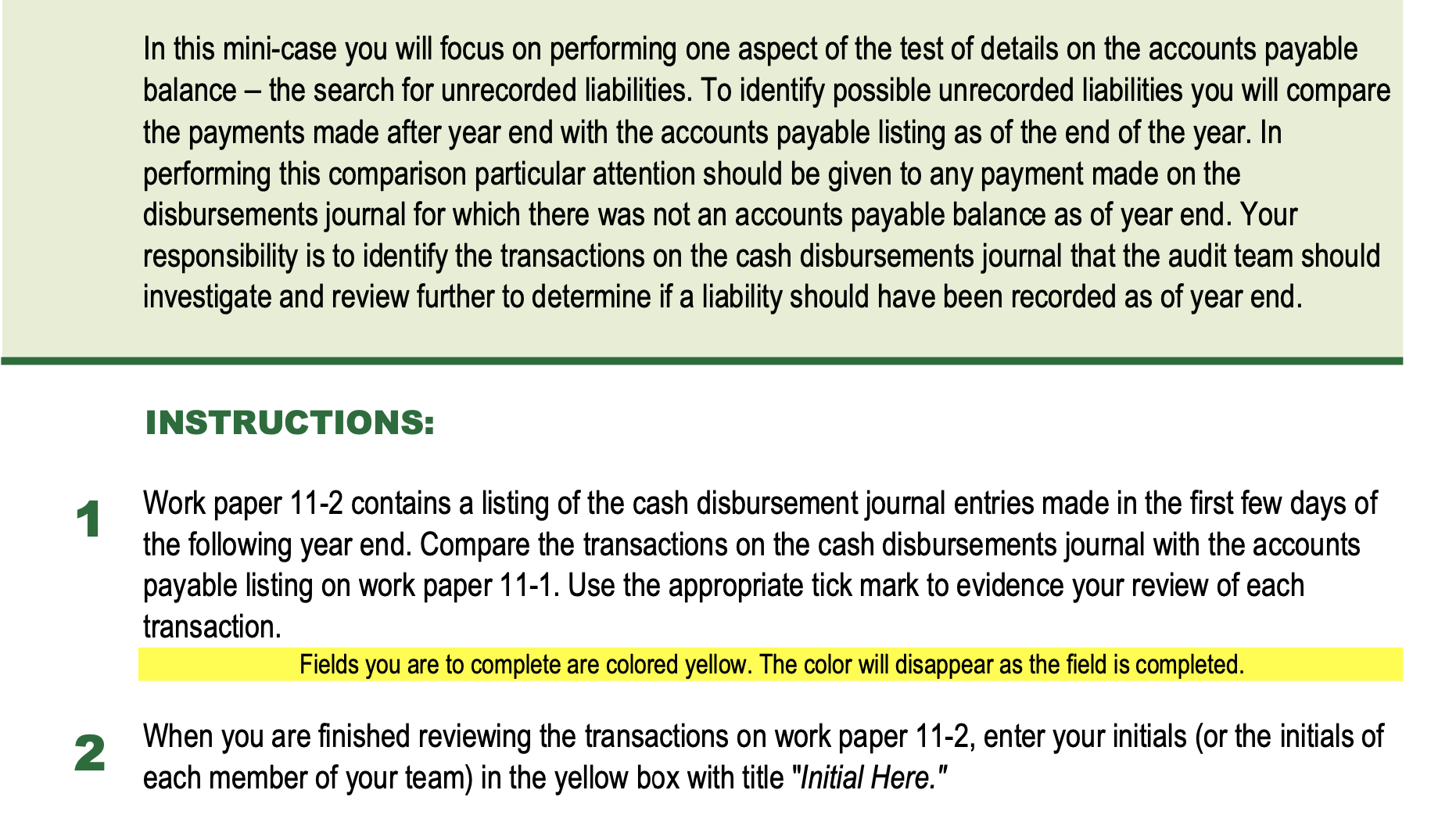

EARTHWEAR CLOTHIERS Accounts Payable Listing noramhar 31 on?2 Name: Class: CASH DISBURSEMENTS JOURNAL from 1/1/2023 through 1/11/2023 LEGEND F= Footed. S= Scanned and Reviewed. = Traced to December Accounts Payable Listing. = Flagged for further inquiriy and review. In this mini-case you will focus on performing one aspect of the test of details on the accounts payable balance - the search for unrecorded liabilities. To identify possible unrecorded liabilities you will compare the payments made after year end with the accounts payable listing as of the end of the year. In performing this comparison particular attention should be given to any payment made on the disbursements journal for which there was not an accounts payable balance as of year end. Your responsibility is to identify the transactions on the cash disbursements journal that the audit team should investigate and review further to determine if a liability should have been recorded as of year end. INSTRUCTIONS: Work paper 11-2 contains a listing of the cash disbursement journal entries made in the first few days of the following year end. Compare the transactions on the cash disbursements journal with the accounts payable listing on work paper 11-1. Use the appropriate tick mark to evidence your review of each transaction. Fields you are to complete are colored yellow. The color will disappear as the field is completed. When you are finished reviewing the transactions on work paper 11-2, enter your initials (or the initials of each member of your team) in the yellow box with title "Initial Here." EARTHWEAR CLOTHIERS Accounts Payable Listing noramhar 31 on?2 Name: Class: CASH DISBURSEMENTS JOURNAL from 1/1/2023 through 1/11/2023 LEGEND F= Footed. S= Scanned and Reviewed. = Traced to December Accounts Payable Listing. = Flagged for further inquiriy and review. In this mini-case you will focus on performing one aspect of the test of details on the accounts payable balance - the search for unrecorded liabilities. To identify possible unrecorded liabilities you will compare the payments made after year end with the accounts payable listing as of the end of the year. In performing this comparison particular attention should be given to any payment made on the disbursements journal for which there was not an accounts payable balance as of year end. Your responsibility is to identify the transactions on the cash disbursements journal that the audit team should investigate and review further to determine if a liability should have been recorded as of year end. INSTRUCTIONS: Work paper 11-2 contains a listing of the cash disbursement journal entries made in the first few days of the following year end. Compare the transactions on the cash disbursements journal with the accounts payable listing on work paper 11-1. Use the appropriate tick mark to evidence your review of each transaction. Fields you are to complete are colored yellow. The color will disappear as the field is completed. When you are finished reviewing the transactions on work paper 11-2, enter your initials (or the initials of each member of your team) in the yellow box with title "Initial HereStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started