Answered step by step

Verified Expert Solution

Question

1 Approved Answer

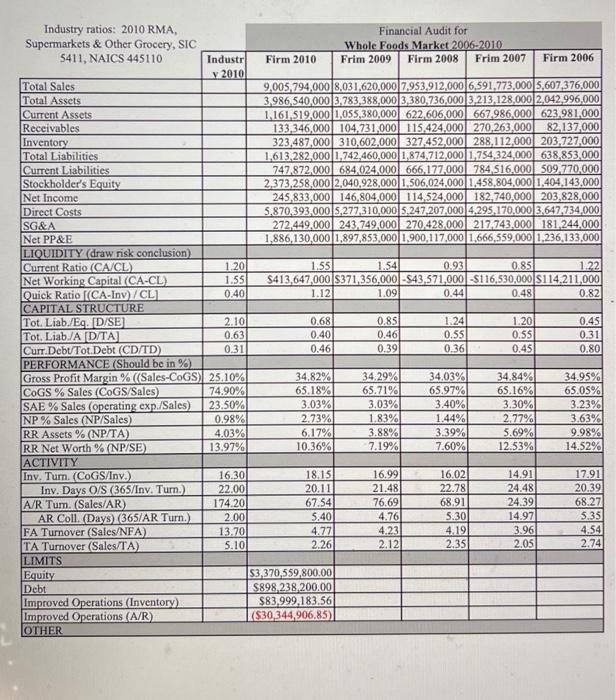

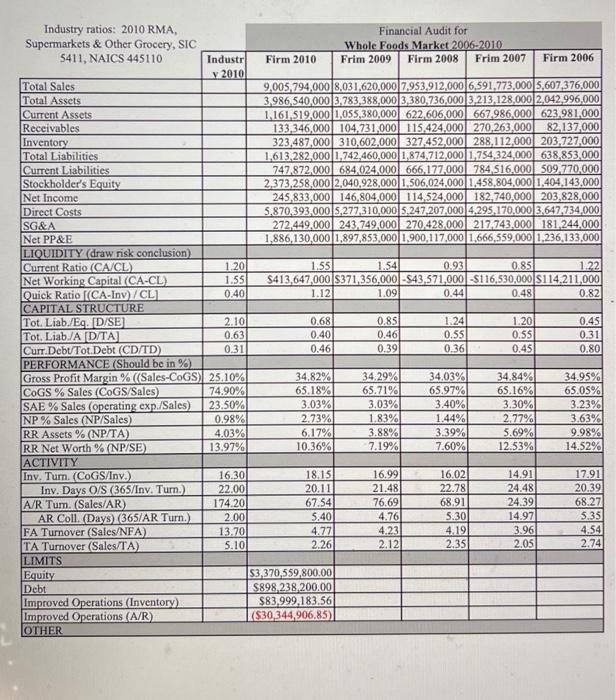

Can you write a finanical analysis for this financial worksheet including analysis liquidity (including risk), capital structure (including cost of capital), performance, activity, and limits

Can you write a finanical analysis for this financial worksheet including analysis liquidity (including risk), capital structure (including cost of capital), performance, activity, and limits (including resources availbility from external sources and improved operations).

\begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow{2}{*}{\begin{tabular}{l} Industry ratios: 2010 RMA, \\ Supermarkets \& Other Grocery, SIC \\ 5411 , NAICS 445110 \end{tabular}} & & \multicolumn{5}{|c|}{\begin{tabular}{l} Financial Audit for \\ hole Foods Market 200 \end{tabular}} \\ \hline & \begin{tabular}{|r|} Industr \\ v 2010 \\ \end{tabular} & Firm 2010 & Frim 2009 & Firm 2008 & Frim 2007 & Firm 2006 \\ \hline Total Sales & & 9,005,794,000 & \begin{tabular}{|l|l|} 8,031,620,000 & 7 \\ \end{tabular} & 7,953,912,000 & 6,591,773,000 & 5,607,376,000 \\ \hline Total Assets & & 3,986,540,000 & \begin{tabular}{|l|l|} 3,783,388,000 & 3 \\ \end{tabular} & 3,380,736,000 & 3,213,128,000 & 2,042,996,000 \\ \hline Current Assets & & 1,161,519,000 & 1,055,380,000 & 622,606,000 & 667,986,000 & 623,981,000 \\ \hline Receivables & & 133,346,000 & \begin{tabular}{|c|} 104,731,000 \\ \end{tabular} & 115,424,000 & 270,263,000 & 82,137,000 \\ \hline \begin{tabular}{|l|l|} Inventory \\ \end{tabular} & & 323,487,000 & \begin{tabular}{|c|} 310,602,000 \\ \end{tabular} & 327,452,000 & 288,112,000 & 203,727,000 \\ \hline \begin{tabular}{|c|} Total Liabilities \\ \end{tabular} & & 1,613,282,000 & \begin{tabular}{|l|l|} 1,742,460,000 & 1 \\ \end{tabular} & 1,874,712,000 & 1,754,324,000 & 638,853,000 \\ \hline Current Liabilities & & 747,872,000 & 684,024,000 & 666,177,000 & 784,516,000 & 509,770,000 \\ \hline Stockholder's Equity & & 2,373,258,000 & \begin{tabular}{|l|l|} 2,040,928,000 \\ \end{tabular} & 1,506,024,000 & \begin{tabular}{|l|l|} 1,458,804,000 \\ \end{tabular} & 1,404,143,000 \\ \hline Net Income & & 245,833,000 & \begin{tabular}{|l|l|} 146,804,000 \\ \end{tabular} & \begin{tabular}{|l|} 114,524,000 \\ \end{tabular} & 182,740,000 & 203,828,000 \\ \hline Direct Costs & & 5,870,393,000 & 5,277,310,0005 & 5,247,207,000 & \begin{tabular}{|c|c|} 4,295,170,000 \\ \end{tabular} & 3,647,734,000 \\ \hline SG\&A & & 272,449,000 & 243,749,000 & 270,428,000 & \begin{tabular}{|c|} 217,743,000 \\ \end{tabular} & 181,244,000 \\ \hline Net PP\&E & & 1,886,130,000 & 1,897,853,000 & 1,900,117,000 & 1,666,559,000 & 1,236,133,000 \\ \hline \multicolumn{7}{|l|}{ LIQUIDITY (draw risk conclusion) } \\ \hline Current Ratio (CA/CL) & 1.20 & 1.55 & 1.54 & 0.93 & 0.85 & 1.22 \\ \hline Net Working Capital (CA-CL) & 1.55 & $413,647,000 & $371,356,000 & $43,571,000 & $116,530,000 & $114,211,000 \\ \hline Quick Ratio [(CA-Inv)/CL] & 0.40 & 1.12 & 1.09 & 0.44 & 0.48 & 0.82 \\ \hline \multicolumn{7}{|l|}{ CAPITAL STRUCTURE } \\ \hline Tot. Liab./Eg. [D/SE] & 2.10 & 0.68 & 0.85 & 1.24 & 1.20 & 0.45 \\ \hline Tot. Liab/A [D/TA] & 0.63 & 0.40 & 0.46 & 0.55 & 0.55 & 0.31 \\ \hline Curr.Debt/Tot.Debt (CD/TD) & 0.31 & 0.46 & 0.39 & 0.36 & 0.45 & 0.80 \\ \hline \multicolumn{7}{|l|}{ PERFORMANCE (Should be in \%) } \\ \hline Gross Profit Margin \% ((Sales-CoGS) & 25.10% & 34,82% & 34.29% & 34.03% & 34.84% & 34.95% \\ \hline CoGS \% Sales (CoGS/Sales) & 74.90% & 65.18% & 65.71% & 65.97% & 65.16% & 65.05% \\ \hline SAE \% Sales (operating exp./Sales) & 23.50% & 3.03% & 3.03% & 3.40% & 3.30% & 3.23% \\ \hline NP \% Sales (NP/Sales) & 0.98% & 2.73% & 1.83% & 1.44% & 2.77% & 3.63% \\ \hline RR Assets \% (NP/TA) & 4.03% & 6.17% & 3.88% & 3.39% & 5.69% & 9.98% \\ \hline RR Net Worth \% (NP/SE) & 13.97% & 10.36% & 7.19% & 7.60% & 12.53% & 14.52% \\ \hline \multicolumn{7}{|l|}{\begin{tabular}{|l|l|} ACTIVITY \\ \end{tabular}} \\ \hline Inv. Tum. (CoGS/Inv.) & 16.30 & 18.15 & 16.99 & 16.02 & 14.91 & 17.91 \\ \hline Inv. Days O/S (365/Inv. Tum.) & 22.00 & 20.11 & 21.48 & 22.78 & 24.48 & 20.39 \\ \hline A/R Tum. (Sales/AR) & 174.20 & 67.54 & 76,69 & 68.91 & 24.39 & 68.27 \\ \hline AR Coll. (Days) (365/AR Turn.) & 2.00 & 5.40 & 4.76 & 5.30 & 14.97 & 5.35 \\ \hline FA Tumover (Sales/NFA) & 13.70 & 4.77 & 4.23 & 4.19 & 3.96 & 4.54 \\ \hline TA Turnover (Sales/TA) & 5.10 & 2.26 & 2.12 & 2.35 & 2.05 & 2.74 \\ \hline \multicolumn{7}{|l|}{\begin{tabular}{l} LIMITS \\ \end{tabular}} \\ \hline Equity & & $3,370,559,800,00 & & & & \\ \hline Debt & & $898,238,200.00 & & & & \\ \hline Improved Operations (Inventory) & & $83,999,183.56 & & & & \\ \hline Improved Operations (A/R) & - & ($30,344,906.85) & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow{2}{*}{\begin{tabular}{l} Industry ratios: 2010 RMA, \\ Supermarkets \& Other Grocery, SIC \\ 5411 , NAICS 445110 \end{tabular}} & & \multicolumn{5}{|c|}{\begin{tabular}{l} Financial Audit for \\ hole Foods Market 200 \end{tabular}} \\ \hline & \begin{tabular}{|r|} Industr \\ v 2010 \\ \end{tabular} & Firm 2010 & Frim 2009 & Firm 2008 & Frim 2007 & Firm 2006 \\ \hline Total Sales & & 9,005,794,000 & \begin{tabular}{|l|l|} 8,031,620,000 & 7 \\ \end{tabular} & 7,953,912,000 & 6,591,773,000 & 5,607,376,000 \\ \hline Total Assets & & 3,986,540,000 & \begin{tabular}{|l|l|} 3,783,388,000 & 3 \\ \end{tabular} & 3,380,736,000 & 3,213,128,000 & 2,042,996,000 \\ \hline Current Assets & & 1,161,519,000 & 1,055,380,000 & 622,606,000 & 667,986,000 & 623,981,000 \\ \hline Receivables & & 133,346,000 & \begin{tabular}{|c|} 104,731,000 \\ \end{tabular} & 115,424,000 & 270,263,000 & 82,137,000 \\ \hline \begin{tabular}{|l|l|} Inventory \\ \end{tabular} & & 323,487,000 & \begin{tabular}{|c|} 310,602,000 \\ \end{tabular} & 327,452,000 & 288,112,000 & 203,727,000 \\ \hline \begin{tabular}{|c|} Total Liabilities \\ \end{tabular} & & 1,613,282,000 & \begin{tabular}{|l|l|} 1,742,460,000 & 1 \\ \end{tabular} & 1,874,712,000 & 1,754,324,000 & 638,853,000 \\ \hline Current Liabilities & & 747,872,000 & 684,024,000 & 666,177,000 & 784,516,000 & 509,770,000 \\ \hline Stockholder's Equity & & 