Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Canada Corporation (CC) has 100,000 common shares outstanding and has to date not issued any preferred shares. The market value of CC's is $50 per

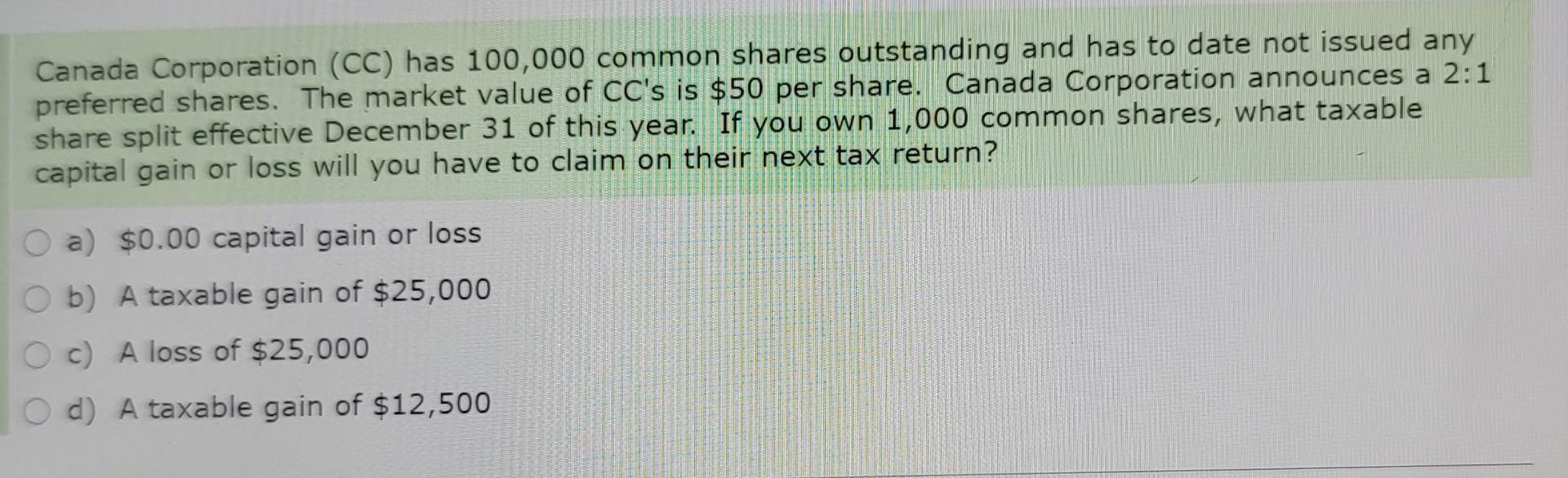

Canada Corporation (CC) has 100,000 common shares outstanding and has to date not issued any preferred shares. The market value of CC's is $50 per share. Canada Corporation announces a 2:1 share split effective December 31 of this year. If you own 1,000 common shares, what taxable capital gain or loss will you have to claim on their next tax return? a) $0.00 capital gain or loss b) A taxable gain of $25,000 c) A loss of $25,000 d) A taxable gain of $12,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started