Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Canada Pension Plan (CPP) contributions are calculated on an employee's gross pensionable/ taxable income (GPTI). Gross pensionable/taxable income includes salary, wages, and other remuneration

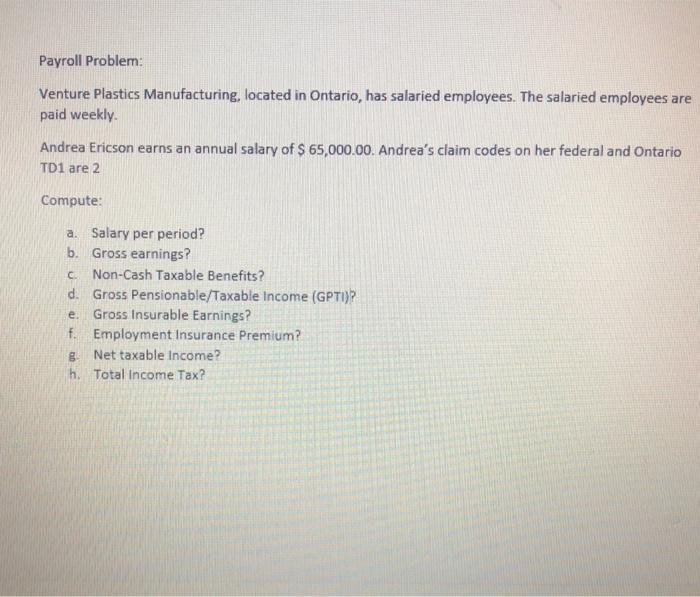

Canada Pension Plan (CPP) contributions are calculated on an employee's gross pensionable/ taxable income (GPTI). Gross pensionable/taxable income includes salary, wages, and other remuneration paid as well as any taxable benefits, taxable allowances and taxable expense reimbursements paid or provided to employees. The yearly maximum pensionable earnings (YMPE) less the yearly basic exemption (YBE) are the contributory earnings the CPP contribution rate is applied to, for deduction purposes. Each year, the Canada Revenue Agency determines: A Yearly Maximum Pensionable Earnings (YMPE) B Yearly Basic Exemption C Contributory Earnings (A-B) D CPP Contribution Rate E Annual Maximum Employee Contribution to CPP (Cx D) F Annual Maximum Employer Contribution to CPP (CxD) *The QPP contribution rate for Qubec employees (see page 358) Once an employer has deducted the annual maximum CPP contribution from an employee, no further CPP deductions are to be withheld from the employee for that year. Both employees and employers have to make CPP contributions. Employers match their employees' CPP contributions dollar for dollar and remit both portions to the CRA. These exemptions are calculated as follows: Weekly exemption: 52 pay periods per year The yearly basic exemption of $3,500.00 is divided by the number of regular pays in the year to determine the amount of the exemption that should be applied to the pensionable earnings for each pay period. Bi-weekly exemption: 26 pay periods per year 2019 2020 $57,400.00 $58,700.00 $3.500.00 $3,500.00 $53,900.00 $55,200.00 $.10% $2,748.90 $2,748,90 5.55% Semi-monthly exemption: 24 pay periods per year Monthly exemption: 12 pay periods per year 5.2500 $2,898.00 $2,898.00 5.599 $3.500.00 $67.30 52 $3.500.00 $134.61 26 $3.500.00-$145.83* 24 $3,500.00 $291.66 12 *The calculations are not rounded, per the CRA's instructions. Rounding would result in a yearly basic exemption greater than $3,500.00. Payroll Problem: Venture Plastics Manufacturing, located in Ontario, has salaried employees. The salaried employees are paid weekly. Andrea Ericson earns an annual salary of $ 65,000.00. Andrea's claim codes on her federal and Ontario TD1 are 2 Compute: a. Salary per period? b. Gross earnings? c. Non-Cash Taxable Benefits? d. Gross Pensionable/Taxable Income (GPTI)? e. Gross Insurable Earnings? f. Employment Insurance Premium? Net taxable Income? g. h. Total Income Tax?

Step by Step Solution

★★★★★

3.55 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

a Salary per period 6500000 52 125000 b Gross earnings 125000 000 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started