2,373,258,000 & \begin{tabular}{|l|l|} 2,040,928,000 \\ \end{tabular} & 1,506,024,000 & \begin{tabular}{|l|l|} 1,458,804,000 \\ \end{tabular} & 1,404,143,000 \\ \hline Net Income & & 245,833,000 & \begin{tabular}{|l|l|} 146,804,000 \\ \end{tabular} & \begin{tabular}{|l|} 114,524,000 \\ \end{tabular} & 182,740,000 & 203,828,000 \\ \hline Direct Costs & & 5,870,393,000 & 5,277,310,0005 & 5,247,207,000 & \begin{tabular}{|c|c|} 4,295,170,000 \\ \end{tabular} & 3,647,734,000 \\ \hline SG\&A & & 272,449,000 & 243,749,000 & 270,428,000 & \begin{tabular}{|c|} 217,743,000 \\ \end{tabular} & 181,244,000 \\ \hline Net PP\&E & & 1,886,130,000 & 1,897,853,000 & 1,900,117,000 & 1,666,559,000 & 1,236,133,000 \\ \hline \multicolumn{7}{|l|}{ LIQUIDITY (draw risk conclusion) } \\ \hline Current Ratio (CA/CL) & 1.20 & 1.55 & 1.54 & 0.93 & 0.85 & 1.22 \\ \hline Net Working Capital (CA-CL) & 1.55 & $413,647,000 & $371,356,000 & $43,571,000 & $116,530,000 & $114,211,000 \\ \hline Quick Ratio [(CA-Inv)/CL] & 0.40 & 1.12 & 1.09 & 0.44 & 0.48 & 0.82 \\ \hline \multicolumn{7}{|l|}{ CAPITAL STRUCTURE } \\ \hline Tot. Liab./Eg. [D/SE] & 2.10 & 0.68 & 0.85 & 1.24 & 1.20 & 0.45 \\ \hline Tot. Liab/A [D/TA] & 0.63 & 0.40 & 0.46 & 0.55 & 0.55 & 0.31 \\ \hline Curr.Debt/Tot.Debt (CD/TD) & 0.31 & 0.46 & 0.39 & 0.36 & 0.45 & 0.80 \\ \hline \multicolumn{7}{|l|}{ PERFORMANCE (Should be in \%) } \\ \hline Gross Profit Margin \% ((Sales-CoGS) & 25.10% & 34,82% & 34.29% & 34.03% & 34.84% & 34.95% \\ \hline CoGS \% Sales (CoGS/Sales) & 74.90% & 65.18% & 65.71% & 65.97% & 65.16% & 65.05% \\ \hline SAE \% Sales (operating exp./Sales) & 23.50% & 3.03% & 3.03% & 3.40% & 3.30% & 3.23% \\ \hline NP \% Sales (NP/Sales) & 0.98% & 2.73% & 1.83% & 1.44% & 2.77% & 3.63% \\ \hline RR Assets \% (NP/TA) & 4.03% & 6.17% & 3.88% & 3.39% & 5.69% & 9.98% \\ \hline RR Net Worth \% (NP/SE) & 13.97% & 10.36% & 7.19% & 7.60% & 12.53% & 14.52% \\ \hline \multicolumn{7}{|l|}{\begin{tabular}{|l|l|} ACTIVITY \\ \end{tabular}} \\ \hline Inv. Tum. (CoGS/Inv.) & 16.30 & 18.15 & 16.99 & 16.02 & 14.91 & 17.91 \\ \hline Inv. Days O/S (365/Inv. Tum.) & 22.00 & 20.11 & 21.48 & 22.78 & 24.48 & 20.39 \\ \hline A/R Tum. (Sales/AR) & 174.20 & 67.54 & 76,69 & 68.91 & 24.39 & 68.27 \\ \hline AR Coll. (Days) (365/AR Turn.) & 2.00 & 5.40 & 4.76 & 5.30 & 14.97 & 5.35 \\ \hline FA Tumover (Sales/NFA) & 13.70 & 4.77 & 4.23 & 4.19 & 3.96 & 4.54 \\ \hline TA Turnover (Sales/TA) & 5.10 & 2.26 & 2.12 & 2.35 & 2.05 & 2.74 \\ \hline \multicolumn{7}{|l|}{\begin{tabular}{l} LIMITS \\ \end{tabular}} \\ \hline Equity & & $3,370,559,800,00 & & & & \\ \hline Debt & & $898,238,200.00 & & & & \\ \hline Improved Operations (Inventory) & & $83,999,183.56 & & & & \\ \hline Improved Operations (A/R) & - & ($30,344,906.85) & & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started