Canada Quarries processes large pieces of granite into finely finished countertop material...

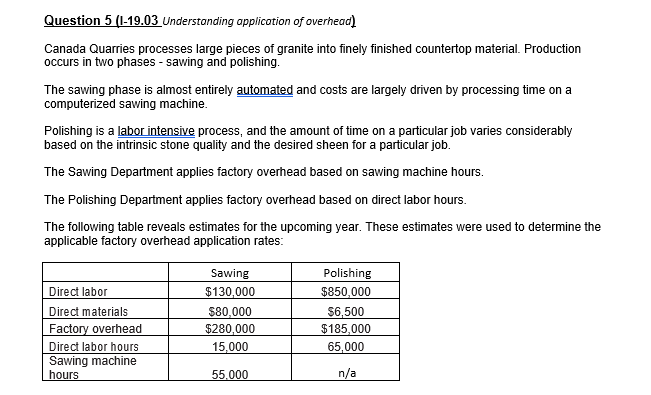

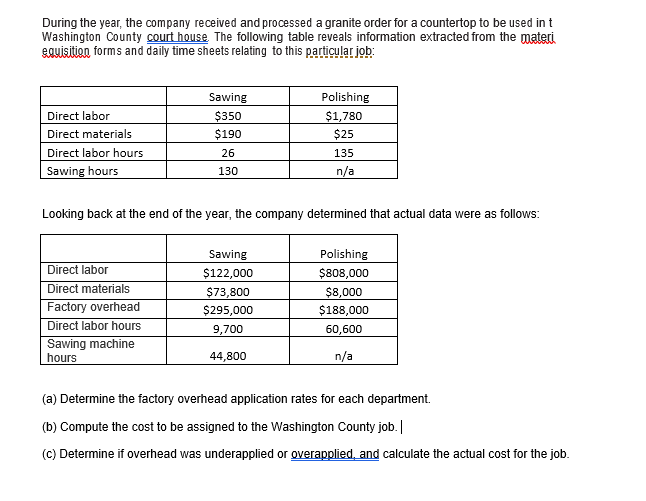

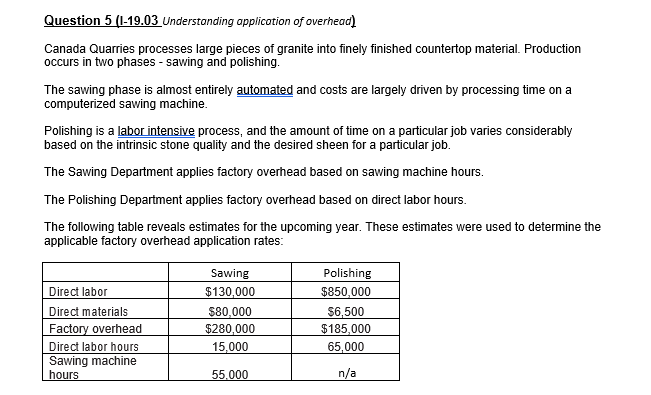

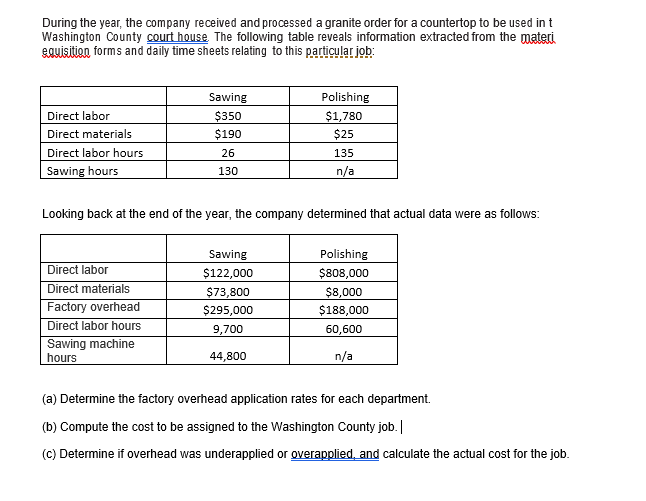

Question 5 (1-19.03 Understanding application of overhead) Canada Quarries processes large pieces of granite into finely finished countertop material. Production occurs in two phases - Sawing and polishing. The sawing phase is almost entirely automated and costs are largely driven by processing time on a computerized sawing machine. Polishing is a labor intensive process, and the amount of time on a particular job varies considerably based on the intrinsic stone quality and the desired sheen for a particular job. The Sawing Department applies factory overhead based on sawing machine hours. The Polishing Department applies factory overhead based on direct labor hours. The following table reveals estimates for the upcoming year. These estimates were used to determine the applicable factory overhead application rates: Direct labor Direct materials Factory overhead Direct labor hours Sawing machine hours Sawing $130,000 $80,000 $280,000 15,000 Polishing $850,000 $6,500 $185,000 65,000 55.000 n/a During the year, the company received and processed a granite order for a countertop to be used in t Washington County court house. The following table reveals information extracted from the materi equisition forms and daily time sheets relating to this particular job: Direct labor Direct materials Direct labor hours Sawing hours Sawing $350 $190 26 130 Polishing $1,780 $25 135 n/a Looking back at the end of the year, the company determined that actual data were as follows: Direct labor Direct materials Factory overhead Direct labor hours Sawing machine hours Sawing $122,000 $73,800 $295,000 9,700 Polishing $808,000 $8,000 $188,000 60,600 44,800 n/a (a) Determine the factory overhead application rates for each department (b) Compute the cost to be assigned to the Washington County job. (c) Determine if overhead was underapplied or overapplied, and calculate the actual cost for the job. Question 5 (1-19.03 Understanding application of overhead) Canada Quarries processes large pieces of granite into finely finished countertop material. Production occurs in two phases - Sawing and polishing. The sawing phase is almost entirely automated and costs are largely driven by processing time on a computerized sawing machine. Polishing is a labor intensive process, and the amount of time on a particular job varies considerably based on the intrinsic stone quality and the desired sheen for a particular job. The Sawing Department applies factory overhead based on sawing machine hours. The Polishing Department applies factory overhead based on direct labor hours. The following table reveals estimates for the upcoming year. These estimates were used to determine the applicable factory overhead application rates: Direct labor Direct materials Factory overhead Direct labor hours Sawing machine hours Sawing $130,000 $80,000 $280,000 15,000 Polishing $850,000 $6,500 $185,000 65,000 55.000 n/a During the year, the company received and processed a granite order for a countertop to be used in t Washington County court house. The following table reveals information extracted from the materi equisition forms and daily time sheets relating to this particular job: Direct labor Direct materials Direct labor hours Sawing hours Sawing $350 $190 26 130 Polishing $1,780 $25 135 n/a Looking back at the end of the year, the company determined that actual data were as follows: Direct labor Direct materials Factory overhead Direct labor hours Sawing machine hours Sawing $122,000 $73,800 $295,000 9,700 Polishing $808,000 $8,000 $188,000 60,600 44,800 n/a (a) Determine the factory overhead application rates for each department (b) Compute the cost to be assigned to the Washington County job. (c) Determine if overhead was underapplied or overapplied, and calculate the actual cost for the job