Answered step by step

Verified Expert Solution

Question

1 Approved Answer

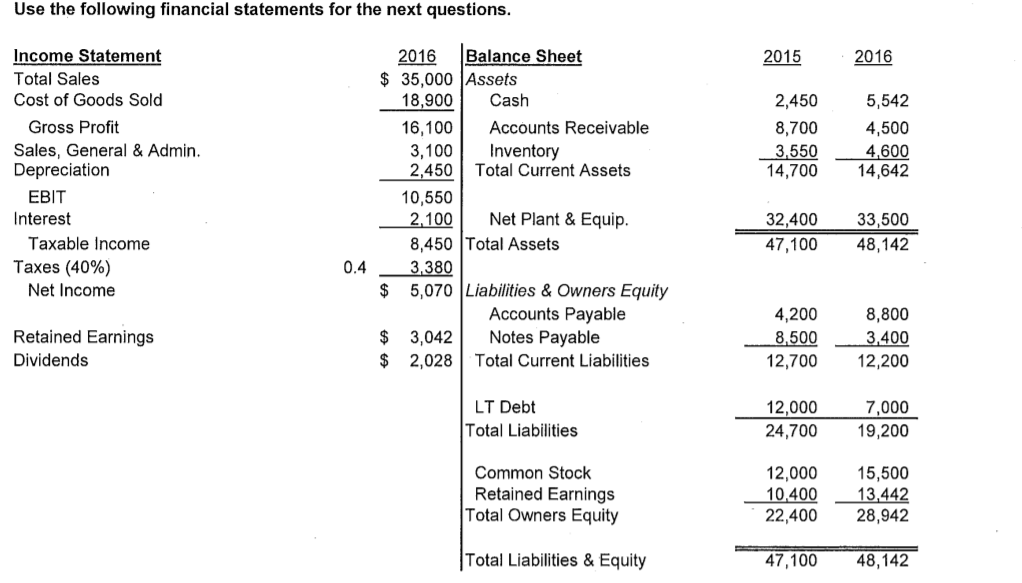

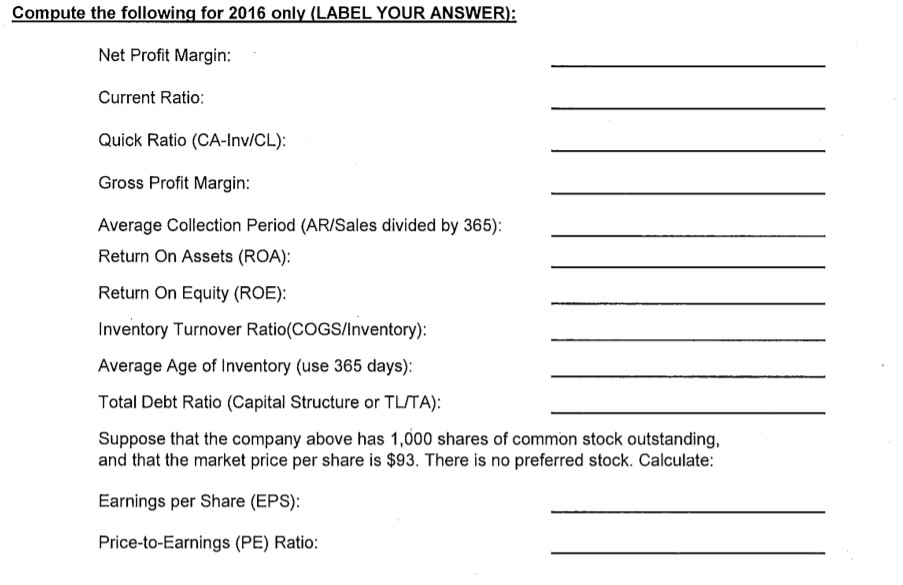

can you write down the formulas for me because i dont know how to solve this question. thank you in advance Use the following financial

can you write down the formulas for me because i dont know how to solve this question. thank you in advance

Use the following financial statements for the next questions. 2015 2016 Income Statement Total Sales Cost of Goods Sold Gross Profit Sales, General & Admin. Depreciation EBIT Interest Taxable income Taxes (40%) Net Income 2,450 8,700 3,550 14,700 5,542 4,500 4,600 14,642 2016 Balance Sheet $ 35,000 Assets 18,900 Cash 16,100 Accounts Receivable 3,100 Inventory 2,450 Total Current Assets 10,550 2.100 Net Plant & Equip. 8,450 Total Assets 3,380 $ 5,070 Liabilities & Owners Equity Accounts Payable $ 3,042 Notes Payable $ 2,028 Total Current Liabilities 32,400 47,100 33,500 48,142 0.4 Retained Earnings Dividends 4,200 8,500 12,700 8,800 3,400 12,200 LT Debt Total Liabilities 12,000 24,700 7,000 19,200 Common Stock Retained Earnings Total Owners Equity 12,000 10,400 22,400 15,500 13,442 28,942 Total Liabilities & Equity 47,100 48,142 Compute the following for 2016 only (LABEL YOUR ANSWER): Net Profit Margin: Current Ratio: Quick Ratio (CA-Inv/CL): Gross Profit Margin: Average Collection Period (AR/Sales divided by 365): Return On Assets (ROA): Return On Equity (ROE): Inventory Turnover Ratio(COGS/Inventory): Average Age of Inventory (use 365 days) Total Debt Ratio (Capital Structure or TL/TA): Suppose that the company above has 1,000 shares of common stock outstanding, and that the market price per share is $93. There is no preferred stock. Calculate: Earnings per Share (EPS): Price-to-Earnings (PE) RatioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started